Introducing Zeller for Startups.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

Speak to our expert team about your in-store payments, and we’ll personalise a solution to your business and budget.

Enjoy a free, built-in POS system with the new Zeller Terminal 2. Order today with free express shipping nationally.

Starting a new business? Enjoy a free, built-in POS system with the new Zeller Terminal 2.

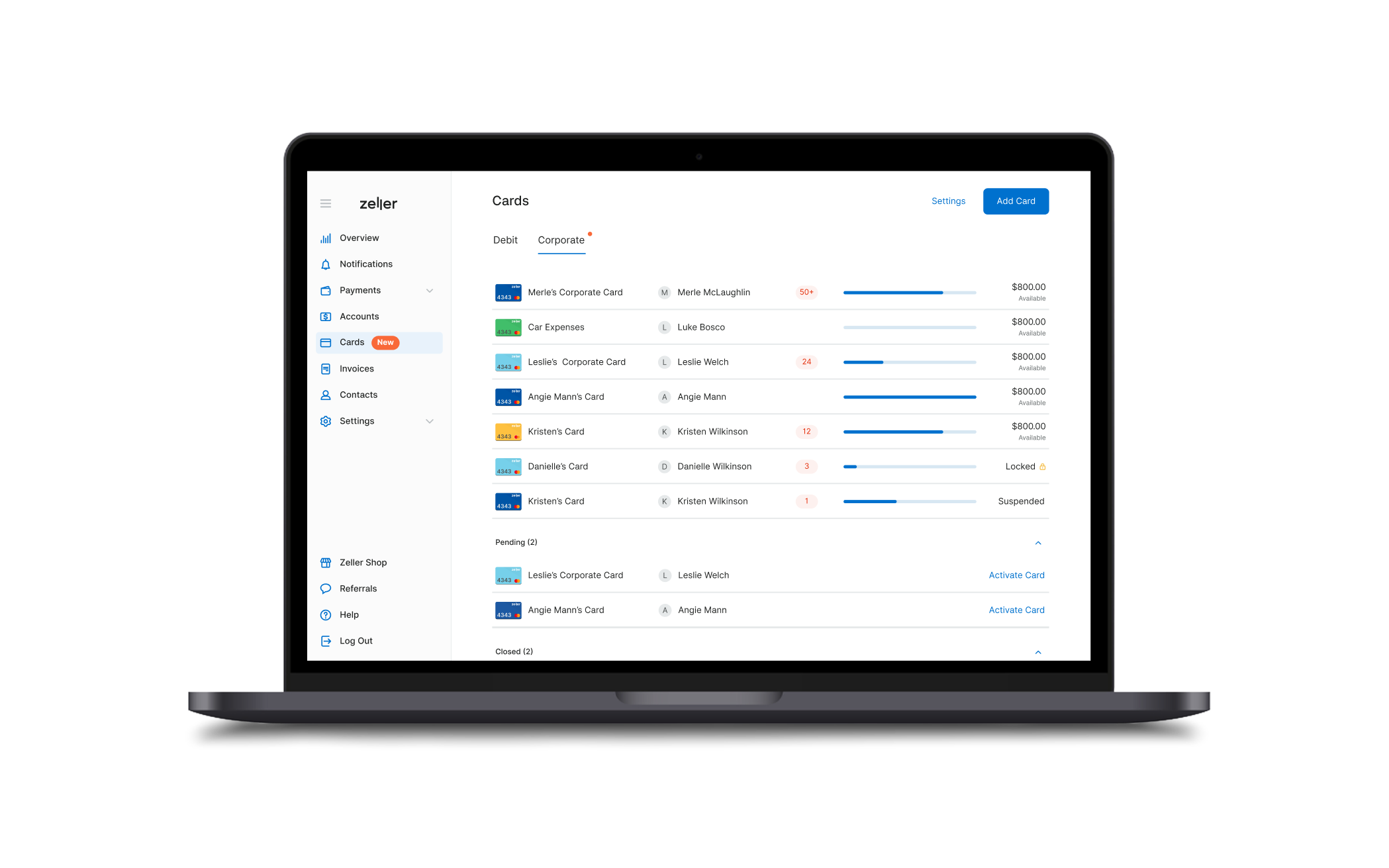

Issue virtual corporate cards instantly, or order physical cards.

