Most business banks ask for 6 or more documents to open an account.

At Zeller you can open an account online in minutes.

Fast setup

Get up and running with a BSB and account number in minutes.

Freedom to spend

Issue a Zeller Debit Card instantly to make purchases in-person and online.

High-interest savings

Earn a better interest rate than with a big-4 bank on your business savings.

Real-time visibility

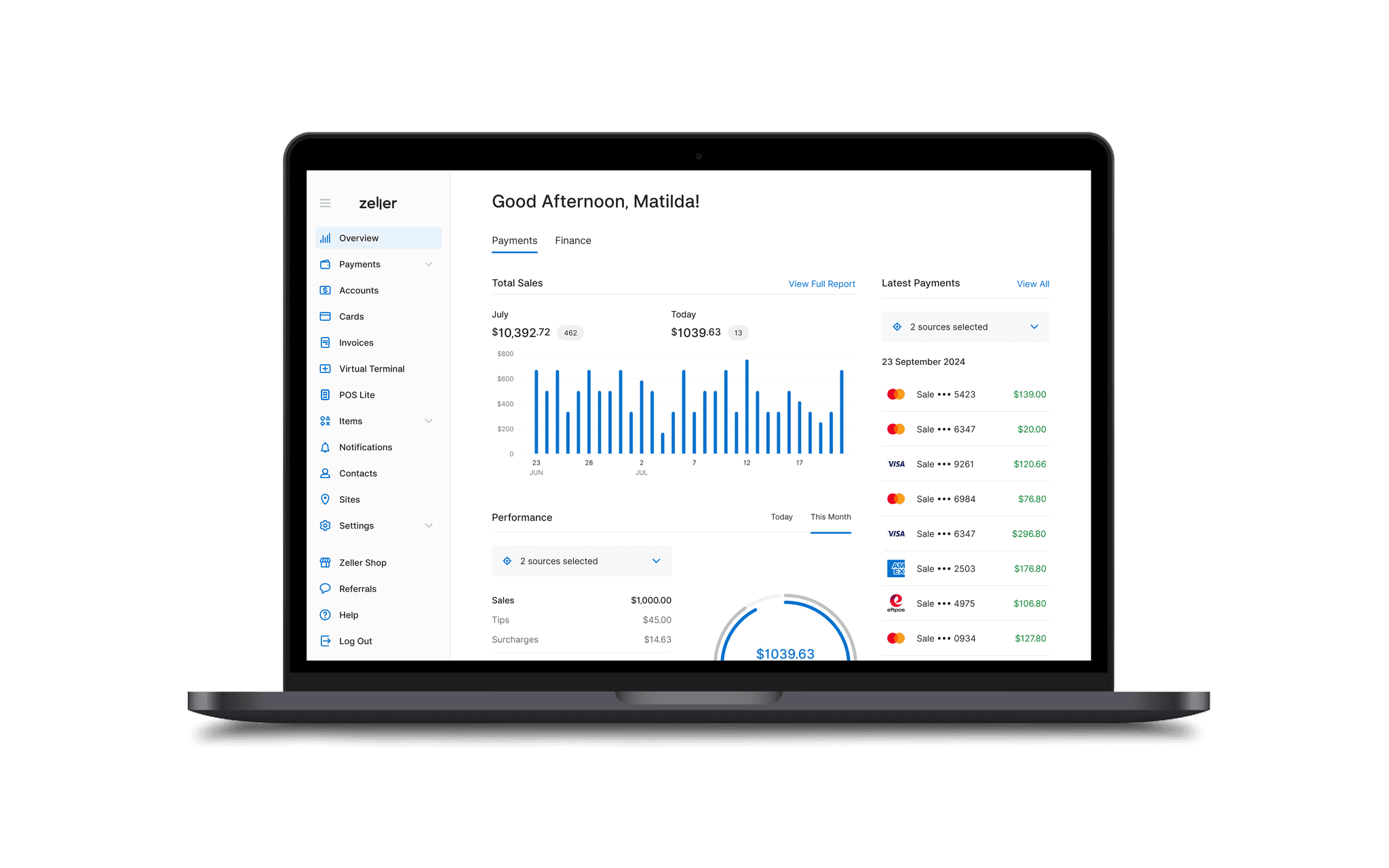

See transactions, expenses, and income with real-time cash flow reporting.

