Best Business Bank Accounts in Australia for 2026

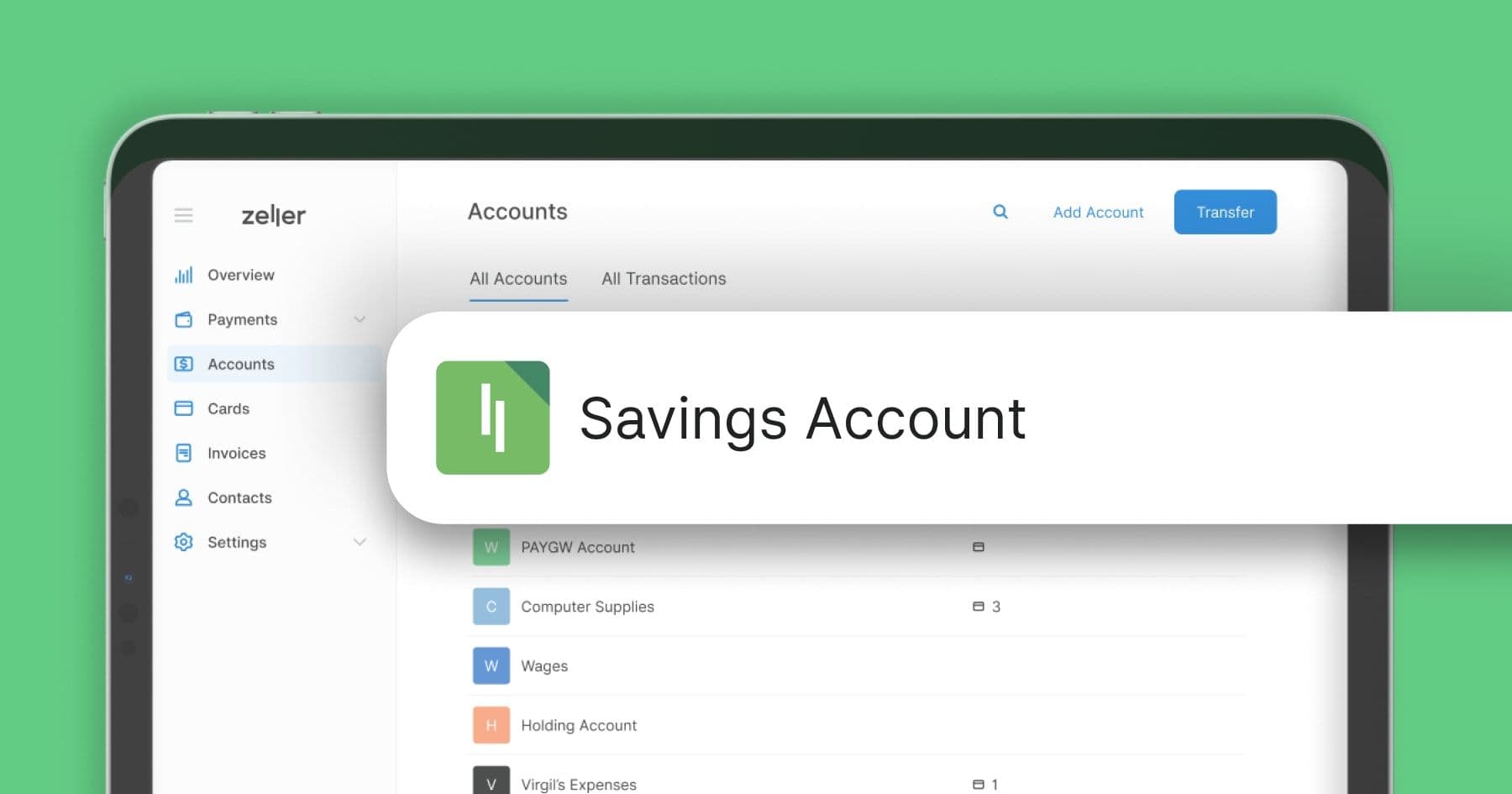

Keeping accurate financial records all starts with a business bank account. But navigating bank jargon, fees, and add-on services can be overwhelming. Let us simplify things for you . We’ve compared the best business bank accounts in Australia for 2026 and weighed them against Zeller—a smarter, more affordable alternative to traditional business banks. Read on to discover why a business bank account is essential, what factors to consider, and why a modern solution like Zeller might be the better choice for your business. How Zeller compares to Australia's major banks We’ve aggregated fees and features from the business accounts of six major Australian banks— Westpac , CommBank , NAB , ANZ , Suncorp , and Bendigo Bank —and compared them to the Zeller Transaction Account in one simple table. Use the drop-down to select two accounts and compare all key criteria for choosing a business bank account. While the major banks offer in-branch support and cash handling (which may suit businesses that still rely on physical banking) they often come with much higher monthly fees and far less flexibility when it comes to things like adding debit cards, or creating sub-accounts. Zeller on the other hand, provides a fee-free account with far more functionality than the major banks. You can create unlimited sub-accounts to organise your funds, add notes to transactions for simplified record-keeping, and issue unlimited debit cards for employees. Receipts can be uploaded directly to make managing expenses easier, while a built-in contact directory lets you quickly see all your payers and payees. On top of that, Zeller includes an invoicing system to create and send invoices, with payments tracked seamlessly, and 24/7 customer support ensures help is always at hand. With Zeller, everything you need to manage your business finances is consolidated into one flexible, easy-to-use platform—without the high fees or unnecessary complexity of traditional banks. What is a business bank account? A business bank account is a specialised account built to meet the financial needs of a business. It helps manage day-to-day transactions like paying bills, receiving customer payments, and handling payroll. Most banks and financial institutions offer a range of account types to suit different business sizes and structures, making it easier to find the right fit for your company. Why do you need a business bank account? A business bank account isn’t just a nice-to-have, it’s a key part of running a compliant, professional and scalable operation. Here’s why you need one: Legal and tax compliance: If you're registered for GST or operate as a company, you’ll need a dedicated account for your business transactions. Simplified admin : Separating personal and business finances makes reconciling income, preparing for BAS, and managing deductions far easier. Professionalism : Customers take you more seriously, and are more likely to trust your business, when invoices and payments come from a business bank account. Cash flow control : Monitor your business incomings and outgoings more clearly to make faster decisions. Access to finance : It’s typically a requirement for business loans, overdrafts, business credit cards, and trade accounts. Types of business bank accounts in Australia In Australia, there are a few core types of business accounts on offer, such as: Transaction accounts : Your day-to-day account for receiving payments, making purchases, paying suppliers. For example, Zeller Transaction Account . Savings accounts : For earning interest on unused business funds. With a Zeller Savings Account , you can earn up to 5% p.a. Term deposits : Lock away funds for a set time to earn higher interest. Offset accounts : Linked to a business loan, helping reduce interest payments. The 