- Business Growth & Optimisation

Is a trust the right legal structure for your business?

As a new business owner, one of the first tasks on your checklist is to decide the legal structure of your business.

There are a number of different ways to set up a business, and they all come with their own unique tax, finance and liability implications —which is why it’s important that you do your research before locking in your structure.

That said, the legal structure of a business tends to be guided by the size, type, and how you want to run it. In terms of your options, the four most common structures in Australia are a sole proprietorship, partnership, company, or trust.

In this post, we explore the appeal of the latter – a trust. For many, it’s the unconventional choice due to its setup costs and inflexibility once established. However, trusts —typically favoured by family-owned businesses — arguably offer greater protection and reduced liability than other business structures.

After reading this article, you should have a better idea of whether a trust structure is right for your business.

What is a trust in business?

The Australian Government defines a trust as “an obligation imposed on a person (a trustee) to hold property or assets (such as business assets) for the benefit of others, known as beneficiaries”. What this essentially means is setting a business up to be carried out by a person or company (the trustee) on behalf of others (the trust’s members, or ‘beneficiaries’). A trustee’s specific obligations are outlined in a trust deed.

A trust is a complex but flexible structure, with clear benefits for the right type of business.

The trustee is legally liable for all of the trust’s debts. It can, however, use its own assets to cover those debts, but if those assets fall short of the outstanding sum, the trustee is responsible for footing the difference.

As for what a trust is not, it’s quite simple: a trust is not a separate legal entity.

Can a charitable trust do business?

Charities registered as trusts are commonly known as charitable trusts. Unlike a traditional trust, a charitable trust is established purely for charitable purposes. This purpose means it doesn’t have to adhere to the rule against perpetuities, it does not have named beneficiaries, it is heavily controlled by the law, and there are sizable tax concessions.

As it is established for charitable purposes, a charitable trust is not technically a business. However, they are often established as ‘investment strategies’ that allow you to grow your wealth while also making a meaningful difference for those less fortunate.

Business trust advantages and disadvantages

There are a number of advantages afforded by a trust business structure, the main advantage being its relative flexibility. Trustees have the power to distribute income at their discretion. There is also reduced liability and increased asset protection, particularly if it’s a corporate trustee. In addition, beneficiaries are not liable for debts, and pay tax on income they receive from the trust at their own marginal rate.

On the other hand, trusts can often be confusing and expensive to establish because they are complex legal structures. For this reason, they must also comply with extensive laws and regulations. And while income can be distributed at the discretion of the trustee, debts and losses cannot.

Business trust vs sole trader

Unlike with a trust, a sole trader business structure is simple and affordable to set up and operate. You also don’t have to register for a tax file number (TFN), and can enjoy full control of all assets and decisions as the sole owner of the business.

However, you have unlimited liability and are fully liable for paying tax on all income earned. It’s also a lot harder to minimise tax as a sole trader —particularly if you’re a successful one. You could be paying a tax rate of up to 45% if you earn over $180,000 as a sole trader.

Business trust vs partnership

Similarly, a partnership is typically considered to be more cost-effective and straightforward to set up and operate than a trust. You also aren’t governed by the duties of the trust, and instead share the control, management and income with only one other person.

However, the liability is much higher as it is only halved rather than shared by multiple trustees. There is also significantly less asset protection and tax advantages.

Business trust vs company

Like with a trust, a company is a separate legal entity, which means your personal assets are protected and you enjoy limited liability. You can also minimise your own income tax by keeping the profits within the company, as corporates tend to pay less tax than individuals.

However, companies do not benefit from capital gains concessions. They are also – like trusts – complex and expensive to set up. In addition, they have a duty of care and diligence to the directors and the employees, ensuring they act in good faith and comply with an extensive range of laws and legislations.

How to structure a trust

While a trust is an extremely complex structure, the broad steps to creating one are relatively straightforward.

Decide on the trust assets

Select a trustee

Determine the beneficiaries

Have a trust deed drafted

Have the trust deed settled by a settlor

Sign the trust

Pay any applicable stamp duty

Create a name for your trust

Apply for an ABN and TFN

Set up a bank account

The process itself is complex and complicated, and you should always consult a professional for legal and financial advice before pursuing this structure.

Will your business benefit from a trust structure?