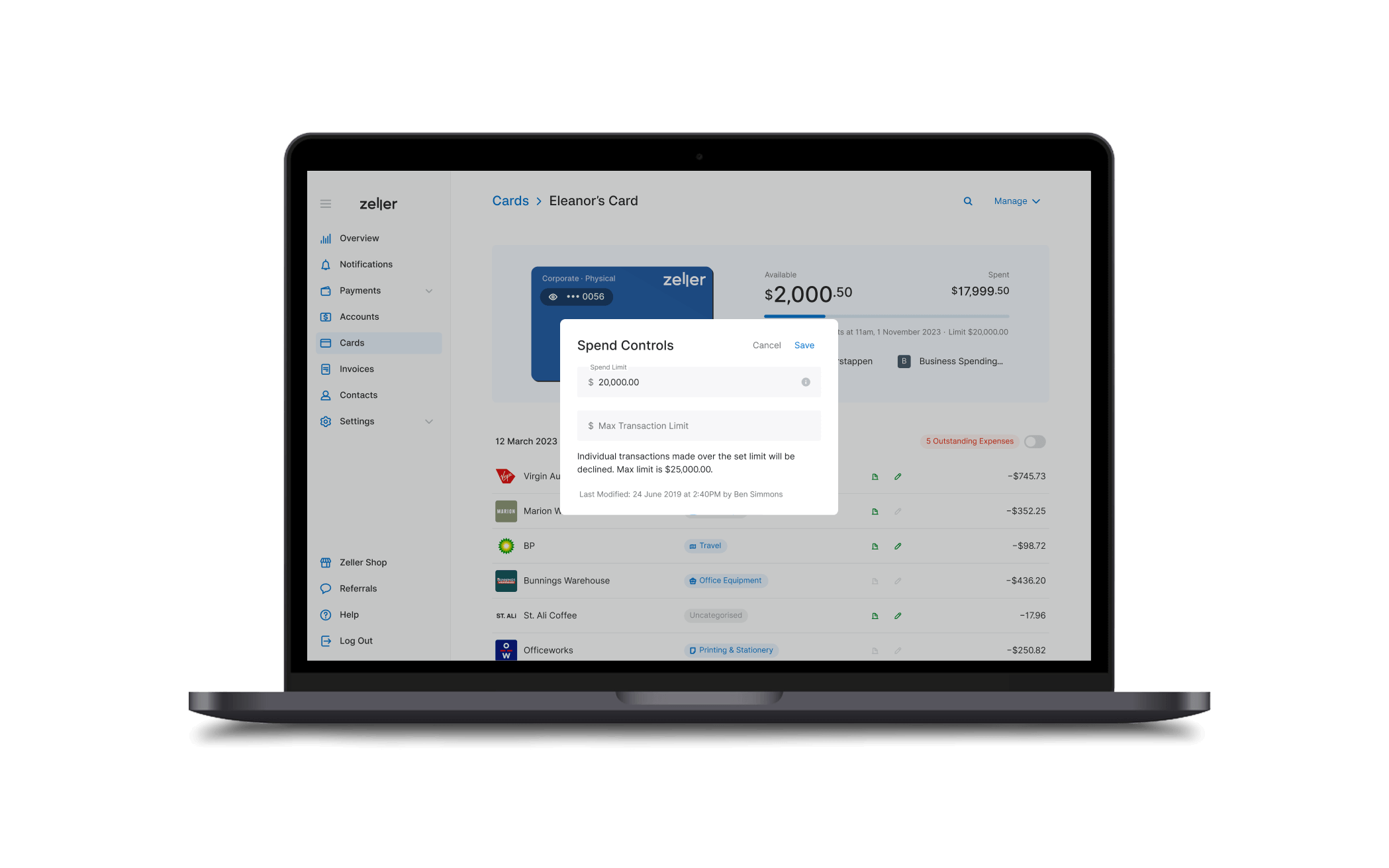

Automate budgets to reset daily, weekly, fortnightly, monthly, or quarterly.