7 key factors to consider when choosing a business bank account 1. Fees Monthly account fees, overdraft charges, dishonour fees, and foreign exchange costs vary widely among business banks. For example, traditional banks often charge $10–$25 per month just to keep an account open. Overdraft fees can be surprisingly high, international payments may include conversion or transfer costs, and even routine transactions—whether electronic or staff-assisted—can incur extra charges. For example, CommBank charges $5 per staff-assisted transaction, while Bendigo Bank charges $0.40 per electronic transaction on their Business Basic Account. In contrast, the Zeller Transaction Account has no monthly fees and no hidden charges. For small businesses, especially those just starting out, these savings can add up quickly—leaving more money where it belongs: in your business. 2. Debit cards All business bank accounts will include a debit card, but their features can vary. If your business handles large purchases or frequent cash withdrawals, then it’s very important to check the maximum daily transaction and withdrawal limits, for example. If you plan to manage staff expenses through your business account, then make sure to check the rules around additional debit cards. The big four banks—Westpac, CommBank, NAB, and ANZ—require every additional cardholder to be an account signatory. For many small business owners, this is restrictive, as it means staff gain access to the full account, not just the funds they need. Zeller offers a more flexible approach. Once your account is set up, you can create as many physical or virtual Zeller Debit Cards or Zeller Corporate Cards as you like, for free. Your staff will only have access to the funds you assign to them, keeping the rest of your business finances secure 3. Online banking and mobile apps How you use and interact with your business bank account can either be seamless — or a constant source of frustration. Rather than finding that out the hard way, take the time to research the provider’s online banking platform and mobile app before opening an account. A simple starting point is checking reviews on the Apple App Store to see how other business owners rate their experience. It’s also important to understand who the app is built for. Most traditional banks use the same app for both personal and business customers, which means the experience isn’t always tailored to the needs of business owners. Zeller, on the other hand, is built specifically for businesses. Zeller App is designed with small business owners in mind, giving you the ability to create and manage accounts, issue new cards, review payment reports and transaction insights, and manage expenses — all powered by real-time business data. 4. Financial reporting One of the most important measures of a business’s financial health is cash flow—the money coming in from customers and the money going out to cover operational costs like rent, salaries, and supplies. When choosing a business bank account, it’s important to consider the reporting tools the provider offers, because these insights inform critical decisions. In this area, the Zeller Transaction Account excels. From the desktop dashboard or the Zeller App, you can break down incoming and outgoing transfers, categorise transactions, assign contacts, and attach receipts to expenses—all helping you spot spending trends and make informed decisions. For busy business owners, having financial insights at a glance is not just convenient—it’s essential. 