- Banking

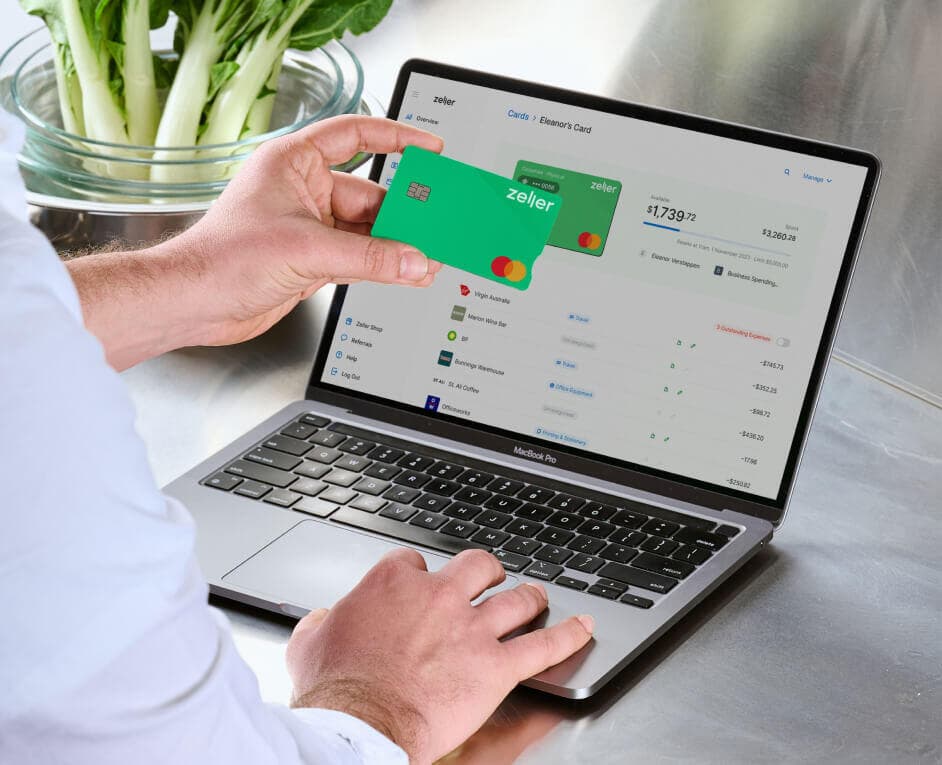

Zeller Corporate Cards: A Winning Hand for Managing Business Expenses

The petty cash box is empty, you can’t find the business credit card, and you’re up to your knees in receipts. Thankfully there’s an easier way to manage team and project expenses. Meet Zeller Corporate Cards.

If you’ve ever checked your bank balance at the end of the week, you know how quickly incidental expenses can add up. Now imagine a team of employees, each with their own needs: a round of coffees for clients, a flight for an upcoming conference, a grocery order for the office, a software subscription. The list goes on. If you’re not staying on top of these purchases, not only is it going to hurt your bottom line, but it’s also going to cause many a headache when it comes to your end-of-month finance reconciliation.

Thankfully, there’s a simple way to track who’s spending what, and it doesn’t involve flashing corporate credit cards or leveraging sophisticated expense management software. Zeller Corporate Cards are designed to help businesses – and finance teams – stay in control of employee and project-related expenses, while also giving staff the freedom to make necessary purchases. Read on to discover how Zeller Corporate Cards will give you back money, time and peace of mind.

Introducing corporate cards

Not to be confused with corporate credit cards or corporate debit cards (learn what these are here), corporate cards are payment cards linked to a business’s transaction account, and are specifically designed for employees or teams to be able to pay for business expenses. A finance team or CFO can easily order multiple cards, assign them to employees, and individually adjust their spending limits. In addition, they typically have built-in expense management features like recurring budgets that reset periodically, set transaction limits, and tools to help cardholders track and manage their expenses.