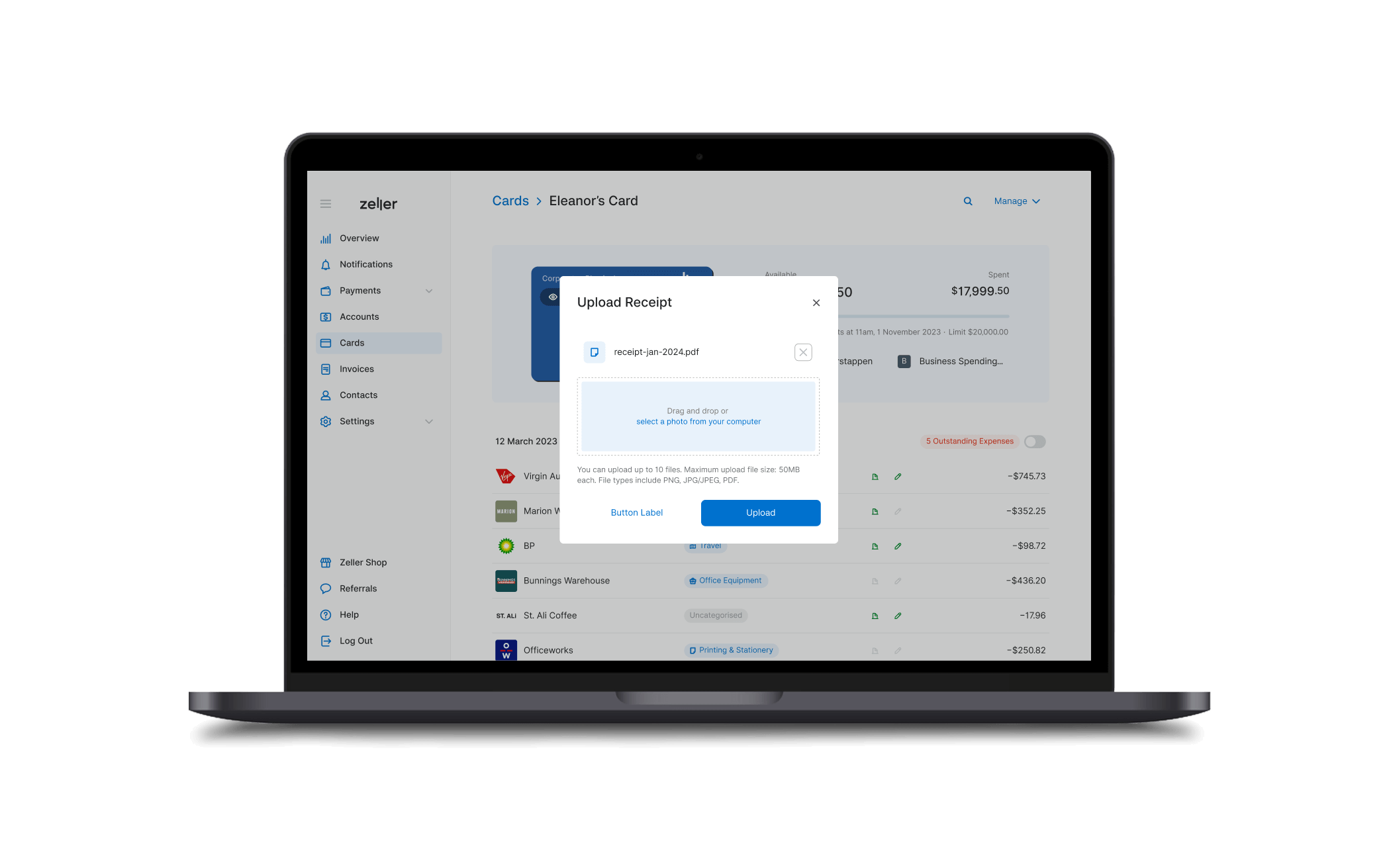

Employees can upload receipts, invoices, or attach notes to expenses.

