- EFTPOS & Point of Sale Solutions

How to Use an EFTPOS Machine

An EFTPOS machine is an essential tool for modern businesses.

EFTPOS (which stands for Electronic Funds Transfer at Point of Sale) machines accept credit and debit card transactions. A modern EFTPOS machine from a reliable payment services provider will capably handle this task, by sending transaction approvals and transferring funds between different systems. Then, the customers' funds are settled into your nominated business transaction account — ready for you to spend, reinvest in your business, or pay suppliers and employees.

This is the bedrock of a functional EFTPOS machine. No matter what other features and services are offered, your business needs an EFTPOS terminal that is ready to process every customer’s electronic payment quickly, securely, and affordably.

This is the bedrock of a functional EFTPOS machine. No matter what other features and services are offered, your business needs an EFTPOS terminal that is ready to process every customer’s electronic payment quickly, securely, and affordably.

Understanding the basic EFTPOS functionality.

An EFTPOS machine facilitates the movement of funds from a customer’s account into your own. When you’re selling in-person, you require an EFTPOS machine in order to accept digital payments. Contactless payments are now the norm in Australia; without an EFTPOS machine, you’re narrowing your potential customer pool to those few Australians who still carry cash. Zeller Terminal accepts payments through various methods, including inserted, swiped, and contactless payments from cards or NFC-enabled devices, as well as MOTO payments.

How do you enter a card number on a payment terminal?

To enter a card number on a card machine, simply key in the card number, expiration date and Card Verification Value (CVV). These transactions are known as MOTO (short for Mail Order Telephone Order) payments. On Zeller Terminal, accepting a manually-entered card payment is easy — simply toggle the mode switch from Card to MOTO.

The ability to manually enter card details provides you with a quick, convenient and secure way to accept payment from customers when they’re not with you in-person.

Using advanced EFTPOS features.

A next-generation EFTPOS machine offers you functionality beyond just accepting payments. The best EFTPOS machines combine fast, reliable payment processing with valuable features that can help you grow your business, such as:

enabling you to showcase your brand through receipts and screensavers.

providing you with enhanced security on every transaction accepted.

integrating with POS systems, or offering a free, built-in point-of-sale.

automatically splitting transactions by amount, or by number of guests.

prompting customers to add a tip at the end of a transaction.

Keep reading to discover how to use an EFTPOS machine to grow your business, by leveraging Zeller Terminal’s advanced features.

Showcasing your brand.

A receipt, whether printed or digital, is the perfect place to promote your business and deliver a memorable customer experience.

No longer just for proof of purchase, your receipts can help you promote your business by:

boosting brand awareness by giving you a place to showcase your logo.

motivating customers to follow you on social media with links.

building customer relationships with a custom note or message.

minimising the risk of chargebacks by including helpful return information.

Additionally, the best EFTPOS machines, like Zeller Terminal, enable you to add a custom screensaver to the display. This screensaver could include your business logo, or a promotional offer to display to customers when they’re making payment. You can also learn how to use Zeller receipts as a marketing tool here.

Providing enhanced security.

As your business grows, it’s likely that you hire new staff members to accept payments with your EFTPOS terminal. Unfortunately in some circumstances, this can create a security risk to your business, and your customers.

Zeller Terminal enables you to take control of who can access secure information and features from your EFTPOS machine — such as transaction information, issuing refunds, or updating terminal settings. By setting a secure PIN code on Zeller Terminal, you can immediately restrict access to specific features on your EFTPOS machine, helping to protect your business and enhance your security.

Point-of-sale functionality and integrations.

A point-of-sale (POS) system enables you to create an item library, track inventory, build a shopping cart, accept payments from customers, and send an itemised receipt, in one seamless, fully integrated flow. POS systems are a modern alternative to the traditional cash register and can be run on computers, tablets, smartphones, and even EFTPOS terminals.

Zeller POS Lite comes built-in free to Zeller Terminal 2, enabling you to build a robust item library that displays directly from your EFTPOS terminal or smartphone (via Zeller App). You can use Zeller POS Lite to manage items, add modifiers and attributes to products, and create detailed item reports to track what’s selling, and what’s not.