Fully-featured business accounts

Reporting

Expense Management

Debit Cards

Transactions

Zeller helps you do more with your money

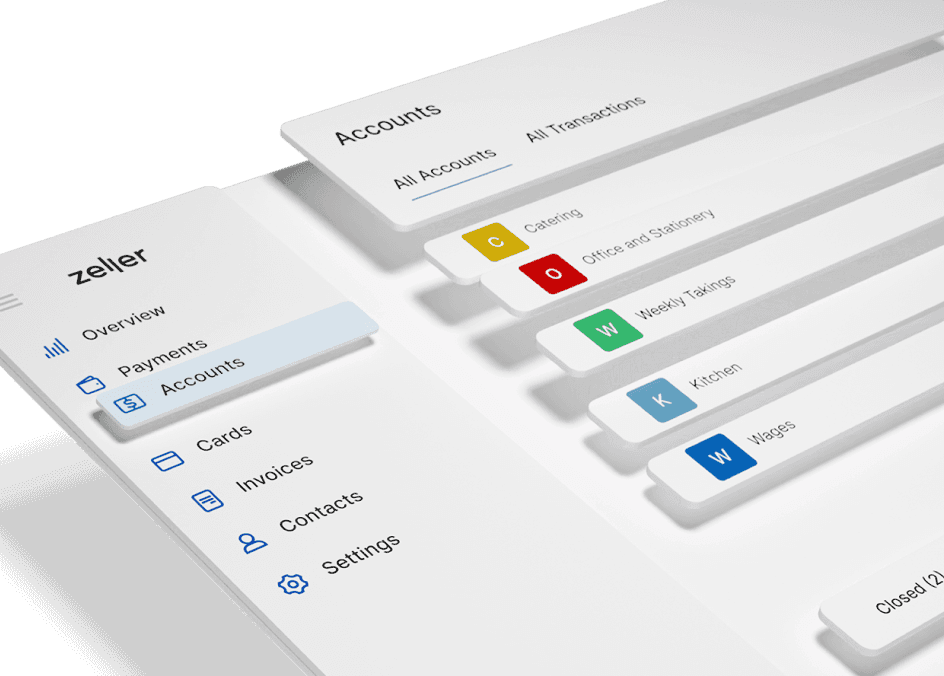

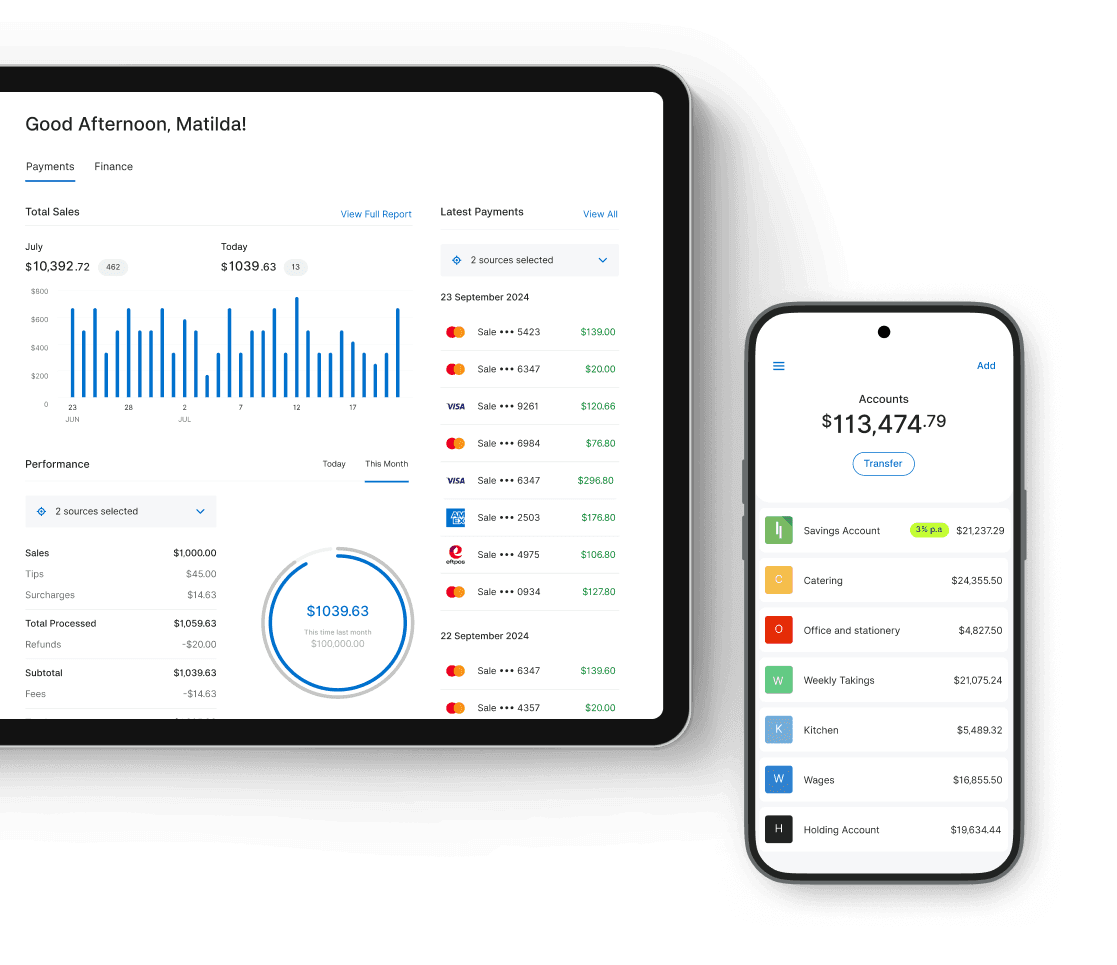

Accounts

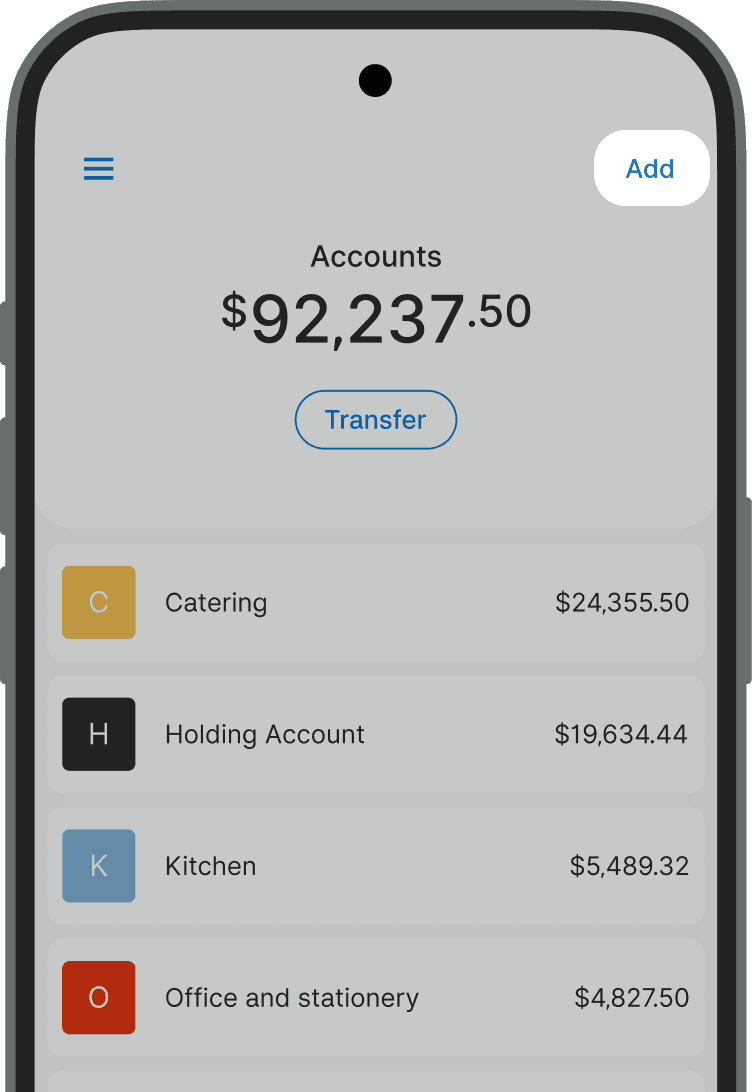

