- EFTPOS & Point of Sale Solutions

Free Surcharge Signage Template

Create an EFTPOS surcharge sign using our free templates.

Do you charge one flat fee for all cards? Or different fees depending on the card type? Find the options relevant to your business below.

Choose the template that corresponds with the card types your business accepts.

Download and open your PDF in the free Adobe Acrobat Reader.

Enter your surcharge rate.

Print your signage and display in your business.

One flat fee for all card types.

Different fees for each card type.

If you’re surcharging in Australia, you need to notify your customers about it. In this article, you'll learn what the legal requirements are around surcharge signs, as well as accepting card-only payments and weekend and holiday surcharges. Plus, download our printable EFTPOS surcharge sign template for free.

So, you’ve decided to start surcharging. To ensure you are being fully transparent with your customers as well as meeting regulatory requirements, there are certain rules around surcharge signage that you must comply with. Being aware of these as soon as you start surcharging will not only help you avoid potential disputes but, importantly, maintain good faith among your clientele.

Not sure about passing the transaction fee onto your customer? This handy guide will help you decide whether surcharging is right for your business.

What are the legal requirements around EFTPOS surcharge signs?

Surcharging in Australia is governed by the Australian Competition & Consumer Commission (ACCC), which mandates very strict requirements around how much a business can legally surcharge (read their guide on calculating surcharges here). According to the ACCC, the rules around surcharge signs are as follows:

If your business accepts alternative, non-surcharged payment methods (such as cash or bank transfer), then you are only legally required to have an EFTPOS surcharge sign visible at the counter. There are no specifications around how this sign must be formatted, however it must sufficiently communicate to your customers what they will be paying before they tap, dip, or swipe their card or mobile wallet. If your bank or payment provider charges a different fee per card type, then you need to specify exactly how much will be surcharged for each card. But don’t worry, we’ve done the work for you: download our credit card surcharge sign template below, add your transaction fees, print it out and display it at your counter.

If your business does not accept any payment methods that don’t incur a surcharge, then you must include the surcharge within the price of the product. For example, a $5 coffee with a 2% surcharge added to it will need to be displayed at all times as $5.10. In this instance, it is not sufficient to display the coffee as $5 on the menu and to only have a credit card surcharge sign at the point of payment.

Is it legal for businesses to not accept cash?

Yes, according to the Reserve Bank of Australia, there is no legal requirement for merchants to accept cash for retail payments. It is the decision of the merchant as to whether they accept or encourage payments in cash. However, the ACCC states that consumers must be made aware of these terms and conditions before they make a purchase and the total minimum price payable for the goods or services must be clearly stated (as per the example above). If you choose to stop accepting cash, make sure to update all your pricing displays to incorporate the surcharge amount into the individual prices, and ensure you have a clear and conspicuous sign detailing the payment methods you do accept.

Are weekend and public holiday surcharges legal in Australia?

Yes. The ACCC allows cafes and restaurants to add a surcharge on weekends and public holidays to help cover the increased costs of penalty rates during these periods. However, it’s imperative that you effectively communicate this to your customers. The ACCC mandates that the venue include the following words on the menu and/or price display: “A surcharge of [percentage] applies on [day or days].” Additionally, the words must be at least as prominent as the most prominent price on the menu, or made visible elsewhere in your venue.

How much should you surcharge on public holidays?

Unlike credit card surcharges, there is no limit to the amount a business can set as a public holiday surcharge. However, the standard rate in Australia is between 10% and 15%. It is up to you as a business to assess whether you risk potential customer dissatisfaction to ensure your operational costs are covered, or whether you absorb the public holiday penalty rates with the knowledge that it might bring in more customers.

The rule of thumb when it comes to surcharge signage

While the ACCC doesn’t specifically detail exactly how large or visible your surcharge signs should be, they can investigate cases of non-compliance. If a customer considers that your business is breaking the rules around pricing displays, at best they won’t return to your business, but at worst, they will report you to the ACCC. It is therefore extremely important that you do not mislead your customers about what they’ll be charged or why.

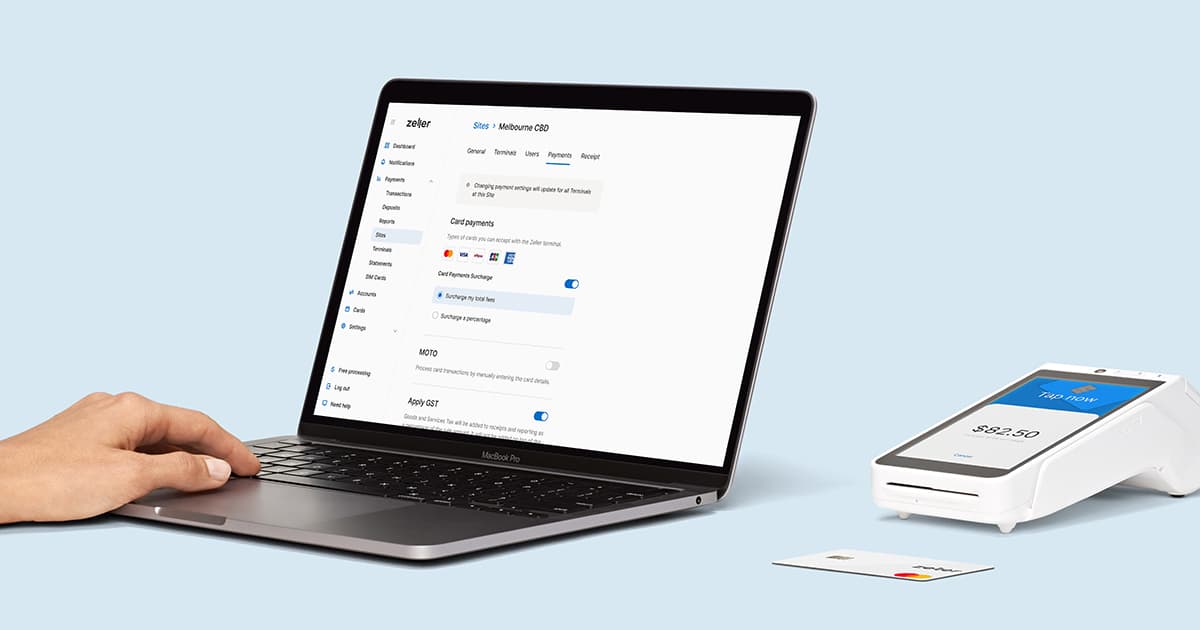

Ensure you have a clear, visible surcharge sign at your counter, so that consumers can easily see whether there are any additional costs that may apply before making their decision. Additionally, opt for an EFTPOS machine, such as Zeller Terminal, which calculates the surcharge and displays it clearly for the customer on-screen before they tap their card.