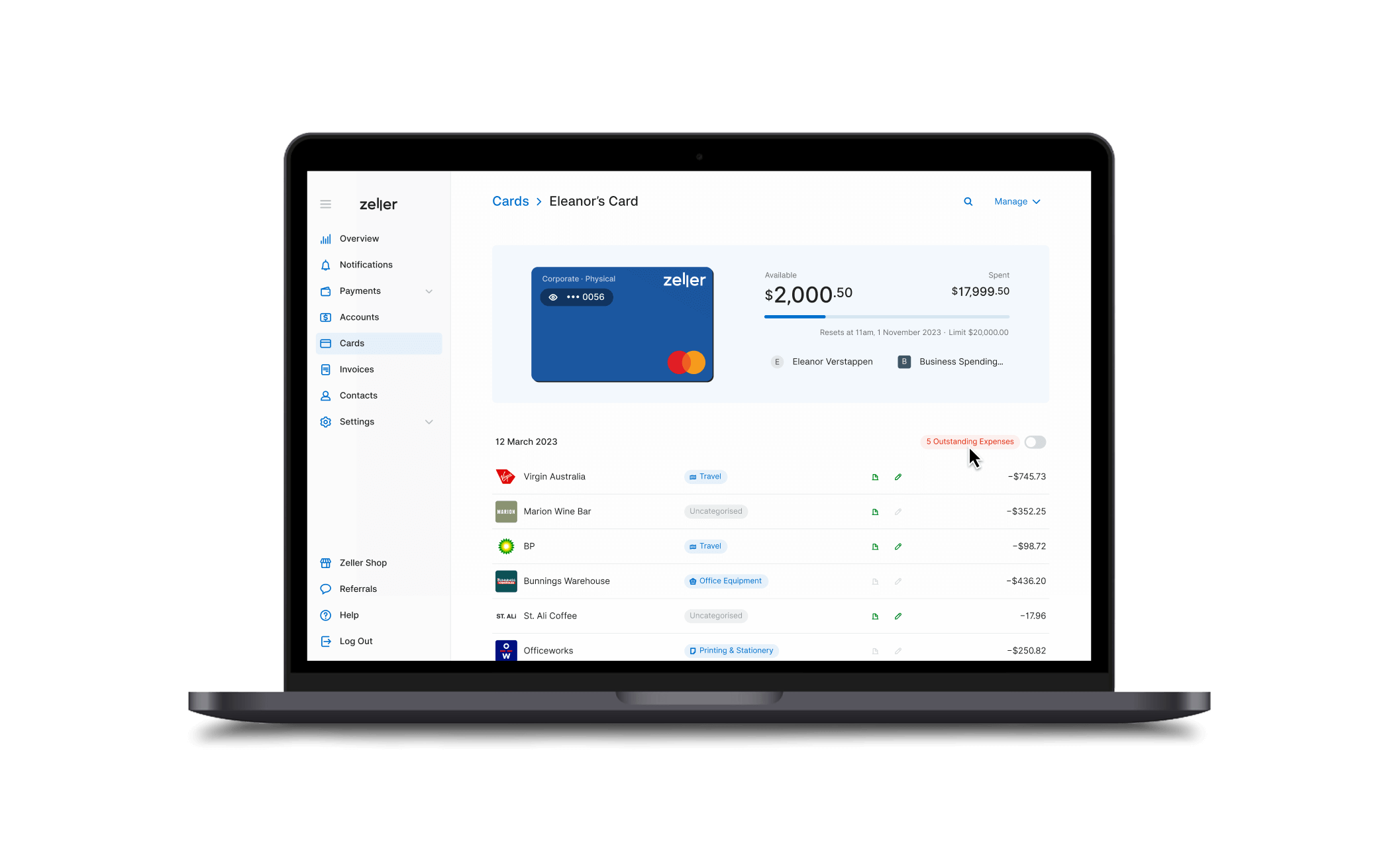

With access to real-time spend data, you'll never encounter surprise expenses.

