- Business Growth & Optimisation

GST for Small Business: All Your Questions Answered

A simple guide to the Australian goods and services tax.

For most Australian business owners and consumers, GST needs no introduction. The 10% ‘goods and services tax’ was introduced on 1 July 2000 as part of the Howard government tax reform. The aim of this new tax was to overhaul the existing sales tax system across all states and territories, providing them with a stable and growing source of revenue and removing their reliance on grants from the federal government. Since GST was implemented more than two decades ago, it has well and truly become a fixture in the Australian small business landscape (whether it’s considered effective or not). Regardless of public sentiment, business owners must remain informed of their GST obligations.

How does GST work for businesses?

If you run a business in Australia, you may be required to register and collect GST. What this means is that, if you fall into one of the categories listed below, you will need to add GST to your prices and send that extra money to the Australian Tax Office (ATO). The advantage of being registered is that you can also claim back any GST you’ve been charged on business supplies and expenses.

The biggest determinant for whether or not you should register for GST is your business’ turnover. Remember, turnover is your gross income, not your profit. So, if you run an online clothing store and sell $80,000 worth of clothes in a year, you’d have to register for GST. This is because your GST turnover is over the $75,000 threshold – even if you only make $40,000 in profit.

Who needs to register?

Australian businesses with a gross income of $75,000 or more

Taxi drivers and ride-sharing drivers irrespective of their revenue

Not-for-profit organisations with an annual turnover of $150,000 or more

Businesses seeking to claim fuel tax credits

Global retailers with Australian sales exceeding $75,000 per year

Do you have to pay GST if you earn under $75,000?

For businesses that expect to remain below the income threshold, registration for GST is optional. However, if you do decide to register, you will still be required to report and pay GST even if you do not reach the threshold. Many businesses choose to register for GST from day one to create a strong first impression for their clients and customers. By charging GST, it implies that your turnover is more than $75,000. What’s more, it also lets you claim back the GST you spend on business expenses.

If you’re starting a new business and are not yet sure what your turnover will be, the ATO recommends registering for GST. If you do reach or surpass the $75,000 threshold without being registered for GST, you have 21 days to register for it.

If you are engaging in a part-time activity, you may wonder if it is deemed a business or a hobby. In short, if you are making a profit from that activity (i.e. selling the goods or services for more than cost price), it’s a business. For further clarification, you can also refer to these guidelines.

Items exempt from GST.

GST-free sales

While GST is a broad tax, some items are in fact exempt. Businesses selling GST-free items like staple foods, some forms of education, medical, healthcare and financial services don’t have to collect and pay GST for these items. However, you can still claim GST credits for any expenses that were incurred in order to produce these items. You can get a full list of GST-free goods and services on the ATO website.

GST on exports

Goods exported from Australia are GST-free, on the condition that they are exported from the supplier within 60 days of you receiving payment or issuing an invoice, whichever occurs first.

Calculating GST.