There are significant advantages and disadvantages associated with a trust business structure. Whether they apply to you will depend on the size, purpose, and goals of your business. If you’re looking for a tax-efficient way to hold family assets and distribute inheritances, it’s a business structure you should explore further with a financial advisor.

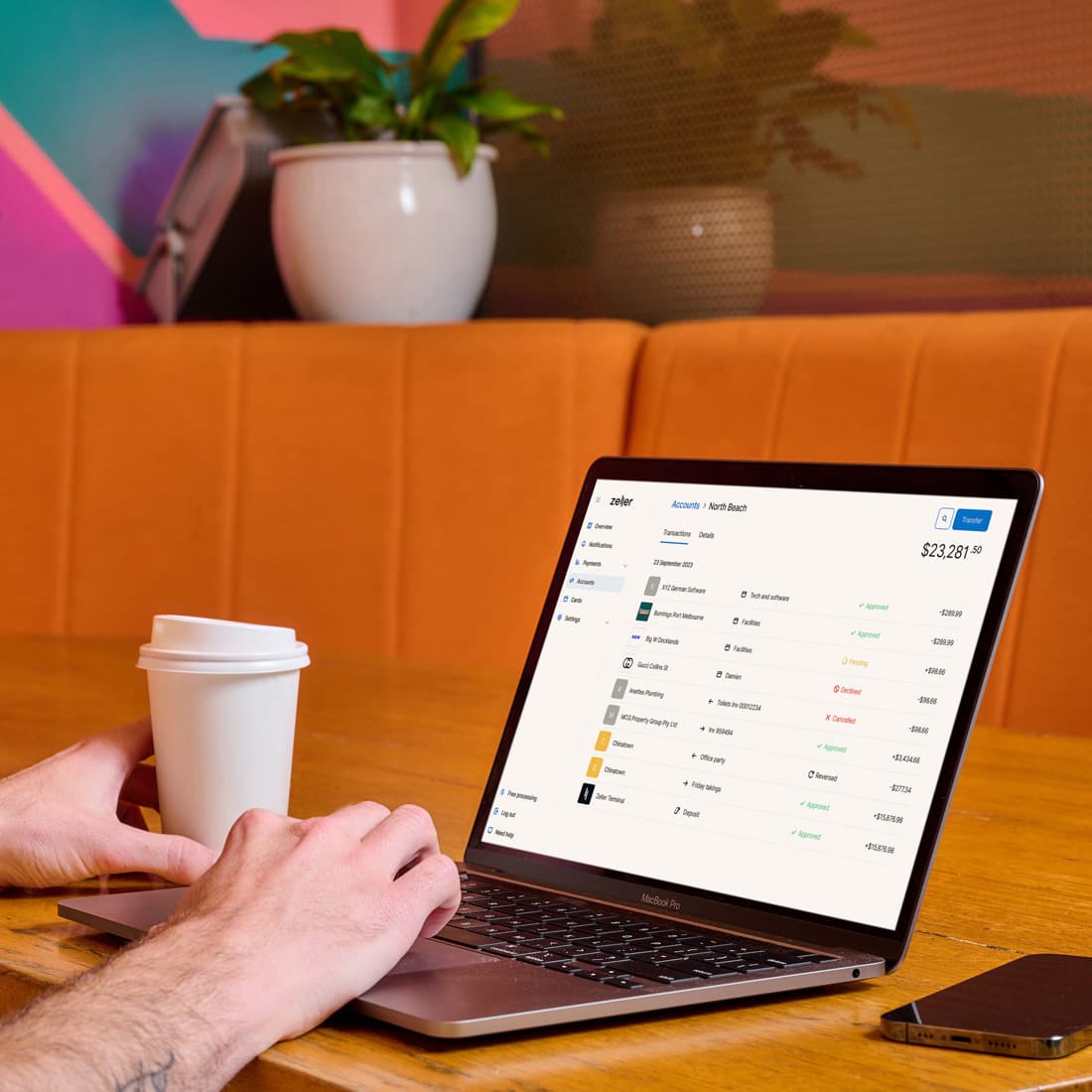

Want to give your business the best possible start right now? Sign up for Zeller – it’s everything you need to accept payments, manage your finances, and pay recipients fast, all in one box. Signing up is free and only takes a few minutes, no lengthy paperwork or visit to a bank branch required.