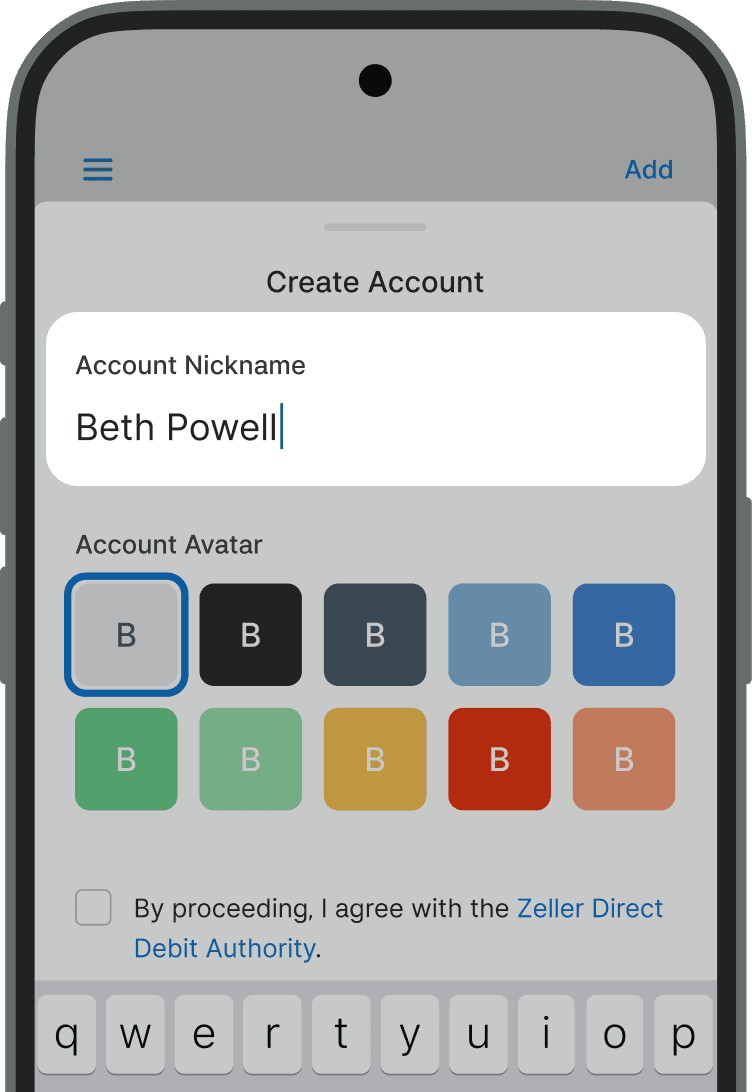

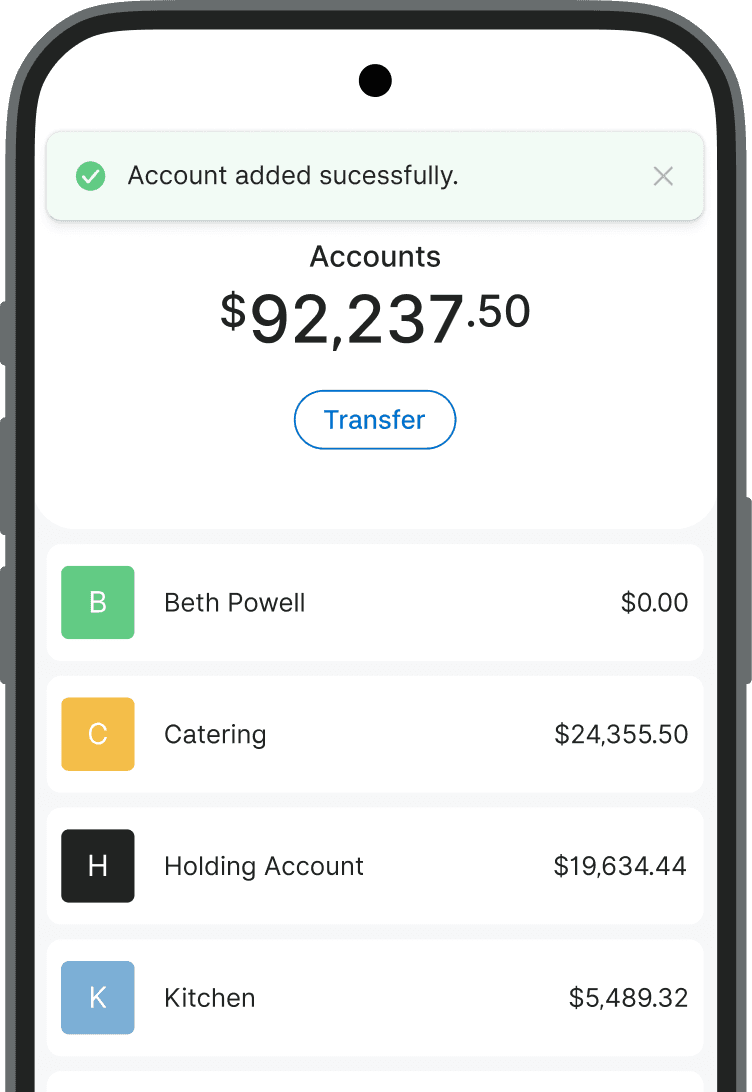

Manage, store, and save your funds with unlimited business accounts.