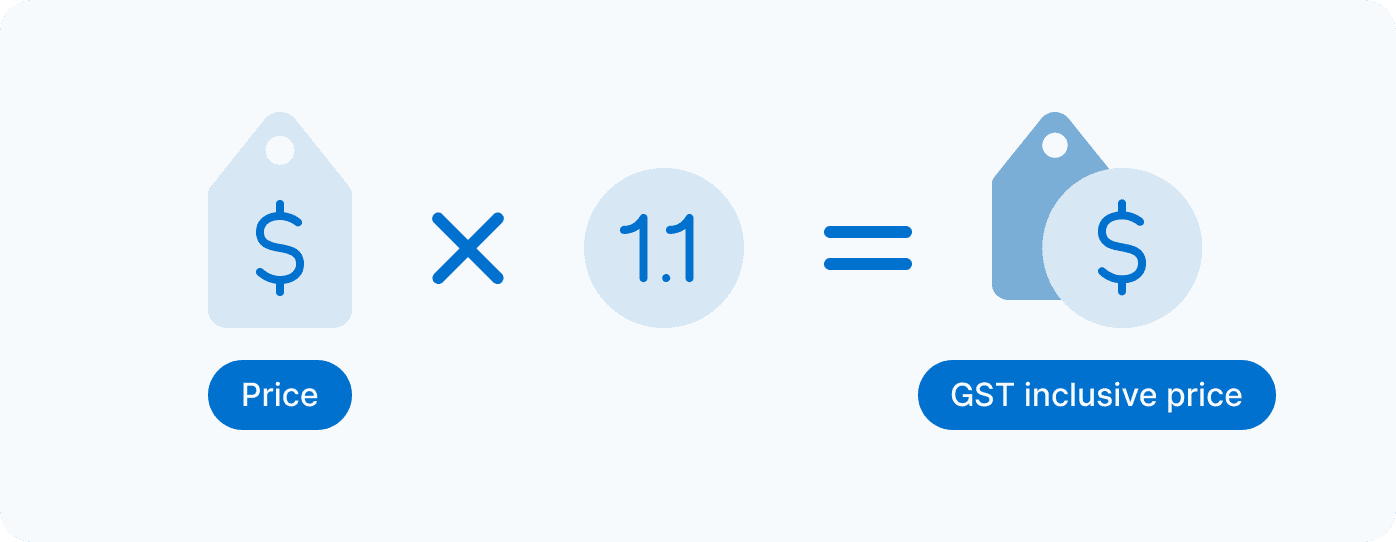

You need to increase your prices by 10% in order to include GST.

Use this simple formula:

Managing GST.

Issuing tax invoices

If your business is registered for GST, the invoice you issue to a customer must be a tax invoice. These differ to regular invoices in that they include the GST amount for each item or for the total price. For customers to be able to claim their own GST credits, you must ensure your tax invoice is formatted correctly. To simplify the process and to be sure you are meeting your GST obligations, we recommend using an online invoicing software. Simply fill in the preformatted invoice with your item details and prices the software will automatically calculate the GST-inclusive price for you.

If you issue receipts at your point-of-sale, these must also contain the words ‘tax invoice’ on it. For customers who are likely to be claiming their own GST credits, having an EFTPOS terminal that can send the receipt as an SMS or email is an easy and convenient way to win their favour.

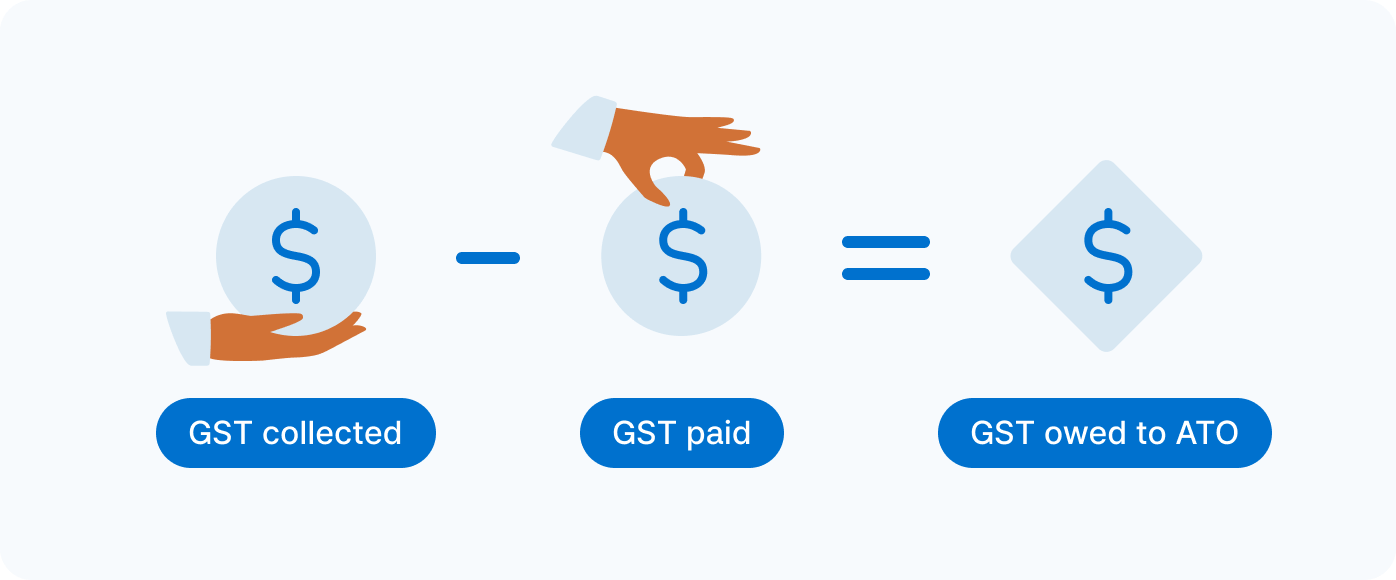

Tracking your GST bill

If your business is running successfully, your expenses will be less than your sales, which means that you will most likely end up with a GST bill to pay to the ATO. So as not to end up with a nasty surprise at the end of every quarter, it’s important to keep track of how much GST you’ve spent (on business expenses) and how much you’ve collected (on sales).