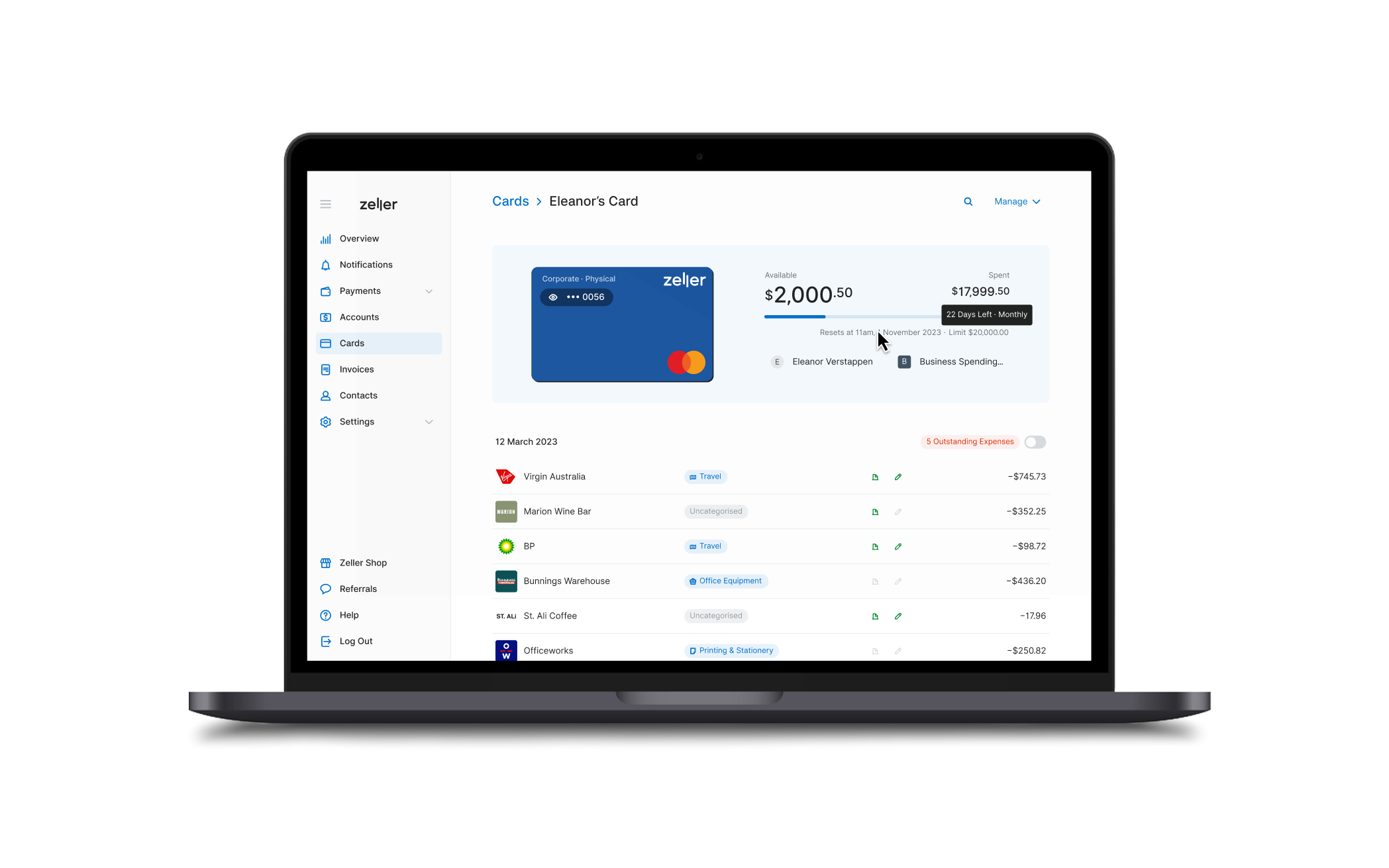

See a real-time status on current spend and remaining budget, reset schedule, and transaction limits for each card.

Zeller Corporate Cards give finance teams greater flexibility and control over business expenses.

Centralise expense tracking to eliminate manual reimbursements.

Sync expenses using the Xero Bank Feeds integration. More

Automate reminders for team members to upload receipt details (coming soon).

Assign corporate cards to individual employees, or to team members working on joint projects.

Issue corporate cards to individual employees with their own budget.

Assign corporate cards to teams to manage project expenses.

Automatically categorise project expenses to simplify finance reconciliation.

Choose to issue a virtual corporate card instantly, or order a physical card.

Employees can add virtual corporate cards to a mobile wallet.

Order a physical Zeller Corporate Card for in-person spending.

Zeller Corporate Cards are available in 4 colours.

Create and manage corporate cards directly from your smartphone with Zeller App.

Issue cards to staff members and add card nicknames.