Alternatively, a modern EFTPOS machine should also integrate directly with your existing POS system — whether you use a hospitality-based POS like Redcat, or a retail-focused system like Zii POS. Zeller Terminal integrates seamlessly with over 600 third-party POS systems, which you can find on the Zeller Partner Hub.

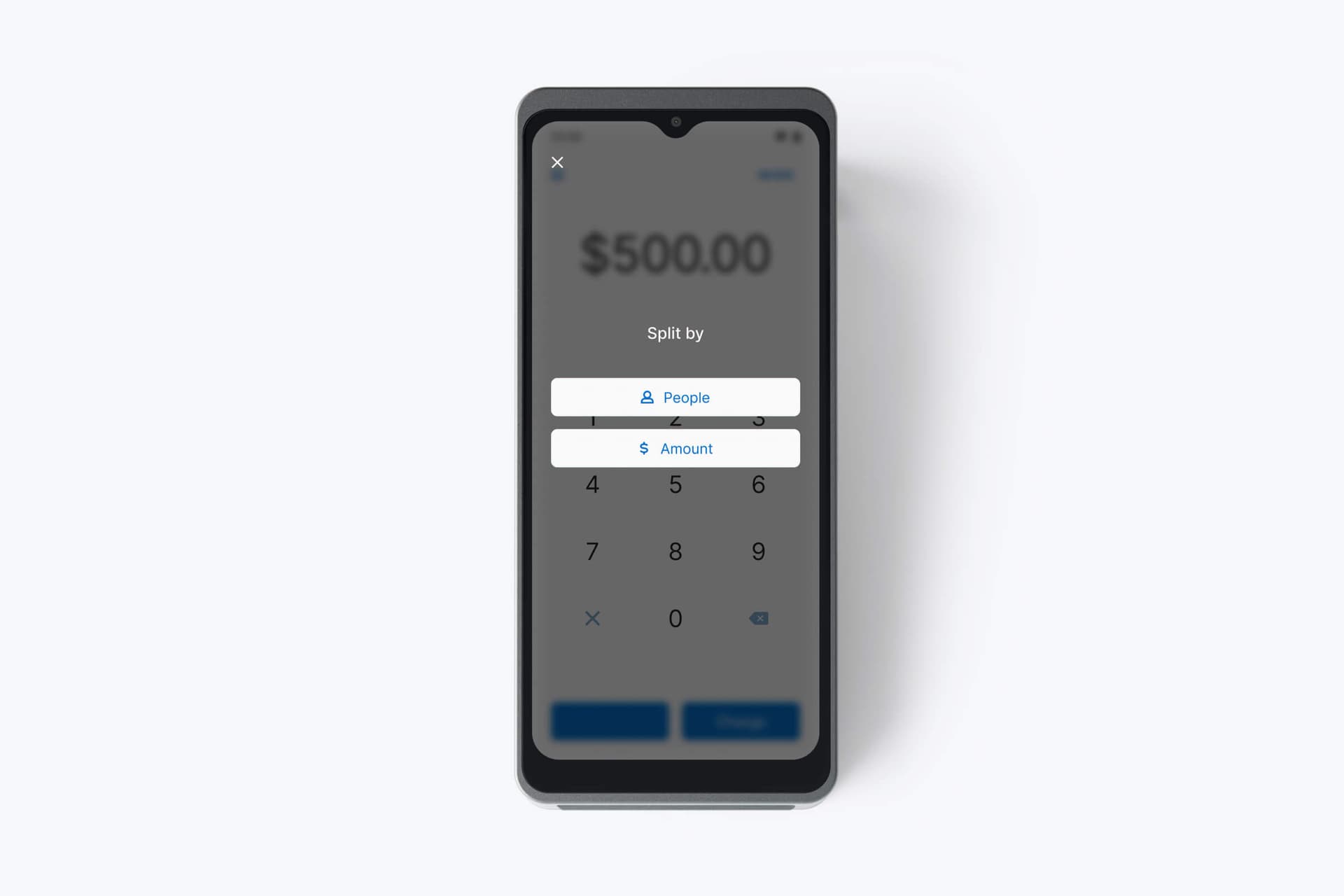

Split transactions.