Create free business transaction accounts in minutes

Understand your spending

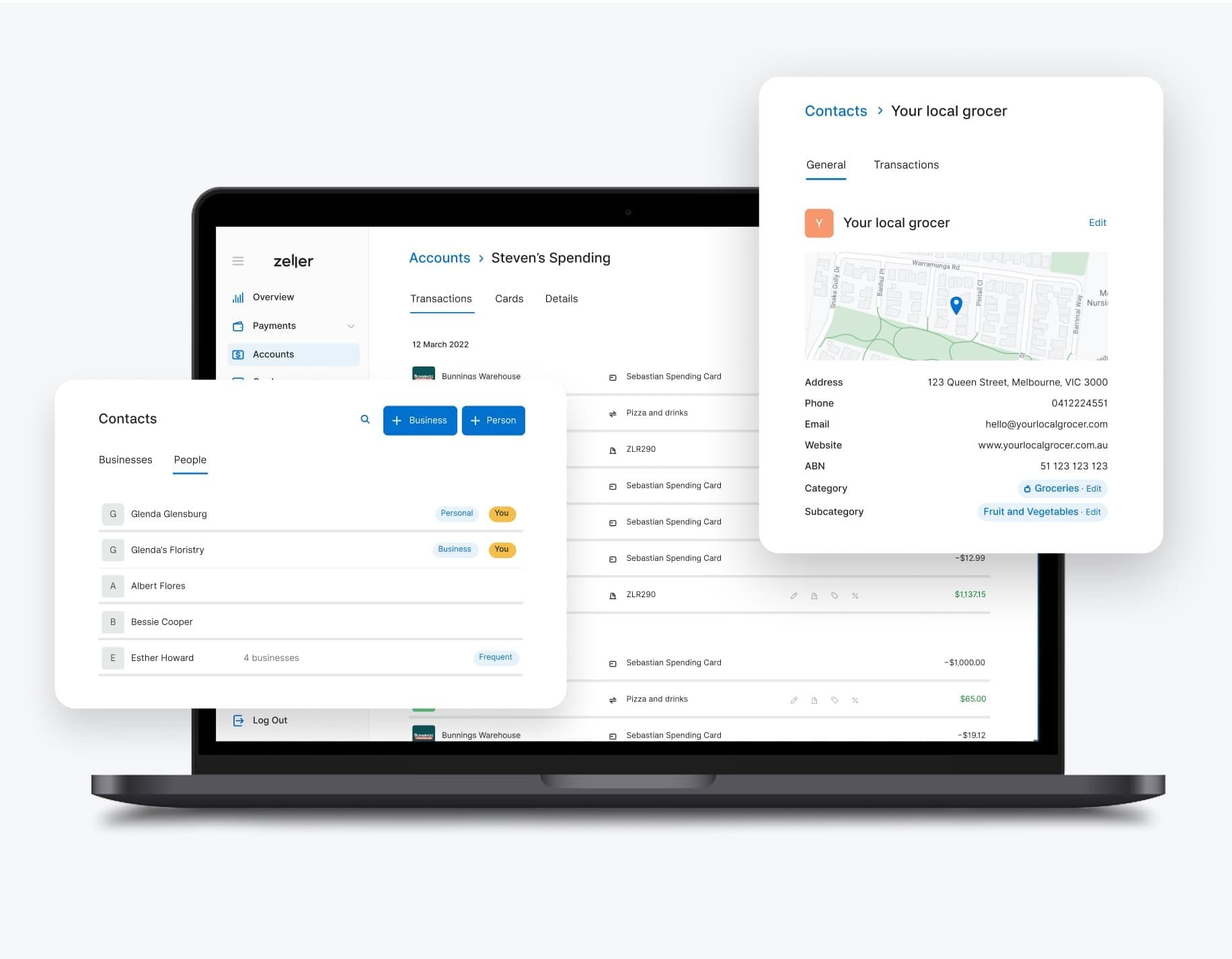

Manage business relationships with Zeller Contact Directory.