Run this calculation regularly, and transfer the owed amount into a separate business account. With Zeller Transaction Account you can create as many sub-accounts as you like — for free. By having a dedicated account for GST payments, you can be sure that you’re covered when it’s time to submit your business activity statement (BAS).

When it comes to tracking your expenses, it’s essential to have a business debit card. Zeller Debit Card lets you attach receipts and notes to transactions, which takes the headache out of tracing your payments and making GST claims.

5-step GST checklist

Once you’ve registered for GST, here are the five steps you need to take to ensure you’re meeting your legal obligations:

Add GST to your prices

Issue tax invoices to your customers

Keep receipts and invoices to claim back GST on business expenses

Submit business activity statements (BAS) to the ATO every quarter

Pay any GST due

Claiming back GST.

One of the advantages with GST is that you can claim back any of the tax you have paid on business expenses. So, whatever you buy for your business, the GST included in the price can be claimed back as a GST tax credit (otherwise known as an input tax credit) when you lodge your BAS.

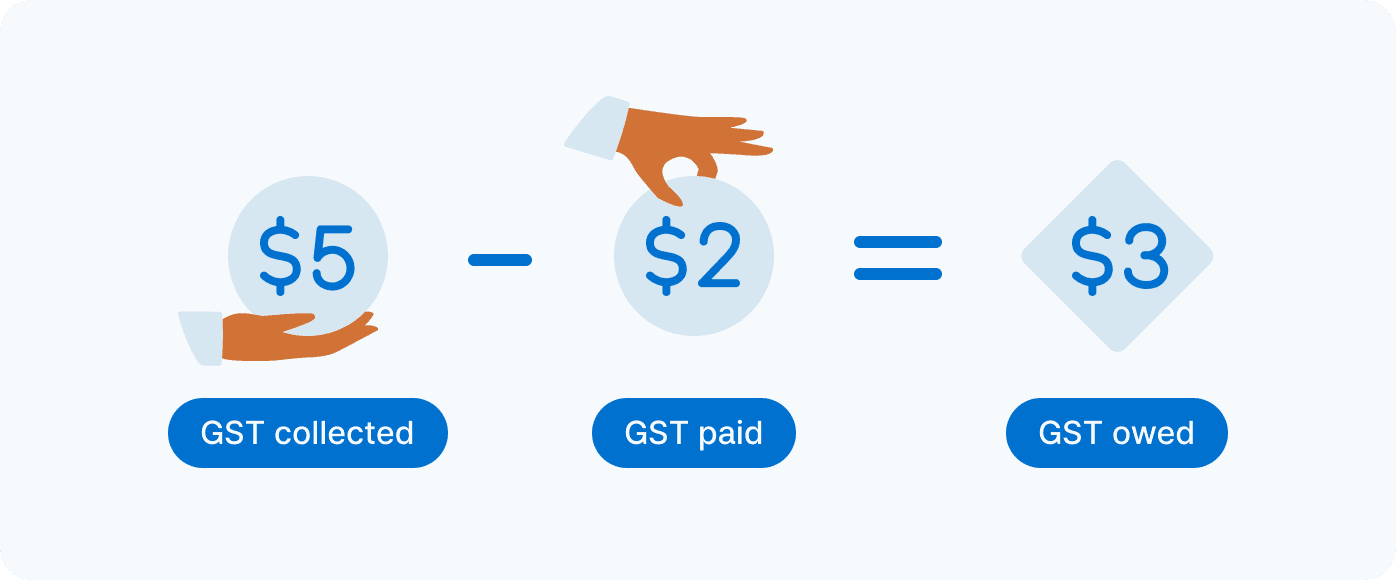

Example:

Shirley runs her own retail business, where she sells hats. She purchases fabric for $22 ($20 + $2 GST), then turns the fabric into three hats — which she sells for $55 each ($50 + $5 GST).

What is a GST rebate for small business?

Even if the final product that you sell is on the list of GST-free sales, you can still claim any GST that you paid in creating that product.

