Fee-free EFTPOS

Switch on surcharging to enable fee-free EFTPOS instantly.

Faster settlement

7-day a week settlement to your free Zeller Transaction Account.

Powerful features

Split payments, tipping, digital receipts, point-of-sale integrations and more.

No monthly fees

With no monthly rental fees, Zeller is a truly fee-free EFTPOS solution.

Get 20% off Zeller Terminal.

Unlock an exclusive promo code when you complete your account registration within 24 hours.

Stylish zero-cost EFTPOS solutions.

50%

Annual cost savings

Businesses save up to 50% more on EFTPOS over their previous provider after switching to Zeller.

Why Zeller is better than

other fee-free EFTPOS providers.

Other fee-free EFTPOS providers | ||

|---|---|---|

| Sign up free online in 5 minutes | ||

| No monthly terminal rental fees | ||

| No minimum turnover required | ||

| 7-day nightly settlements | ||

| Reliable, 99.999% uptime | ||

| SIM, WI-Fi and ethernet | ||

| No lock-in contracts | ||

| Customisable surcharge amount | ||

| Split payments | ||

| Enable customers to add a tip | ||

| Free, built-in POS | ||

| POS-integrated EFTPOS | ||

| 24/7 phone and email support |

Eliminate your EFTPOS fees.

Merchants save thousands of dollars in fees with Zeller zero-cost EFTPOS machines.

Unlimited, fee-free transactions included.

Surcharges displayed to customers on-screen.

Choose to surcharge the full or partial transaction fee.

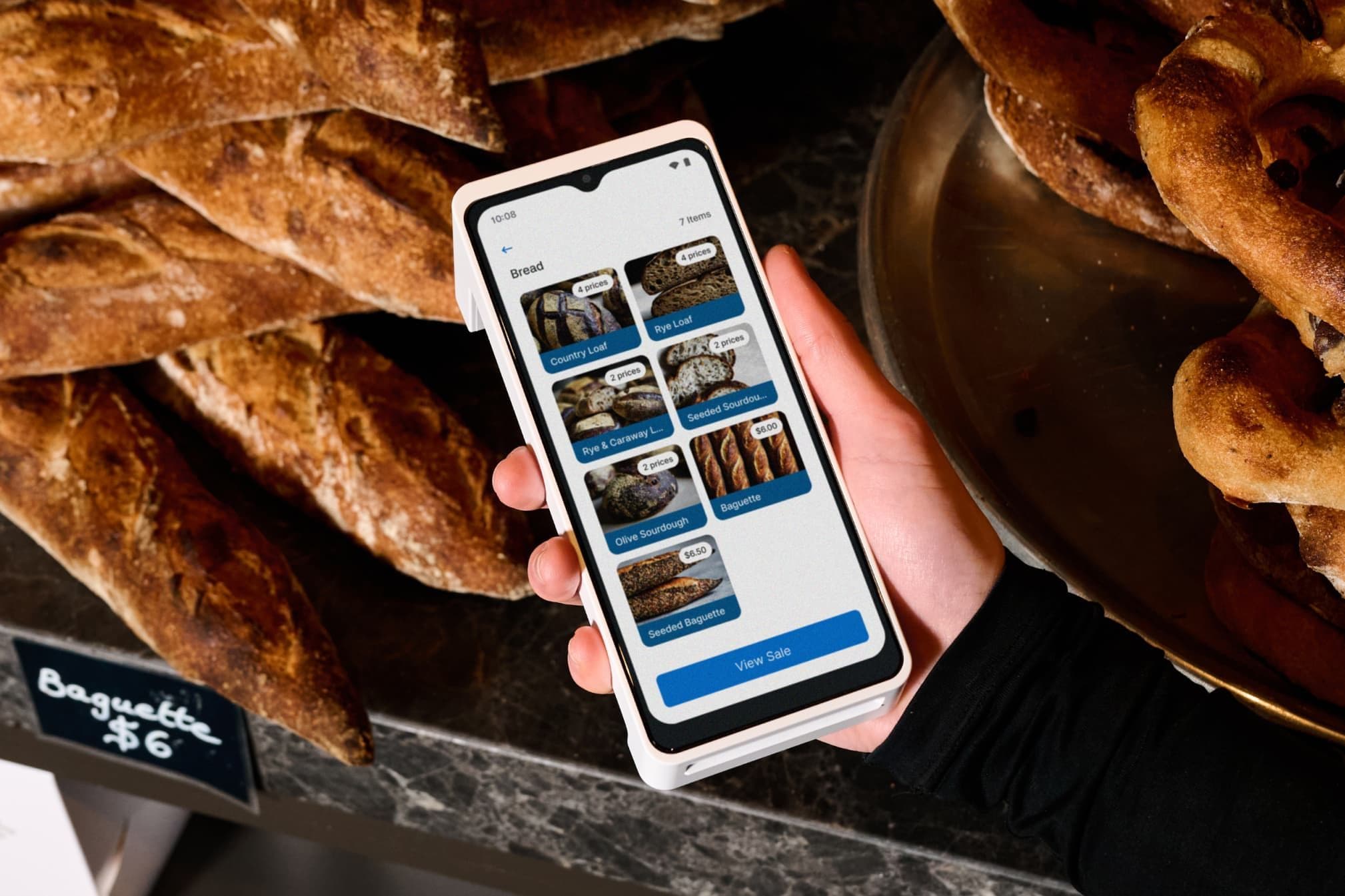

Point-of-sale included.

Integrate zero-cost EFTPOS with your POS, or use the free built-in Zeller POS Lite.

Choose from over 600 different point-of-sale integrations. More

Manage items, discounts, and more with Zeller POS Lite.

No additional integration fees or hidden charges.

Why over 100,000 businesses choose Zeller.

No more bill shock

With zero-cost EFTPOS and no hidden fees, there's no bill shock when your processing volume increases.

Get started in minutes

Sign up for your free Zeller Account and order Zeller Terminal — you'll be up and running fast.

24/7 support

Speak to our dedicated support team via phone, email, or SMS, 24 hours a day, 7 days a week.

Fee-free EFTPOS with no hidden charges.

Unlike other fee-free EFTPOS providers, we never sneak in hidden fees.

Transaction Fees

0%

Customer surcharge covers your fees.

Terminal Rental Fees

$0

No hidden fees or monthly charges.

Zeller Terminal 1

$99

No monthly rental fees or lock-in contracts.

Zeller Terminal 2

$199

No monthly rental fees or lock-in contracts.

Ready to get started?

Most businesses can be up and running on Zeller within minutes. Sign up free online now.

Fast and free to sign up.

No lock-in contracts or monthly rental fees.

Access to all Zeller products instantly.

24/7 support via phone, email and SMS.

Over $250K in card payments?

Zeller Sales can help you discover which products are right for your business.

Get the best card processing rate.

Staff training and implementation support.

Dedicated Account Management.

Dedicated 24/7 priority support team.