Zeller Corporate Cards can be created from Zeller Dashboard. Simply follow the prompts to create a new Corporate Card, assign the card to an employee, set the spend limits and choose your card colour. It’s as simple as that. Your card can then be added to your employee’s mobile wallet or a physical card can be ordered.

What are the benefits of using Zeller Corporate Cards in your business?

1. Flexibility for staff

With Zeller’s corporate card program, your staff are empowered to make purchases as they need them. Rather than having to ask your permission every time they need to process a payment, or paying with their own money and submitting an expense report for reimbursement, a corporate card will give them the freedom to pay for expenses, within the limits that you prescribe.

2. Reduced financial admin

Without the burden of having to process employee reimbursements, administrative time is greatly reduced. With Zeller Corporate Cards, all your expenses are centralised into one dashboard, where finance teams can easily and efficiently track who has spent what.

3. Improved tracking

Every corporate card is assigned to an individual employee, team, or project, meaning that it's easy to track and isolate expenditure into different areas of your business. Employees will know that their spend is being monitored, engendering a greater sense of responsibility and ownership over expense management — as everything will be traced back to them. What’s more, businesses can choose to make it mandatory for employees to provide certain information, such as the expense category (‘travel’ or ‘entertainment’, for example), the receipt, and a note (with additional information or reasons as to why the purchase was made).

4. Receipt reconciliation

With Zeller Corporate Cards, employees can log in to their account on Zeller App or Zeller Dashboard, take a photo of multiple receipts, including tax invoices and transaction receipts, and upload them to a transaction processed with a Zeller Corporate Card. Not only does this do away with having to collect paper receipts, which can get lost or damaged, but it also saves a huge amount of time when it comes to reconciling receipts against their transactions.

5. Cash flow management

Zeller Corporate Cards draw money directly from Zeller Transaction Account, which means that you can track your business cash flow in real time. Unlike a corporate credit card which draws on borrowed funds that you need to pay back later (with interest), corporate cards ensure you always know your business’s cash balance – with no hidden surprises at the end of the month. What’s more, you can see a visual representation of your cash flow from both Zeller Dashboard and Zeller App.

6. Budget control for projects

Instead of assigning a card to an employee, Zeller Corporate Cards can also be assigned to individual projects. This allows all expenses for a specific project to be paid for on one card, ensuring that the budget is adhered to and that finance teams or managers can easily identify costs directly associated with that project.

7. Fraud protection

By allocating corporate cards against individual employees, or by teams or projects, you are able to implement a greater level of fraud protection in your business. You’ll know exactly who is using each corporate card, what the card is being used for, and why — meaning any examples of expenses that fall outside of these guidelines can be identified immediately.

8. Mobile management

With Zeller App, you can create and manage cards directly from your smartphone. If a team member needs to pay for a large expense above their usual transaction limit, you can quickly log in to the app and make the necessary changes within a few clicks. The same goes for issuing cards, if you’ve got a new employee or volunteer on the team, simply log in to Zeller App to add a new card, which – if you choose the virtual option – they can start using immediately.

9. Instant virtual card creation

Zeller Corporate Cards can be created and added to a mobile wallet instantly. Your employees can start using their virtual card within minutes of you setting it up, meanwhile you can have a physical card sent out in the mail, if you wish. This convenient solution is not only fast to set up, but also ensures your employees will never lose their card.

10. Affordability

In comparison to corporate credit card schemes which can cost upwards of $25 per card with establishment fees and late payment charges, or expense management software, which is likely to set you back hundreds of dollars a year, Zeller Corporate Cards are an affordable alternative. There are no monthly or annual subscription fees, and no transaction fees on domestic purchases either. The first 60 days are free, after which you will pay one low, flat cost of $9 per corporate card, per month.

Whether you’re running a small business with just a few staff or a rapidly growing company: managing your expenses doesn’t have to be complicated, but it does have to be controlled. Reduce your administrative burden, empower your employees and know where your money is going, all with Zeller Corporate Cards.