5. Extra account features Choosing a business account isn’t just about holding funds. The right provider will offer you additional features that can reduce admin time and give you more control over how your business operates. For example, when you open a Zeller Transaction Account, you will also gain access to: Invoicing: Create, send, and track invoices with Zeller’s free online invoicing software. Multi-user access: Set custom permissions so team members can view balances, send invoices, or manage cards without full account control. Integrations: Connect your Zeller account to tools like Xero for seamless bookkeeping. Transaction management: Categorise transactions, schedule recurring transfers, and add notes or receipts to expenses so you’re not searching for them later. Multiple accounts: Open as many Transaction Accounts as you need, completely free — each with its own BSB and account number. This makes it easy to organise funds for different locations, projects, or things like GST, payroll, or tax, to make reconciliation much simpler. Debit card customisation: Add your business logo or category labels to your Zeller Debit Card to keep them on-brand and organised. Interest-earning savings: Open a Zeller Savings Account to earn up to 5% p.a. interest on surplus business funds instead of letting them sit idle. Real-time fund transfers: Move money instantly using Australia’s New Payments Platform (NPP). BPAY: Pay suppliers quickly and easily directly from your dashboard. 6. Security With scams and fraud on the rise, it’s essential to choose a provider that protects your business. Look for robust fraud monitoring, end-to-end encryption, and clear processes for disputing suspicious transactions. Compliance with standards like PCI DSS ensures your customers’ card data is secure, while real-time monitoring and proactive alerts help prevent fraud before it impacts your business. When you hold your money with Zeller, your account is backed by 24/7 monitoring and a dedicated team of anti-fraud experts. Suspicious activity is quickly picked up, and if you have to raise a chargeback, our payment disputes team will handle it on your behalf, saving you hours on the phone, at no additional cost. You can learn more about our security measures here . 7. Customer support When choosing a business bank account, the quality of support is crucial. Whether you prefer phone, app, or in-branch assistance, pick a provider that fits your needs. If in-person support matters, check branch locations; if you manage finances online, ensure the website and app are intuitive. Also consider the comprehensiveness of help channels, directories, and support articles. Zeller provides 24/7 support via phone, email, and SMS. Whether setting up your account, resolving a transaction, or handling urgent matters at tax time, you’ll speak to a real human with experience supporting Australian businesses. Plus you'll find many of the answers you need in our comprehensive Support Centre. How to open a business account in Australia Opening a business account in Australia is generally straightforward, though exact requirements can vary by provider. You’ll typically need: A business name An ABN or ACN Industry type Personal ID (driver licence or passport) Business contact details In some cases, documentation for your business structure (e.g., partnership agreement) With Zeller, the process is entirely online and takes just a few minutes—no paperwork, no queues, just fast set up with instant access to your transaction account and debit cards. So, which account is right for your business? There’s no one-size-fits-all solution—every business is structured differently, and every owner will prioritise different features. That said, if your business is embracing the shift toward cashless transactions, Zeller’s financial ecosystem is hard to beat for both cost and functionality. Built specifically for businesses, every feature is tailored to the needs of business owners. To make the best choice, consider the factors outlined in this article, consult the comparison table above, do your own research, reach out to banks if you need more details, and try a free Zeller Account to see how it works for your business.