Build customer and supplier profiles

Assign transactions to individual contacts

Track spending on your Zeller Debit or Corporate Cards

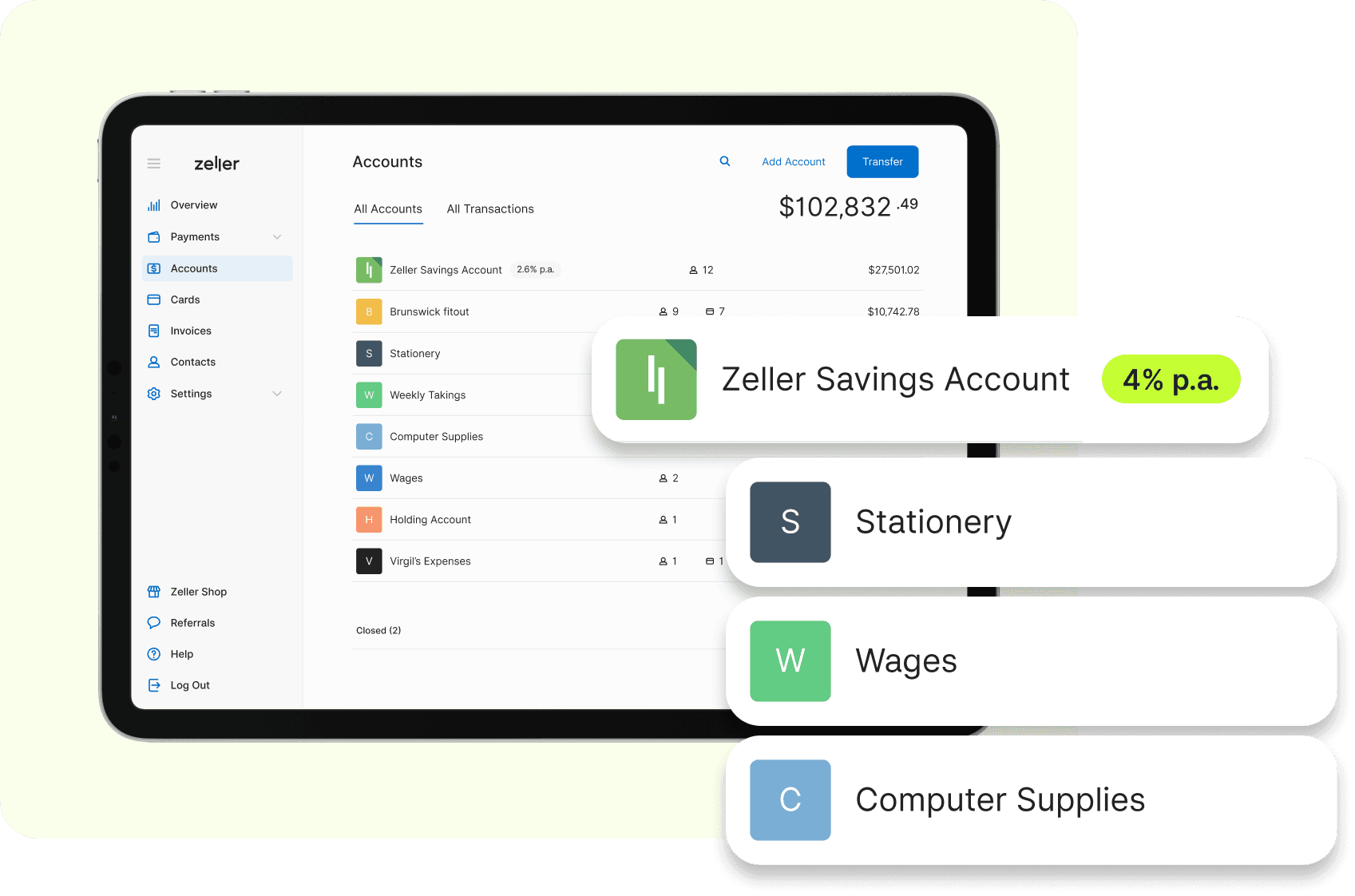

Grow your savings faster

Earn a better interest rate with a Zeller Savings Account.

Activate your savings account instantly – no forms required

Earn a better interest rate than with a big-4 bank

Access and withdraw funds whenever you need them

Pay bills with a click

Schedule or instantly or pay your bills via bank transfer or BPAY.