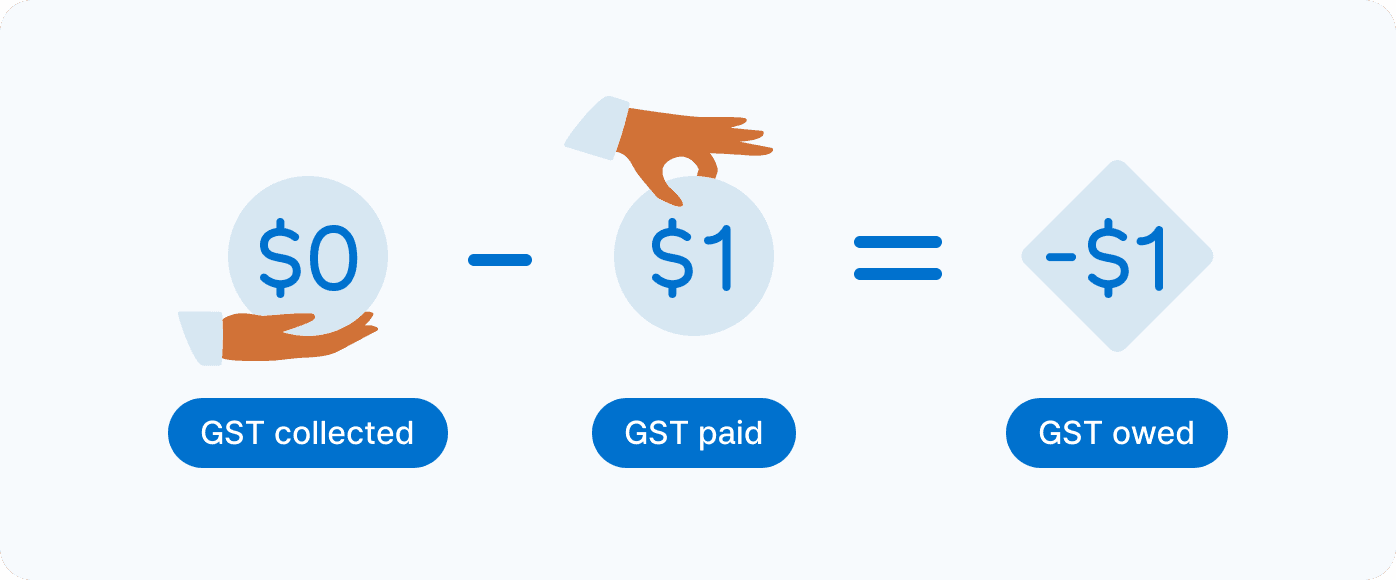

Example:

Max sells strawberry jam for $6 a jar. The government deems strawberry jam to be an essential item and so is exempt from GST. However Max buys glass jars and ribbons to package the jam both of which he pays GST on. He spends $11 ($10 + $1 GST) on the packaging materials but collects no GST from the jam sales.

If the calculation produces a negative number like in the example above, the ATO owes you money, and you will be refunded the balance. It’s essentially a reimbursement for the GST you paid and will be factored into the tax your small business pays.

When claiming input tax credits, you need to make sure of the following:

You must have proof that the goods or services you purchased were used directly for your business

The businesses you purchased the goods and services from must be registered for GST (if unsure, check the invoice or receipt, it must say ‘tax invoice’).

You’ll need to be able to provide the tax invoices for any expenses over $82.50

You need to have paid the invoices before making the claim

You have four years to claim GST credits

Registering for GST.

Registering your small business for GST is easy, and once you’ve done it, you’ll never have to do it again even if you create multiple businesses in the future.

If you have an Australian Business Number (ABN) you can register for GST via:

The ATO’s Online Services for Business

By calling the ATO on 13 28 66

Through your registered tax agent or BAS agent

By completing the ‘Add a new business account’ form. You can order it by typing in the code ‘2954’ into the ATO’s online publication ordering service.

Managing GST for small businesses in Australia doesn’t have to be complex. With Zeller, you can send hassle-free tax invoices, keep track of your expenses, and set aside your collected GST in a dedicated account. It’s all part of Zeller’s smarter solution to small business finance.

Sign up for our newsletter today to receive more advice, insights and small business stories straight to your inbox.

Please note this article is for educational purposes only and does not constitute advice.