- Business Growth & Optimisation

Top Customer Service: The 5 Things Your Business Must Get Right

Discover what your business should do to ensure positive customer experiences.

The way you treat your customers says a lot about your business. No matter the quality of your products or the value of your pricing, you can’t afford to skimp on delivering exceptional customer service.

Read on to discover five things your business needs to get right if you want a reputation for top customer service that keeps people coming back.

1. Broad card acceptance

Your business can’t afford to fail at the point of sale. Refusing common card types is the easiest way to disappoint customers, and one that can be avoided with a simple switch.

There are clear benefits to giving your customers the freedom to pay with their card of choice. Most importantly, you’ll never be forced to turn a customer away or send them to the nearest ATM to get cash out. Keep in mind it’s not only one sale you’re putting at risk by rejecting certain cards — in reality, any customer you lose at that moment might never return.

If, for example, your business doesn’t accept American Express, you’re limiting customers’ credit card payment options to Visa and Mastercard. This matters more than you might think. Why? Because AMEX is accepted at tens of thousands of Australian businesses, including post offices and supermarkets. Your customers are getting used to it being a regular payment option for essentials, and picking up points along the way.

How can Zeller help?

Zeller accepts every common card type — including AMEX — for a low, flat fee of 1.4% for all in-person transactions. This means you’ll never need to refuse a customer’s card of choice.

2. A quick payment experience

In a world where people expect their interactions with a business to be smooth and hassle-free, any bottlenecks or errors at the point of payment can prove costly. In short, it pays to make the customer journey as seamless as possible.

It’s essential for every business to provide a quick payment experience — not least because delays can lead to queues. This in turn might cause some customers to abandon the line, and their purchase, altogether. Even if your customers remain relatively patient at the time, a less than optimal checkout experience could later impact their view (not to mention their review) of your business.

Rather than considering the payment process as just a transaction, think of it as another valuable touchpoint with your customer. You don’t want all the positive aspects of their experience up to that stage — such as helpful staff recommendations and ease of finding the product or service they were looking for — to be undone delays in the payment process that could have been easily avoided.

How can Zeller help?

Zeller Terminal processes transactions in a matter of seconds. It is also mobile — so it can easily be carried around the shop floor or to a diner’s table. This prevents lengthy queues from forming. Plus, back-up connectivity (Wi-Fi, mobile hotspot and Zeller SIM Card) ensures you won’t need to wave the terminal around or carry it to another part of the store trying to process the transaction. And in the event of a dropout or other disruption to your internet network, you won’t need to turn any customers away.

3. Fast refunds

While having to refund a customer is never ideal, refunds are a normal part of business. Whether your customer is dissatisfied with the goods or service received, or they’ve simply changed their mind about a product for reasons beyond your control — such as a sizing issue, you should be able to process a refund promptly and with minimal fuss when required.

What you don’t want to do is turn a refund into an awkward, drawn-out experience that leaves a lasting poor impression of your business. It’s much better to give customers the ease of mind that, should a refund be requested, the whole experience will be painless.

How can Zeller help?

Refunds with Zeller are quick and simple. By streamlining this process using Zeller technology — and eliminating the need to issue store credits — your business could save valuable time that might otherwise be wasted on managing refunds. Basic refund information can even be included on your custom Zeller receipt (SMS and email receipts are free to issue), so your customers don’t have to spend time and effort searching for next steps when they feel a refund is owed.

4. Subtle tipping prompts

Zeller research has found tipping in Australia is becoming more popular. In fact, 70% of Australians are willing to leave a tip when dining out or taking away. Diners are also more likely to leave a tip when the transaction is processed through an EFTPOS terminal, and they are prompted to do so.

That said, it’s still good practice to make tipping available without being forceful or getting in a customer’s face. If your prompt is too pushy — or it automatically nominates an amount that’s too high for the customer’s liking — there’s a fair chance they will opt to not leave a tip at all. And if customers feel confused or under pressure during payment, it’s probably fair to say your business is pushing too hard.

Giving customers the option to leave a tip the right way, however, is entirely acceptable. It’s a worthwhile endeavour, because tips can increase staff satisfaction. The trick is to use subtle tipping prompts — ideally on your EFTPOS terminal screen — that don’t overly disrupt the payment in process.

How can Zeller help?

Not all customers will be comfortable tipping the same amount. That’s why Zeller Terminal allows you to set three custom percentage-based tipping points. Alternatively, you can nudge the customer to enter their preferred amount. This flexibility is important because people like to be given options, not ultimatums.

5. A good customer service team

Your business could have everything in place to be successful, yet if everyday interactions between staff and customers are not memorable for all the right reasons — your business will ultimately suffer.