In many circumstances, such as in a restaurant or cafe, your customers may ask to split a payment across a number of people. This requires you to operate a modern EFTPOS terminal that will enable you to automatically split transactions, without your staff having to calculate the individual payment values manually or with a calculator.

With Zeller Terminal, you have the option to split transactions directly from the device. Transactions can be divided by the number of guests evenly, or alternatively, every guest can choose a custom value to make payment for, until the entire transaction is complete.

Prompting customers for tips.

If you’ve delivered a great customer service experience, customers may want to leave you a tip at the end of an EFTPOS transaction. EFTPOS tipping is increasingly common in service industries such as cafes and restaurants, so having an EFTPOS machine that automatically prompts customers to leave a tip is essential.

EFTPOS terminals that are automatically enabled with a built-in tipping feature may lead to an increase in gratuity, benefitting your employees. In fact, modern EFTPOS machines like Zeller Terminal, which automatically prompt customers for gratuity at the end of a payment, have delivered an increase in tips by up to 30%.

Searching for the perfect EFTPOS machine?

Learn moreWhy you need an EFTPOS machine.

We know, with certainty, that Australians prefer using debit and credit cards over notes and coins. Research from the Reserve Bank of Australia demonstrates the sharp decline of physical cash use: respondents under the age of 40 used cash for less than 15% of their payments in 2019. In 2016, cash accounted for 30% of their payments.

Over the last five years, the number of ATMs across Australia has fallen 53.6% — making it difficult for those few consumers who still want to carry cash to do so. The world has gone digital, and as a result so have businesses.

All of this is unlikely to come as a surprise, considering the obvious benefits of credit and debit cards: they’re simple, fast, secure, and generally easy to use. A customer just needs to tap, dip or swipe their card or mobile wallet to your terminal — without the need to handle cash. For this reason, having an EFTPOS machine is just as critical for your business operations as it is for your customers’ experience.

The cards EFTPOS machines accept.

EFTPOS terminals accept both credit and debit cards. However, with advancements in technology come new ways to pay — meaning older terminals from traditional providers may not support the payment methods your customers prefer.

When selecting the right EFTPOS machine for your business, it’s important to look for a terminal that will enable you to offer customers a broad range of payment processing options. How do your customers expect to be able to pay for the goods or services you provide? If you run a busy coffee shop in the CBD, your customers might want to use their mobile phone or smartwatch to pay for their morning caffeine hit. Your customers may even use lesser-known payment types that are growing in popularity.

When choosing which EFTPOS machine is right for your business, set your sights on an EFTPOS terminal that accepts all of the major card networks (such as eftpos, Mastercard, Visa, American Express, and JCB) as well as other convenient payment methods your customers prefer to use (such as Apple Pay and Google Pay).

Do EFTPOS machines need internet?

An EFTPOS machine will use a wired or wireless internet connection to process payments. Modern terminals use SIM cards, making it possible for you to process transactions outside of Wi-Fi range (a must when customers expect to be able to pay at the table). However, best-in-class terminals will provide multiple connectivity options: a SIM card slot, as well as Wi-Fi connectivity.

Communication between the terminal, the card issuer, the processing bank, and the payment network requires reliable connectivity — but that doesn’t have to come from a traditional internet connection. Technology has evolved so you no longer need to have your terminal hardwired, sitting stationary by your register. Your payment tools should work wherever you do.

How long does an EFTPOS transaction take?

Every business owner wants to know how long an EFTPOS transaction takes. The time it takes to settle funds to your business bank account directly impacts cash flow and, by extension, your ability to grow your business.

Funds accepted via Zeller Terminal are swept to your chosen Zeller Transaction Account nightly, available for spending instantly using your free Zeller Debit Card.

For more information about the limitations of traditional banks, read Transaction Processing and Settlement: Why Do Banks Take so Long?

Finding the best EFTPOS machine for your business needs.

EFTPOS machines make payments easy for customers and business owners alike. Customers can quickly pay for their goods or services and get on with their day, while your business can cut down on wait times and efficiently provide great service to everyone making a purchase. Finding a trusted, secure and innovative EFTPOS provider should be a top priority for your business. Zeller enables merchants to accept every payment, accelerate cash flow, and quickly manage and access funds.