- Business Growth & Optimisation

5 Consumer Trends Shaping Valentine’s Day

Tap into these shopping trends to cash in this Valentine's Day.

Love it or loathe it, Valentine’s Day is a not-to-be-missed opportunity in the retail calendar. Traditionally a day to celebrate love and romance, Valentine’s Day is no longer just for couples. These days, friends are also celebrating connection and gratitude on this special day with their own gift-giving rituals.

Retailers of all shapes and sizes can capitalise on this tradition with some strategic marketing tactics, and well-placed offerings at just the right price point. Keep reading to discover how to tap into current consumer trends and boost sales in the lead up to Valentine's Day.

A Hallmark Holiday with big opportunities

Valentine’s Day is big business in Australia. Surveys show most consumers in a relationship splash between $108 and $208 on their loved one, and spending is expected to exceed $1 billion in the lead up to the day.

While flowers, chocolates and dining are often big winners, spending data shows a diverse group of retailers can benefit from this romantic holiday; travel, beauty, fashion and tech are among the most popular choices for loved-up Aussies every year. One thing that is changing, however, is how consumers plan to shop this Valentine's Day.

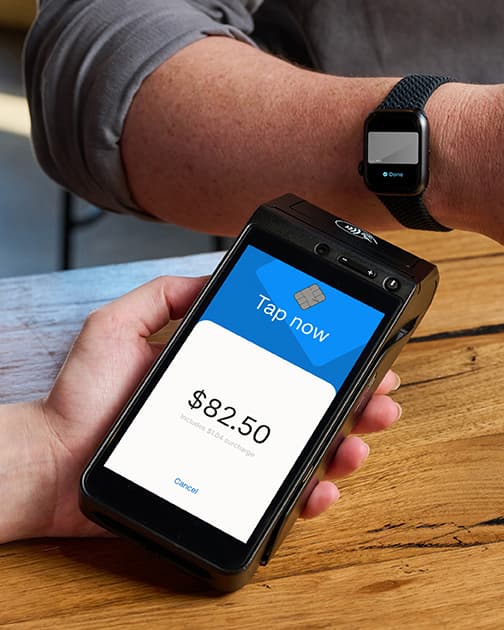

This year, the majority of shoppers— tired of the unpredictability of postage — are opting to buy in-store. That spells a big opportunity for bricks-and-mortar retailers.

2022 Valentine’s Day retail trends

So, what can retailers expect in the way of consumer spending in the lead up to February 14? Here are some current trends driving consumer spending in the lead up to this sweet tradition.

1. Singles are spending big

Romantic love, platonic love or self-love — it’s clear that Valentine’s Day is no longer just for couples. Initiatives such as Galentine’s Day and Palentine’s Day, which celebrate the platonic soul mates in your life, have gained momentum. Interestingly, research has revealed that people are likely to spend around $30 on gifts for family members other than their partners or spouses.

Celebrating self-love by buying gifts for yourself is also emerging as a significant trend. A recent survey reported that 18% of respondents were planning to buy themselves a gift on Valentine’s Day.

By tapping into the singles market and diversifying your marketing message to celebrate love in all its forms, you could effectively double gift sales through the month of February.

2. A surge in last-minute spending

When Valentine's Day comes around, don’t underestimate the power of suggestion in driving impulse purchases. The positive feelings associated with Valentine's Day are known to move people away from their usual shopping habits, and analysts predict a surge in last-minute, in-store purchases.

Here are some tips to cash in on this impulsive behaviour and encourage last-minute spending.

Place appropriate gifts near the register.

Prepare gift hampers to remove decision fatigue.

Offer gift-wrapping to make it easy for your customers.

For those who may be concerned about buyer’s regret, a transparent, well-worded and flexible returns policy may be enough to overcome any hesitations.

3. Spending at both ends of the spectrum

Consumer trends indicate that the joy of shopping for loved ones can be found at either end of the spectrum, with high-end consumers picking up pricey gifts, and budget conscious shoppers loading up on deals. This is great news for all retailers, big and small.

The easiest item to stock and sell is chocolate, which 44% of people say they will be purchasing — and for good reason. For 30% of Australians, chocolate is the ideal Valentine’s gift to receive.

However, surveys show the average consumer is willing to spend around $140 to make their loved one feel special. Keep this price point in mind when putting together your floor displays, or hampers. For tips on setting your price point, read Retail Pricing Strategies: Finding the Right Price to Maximise Your Profits.

4. People are ditching their local florist

While a trip to the florist may have been a Valentine's Day tradition, it appears that consumers have changed the way they shop for their flowers. Instead of stepping into their local florist for a thoughtful bouquet, trends predict that many plan to buy their flowers at their local grocery store or online this year.

2021 also saw a national shortage of roses, due to COVID restrictions. With up to 90% of roses imported from overseas, this shortage is likely to continue in 2022. For florists, this means pivoting how you approach business in the lead up to Valentine’s Day. Stocking locally grown flowers can be an opportunity to showcase your creativity by displaying unique flower combinations in your shop window to attract local passers-by.

Offering the option to order and pay over the phone will be a convenient selling point for Australians who love to shop local. Read How to Securely Transact Over The Phone for a step-by-step guide to take phone payments safely and securely.

5. A shift in perception

While Valentine’s Day has historically been synonymous with flowers and chocolates, modern consumers hold more sophisticated perspectives on what it means to celebrate love. Buyers are craving connection, and retailers with a brand story that reflects a more authentic interpretation of modern love are in a position to redefine the act of gift-giving this Valentine’s Day.

Consider how your buyer feels when they are buying a Valentine’s Day gift, and tailor your marketing message to prioritise romance over revenue. Focus on the experience of gift-giving, rather than the consumerist experience of receiving. They will remember how you made them feel long after the price is forgotten.

Conscious consumerism is another trend which is expected to continue, with shoppers seeking gifts that are aligned with their values, and a buying experience that transcends the cost of the item. Learn more about how conscious consumerism is influencing buying habits in the article 5 Trends Shaping Business in 2021-22.

What can retailers expect in 2022?

One thing is certain: economists will be looking closely at Valentine’s Day sales as an indicator of consumer spending throughout the remainder of 2022.

Staying abreast of consumer trends will prepare retailers to take advantage of new buying behaviours and deliver top-shelf buying experiences that will leave consumers wanting more. Sign up to the Zeller Business Blog to get more retail insights, delivered straight to your inbox.