It’s very difficult to deliver good customer service without a good customer service team, and even the best people need quality training and support to do their jobs well. In addition to prioritising recruitment and retention, you should continue to invest in training your customer service team — or indeed yourself if you’re the only employee of the business — on customer service best practices, techniques and latest trends.

One of the most important skills you'll need to teach your team is how to deal with a declined payment. An agitated customer is more likely to not follow through with their purchase, but if you have a well-versed employee that communicates effectively with the customer, they can often remedy failed payment issues and create a positive outcome for everyone involved.

How can Zeller help?

Equipping your staff with the knowledge to smoothly handle customers and troubleshoot declined transactions is paramount to your business.

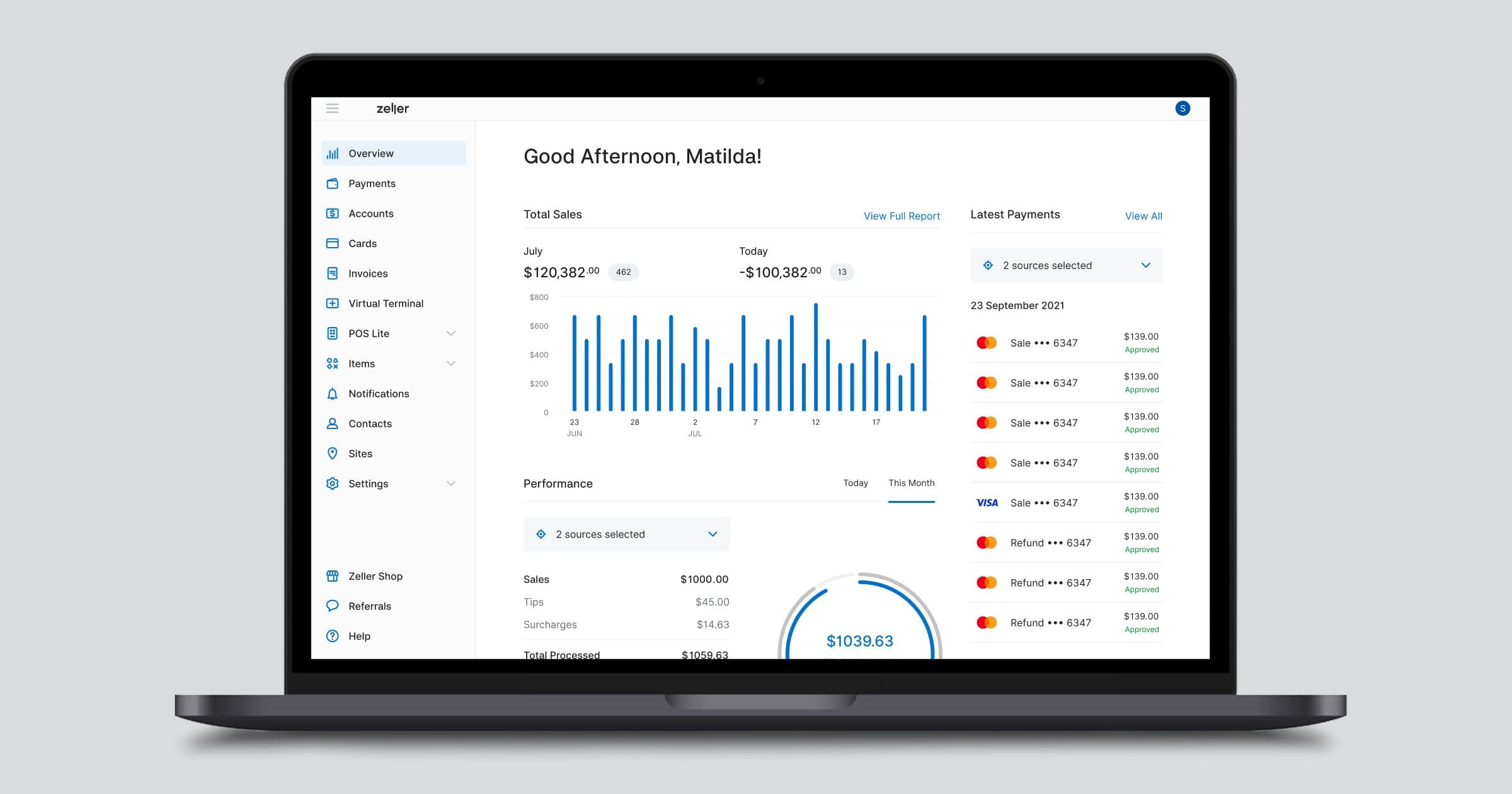

In the event a payment is declined, staff can exit the transaction flow on Zeller Terminal and discover the reason for the decline on the Transactions screen. Or, they can log in on Zeller Dashboard. Armed with the reason for the declined payment, staff can attempt to progress the transaction and make the sale.

The Zeller Customer Success team is always on hand to assist your staff with any queries they may have.