Set spend limits and budget controls with automated reset periods.

Attach receipts to transactions for faster reconciliation.

Try Zeller Corporate Cards free for 60 days from first card activation.

Just a low FX margin on international purchases.

No costly monthly expense management software fees.

Access spend reports from Zeller App or Dashboard.

Signing up takes minutes for most businesses, and it’s free.

Transfer funds to your account to create an opening balance.

Create a virtual or physical corporate card for an employee.

A corporate card is a physical or virtual payment card, sometimes in the form of an employee debit card, which a business issues to employees to use for their day-to-day work-related expenses. Corporate cards makes it easier for employees to spend pre-approved money on behalf of their business, and removes the need for the employee to have to spend their own money for reimbursement at a later date.

For businesses, corporate cards are a tool to help monitor business expenses and track employee spending more efficiently. Spending limits and recurring budgets can typically be set to corporate cards, and restrictions can be set in place to limit purchases to certain categories or types — for example, for business travel or hosting a customer event.

To get a Zeller Corporate Card, simply sign up for your free Zeller Account online. It takes just 5 minutes to complete, with no lengthy paperwork.

From there, you can log in to Zeller Dashboard and order your physical or virtual corporate cards for your employees. Virtual corporate cards are issued instantly, while physical corporate cards may take up to 5 business days to be shipped to the recipient's address.

You can use an unlimited number of physical or virtual Zeller Corporate Cards free for 60 days from the date of your first card activation. After this date, Zeller Corporate Cards are $9 per active card, per month. An active card is defined as a card that has been issued to an employee.

Zeller Corporate Cards can be managed directly from your Zeller Dashboard. Corporate card management includes the ability to create and cancel cards, set and change budgets, and modify expense settings. You can also view all active corporate cards, and track expenses with outstanding receipts to be submitted by employees.

Yes, you can order a physical Zeller Corporate Card for employees to use. Zeller Corporate Cards can also be issued virtually, and added to a mobile wallet such as Apple Pay or Google Pay.

Zeller Corporate Cards are only available in Australia at this time.

Zeller Corporate Cards are employee debit cards designed to help business owners, finance teams, and CFOs manage business and project-related expenses. These cards work similarly to corporate charge cards however they are linked directly to the Zeller business transaction account, and managers can place spending restrictions on them to ensure employees do not exceed specified transaction limits and/or budgets. Zeller Corporate Cards are a great solution for business spend management, removing the need for manual reimbursements, paper receipts, and time spent trying to reconcile unknown expenses. Instead, these corporate business cards give employees the freedom to make payments in full transparency. Receipts can be uploaded against transactions, and individual budgets and transaction limits can be easily modified. A separate corporate card app isn’t necessary, all the business debit cards and corporate cards are managed through Zeller Dashboard and Zeller App.

Zeller Corporate Cards can be created and added to a mobile wallet instantly. Your employees can start using their virtual card within minutes of you setting it up, meanwhile you can have a physical card sent out in the mail, if you wish. This convenient solution is not only fast to set up, but also ensures your employees will never lose their card.

Zeller Corporate Cards give your staff the flexibility to make purchases without constant permission requests or personal expense submissions. With preset spending limits, employees can manage expenses seamlessly. Moreover, Zeller Corporate Card simplify receipt reconciliation. Through the Zeller App, users can effortlessly capture and link receipts to their transactions, eliminating paper receipts and saving valuable time in the reconciliation process.

Zeller Corporate Cards significantly reduce financial admin by eliminating employee reimbursements. The cards draw funds directly from the Zeller Transaction Account, providing real-time cash flow visibility and centralising the management of expenses into one simple dashboard. Cards can be assigned to specific projects or individual employees and spending limits can be controlled and customised per card, ensuring adherence to budgets and promoting expense accountability.

Allocating corporate cards to individual employees, teams, or projects gives your business a greater level of fraud protection. It offers you a clear view of card usage, allowing you to immediately identify expenses that fall outside the established guidelines. With the Zeller App you receive real-time push notifications for any approved corporate card payments, ensuring transparent account monitoring. Moreover, you can easily create and manage cards from the app, allowing quick adjustments to transaction limits for larger expenses. The best corporate card app management solution.