Gain financial clarity and track expenses by contacts or businesses

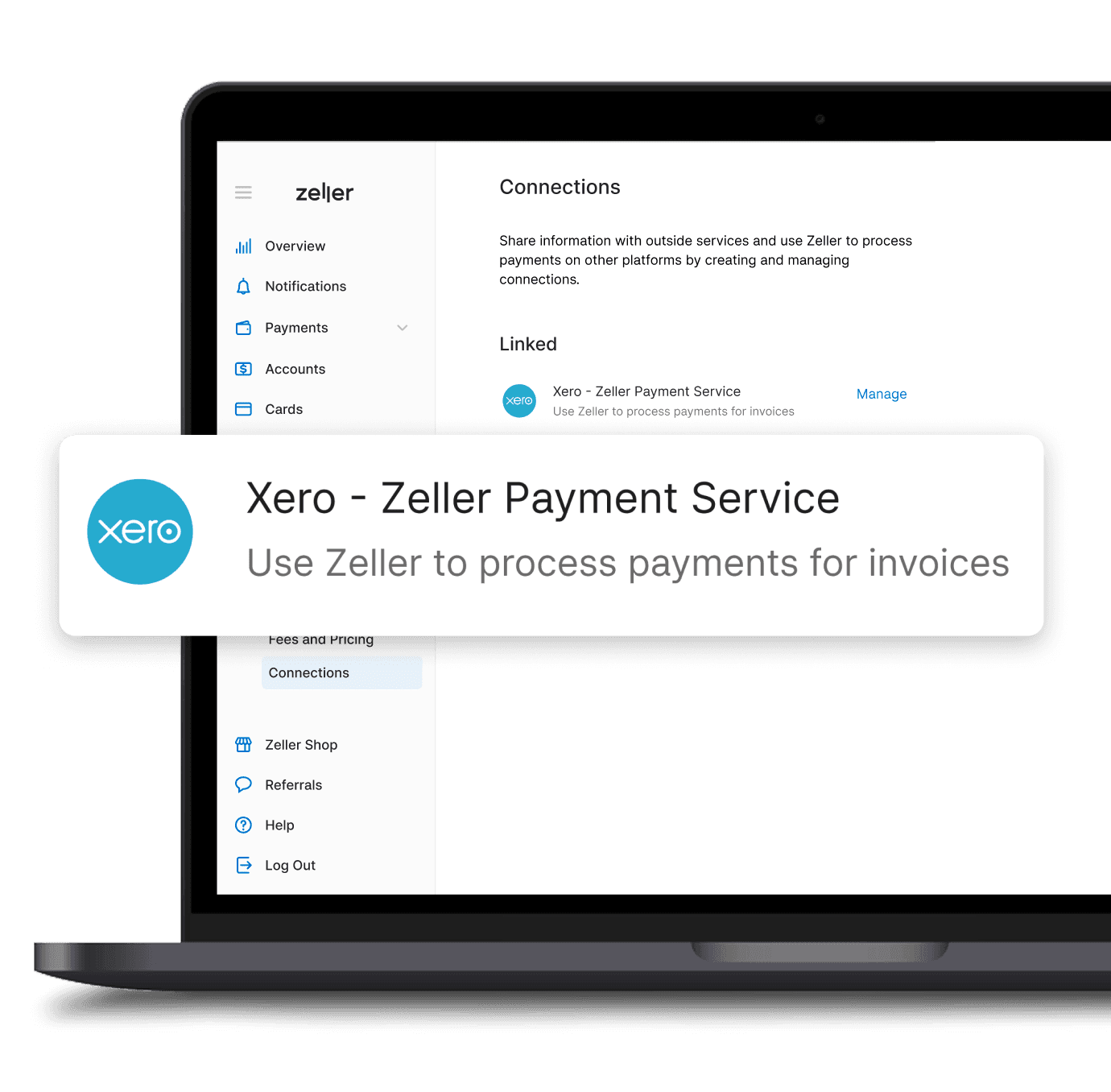

Simplify reconciliation by syncing bill payments with Xero Bank Feeds

Manage recurring subscription payments with your Zeller Debit Card

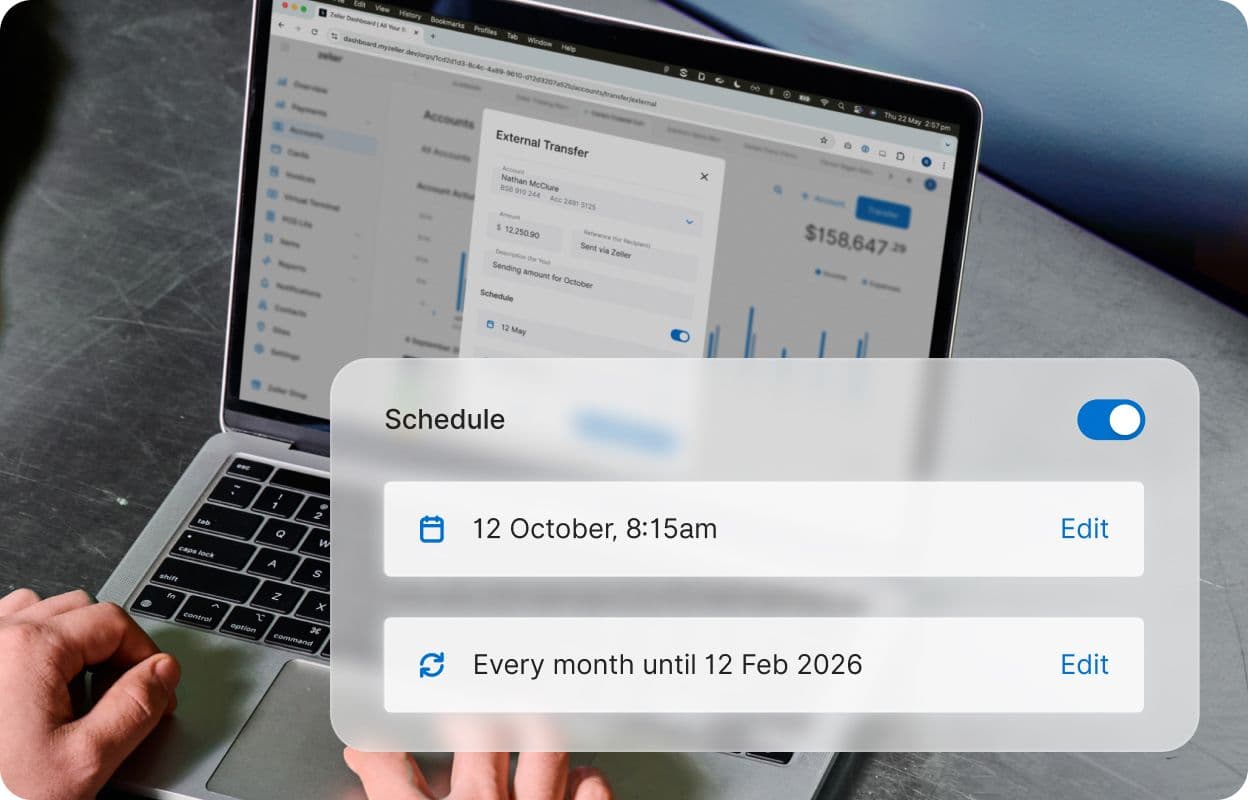

Automate your transfers

Schedule one-time or recurring transfers from your transaction account on Zeller Dashboard or App.

Automate BPAY bill payments for a specific time and date

Reduce admin by scheduling transfers for employee wages at payday

Add funds to Zeller Savings Account when your daily settlement lands

Hundreds of businesses switch to Zeller daily

We urgently needed a business bank account, but Commbank made the process so difficult. With Zeller, everything was incredibly easy — we had our account and EFTPOS machine set up right away.

Monica Bugno

The Last Supper, Darwin

Zeller is better than a business bank. Here’s why.

Business Banks | ||

|---|---|---|

| Instant account creation | ||

| $0 account fees | ||

| No minimum balance | ||

| Dedicated mobile app | ||

| Free, unlimited debit cards | ||

| High-interest savings | ||

| Xero integration | ||

| EFTPOS terminals | ||

| Expense management | ||

| Online invoicing | ||

| 24/7 customer support | ||

| No lock-in contracts |

Don’t pay to manage your own money

It’s free to use Zeller

There are no setup fees, monthly fees, or lock-in contracts. It's that easy.

Support that

never sleeps

Make the switch to Zeller.

Sign up free.

It takes minutes to create a free Zeller Account.

Add funds.

Transfer funds to create your opening balance.

Start spending.

Create a free Zeller Debit Card instantly.

Frequently Asked Questions

To open a business savings account, you also need to obtain the Enhanced Zeller Payment Services. Your funds are held securely by Zeller, on your behalf, in an account with a fully regulated, licence holding Australian bank. Amounts held in the Zeller Savings Account are not protected by the Government’s Financial Claims Scheme. The information provided on this site is for general informational purposes only and should not be considered as advice that takes into account your business needs and objectives. If you are unsure, seek the advice of a qualified accountant or financial service advisor before deciding whether a Zeller Savings Account is right for your business. Please refer to the Product Disclosure Statement, Target Market Determination and Part C of the Zeller Terms of Service here.