Introducing Zeller for Startups.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

24.01.2022

A business bank account is a facility that protects a business’s capital while enabling it to spend its funds. You’ll use a business account to receive payments from customers, fulfill invoices, track business expenses, and generally keep your accountant happy.

A business bank account is not a personal account. For tax and bookkeeping purposes, banks, accountants and payments providers strongly recommend that merchants separate personal from business funds in separate accounts.

To open a business account, business owners used to need to gather their documentation together, visit a bank branch in person to meet with a representative, and then send various forms via fax, postal or electronic mail. Eventually, you’d receive a card and checkbook in the mail.

Instead, you can sign up for a free Zeller Transaction Account in minutes. A Zeller Terminal can be purchased from the online shop, with free express shipping and same-day dispatch. Funds accepted via Zeller Terminal will be available in your Zeller Transaction Account for spending, the very next day, or you can simply use Zeller as your primary financial services provider without taking payments through Zeller Terminal.

When comparing business accounts, it’s important to spend time on working out what’s important to you and which features your business needs. Read our blog about opening your first business account.

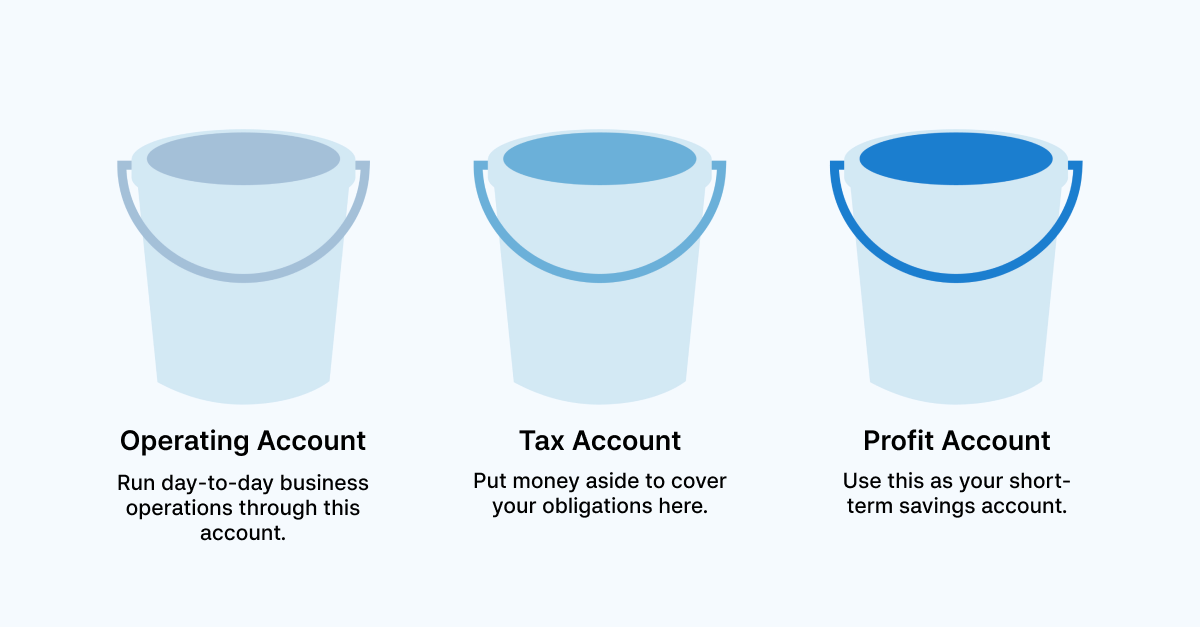

There are three basic business accounts you should consider opening. Of course, there are more sophisticated ways of managing your funds; you could be pouring over your budget every day. However, for simple and straightforward money management, keep reading.

Zeller merchants can set up multiple sub-accounts to tailor their funds management to fit their unique business set-up. Not only does this give you a better overview of your business's finances, it also gives you the ability to more easily manage your money — with quick and seamless transactions between your main and sub-accounts.

Here are the three accounts every small business owner needs.

The first account you’ll need is your operating account. Your operating account is where you run the day-to-day operations of your business.

It’s where you:

and so much more. Basically, all your day-to-day cash inflows and outflows go through this account. Most businesses should have one of these accounts already. For most Zeller merchants, this will be your Zeller Transaction Account.

Funds are collected from your Zeller Terminal, settled and cleared into your Zeller Transaction Account overnight — so they’re available for spending the very next day. It’s the fasted way to get access to your takings and speed up your cash flow.

Sign up for Zeller and you could have your Business Transaction Account in less than five minutes. Once your account is set up, stop using cash and do all your transactions electronically. If you’re paying suppliers in cash, it’s easy to lose track of the payment. If you pay electronically, you can always find a record of the transaction — ensuring you don’t miss out on claiming GST (if you are registered for it), or other tax deductions.

Bigger businesses may choose to use a traditional bank for their operating account, because they offer overdraft facilities (subject to approval). These banks likely charge a monthly fee for the service.

The second account that you’ll need is your tax account. Your tax account is where you start putting money aside for tax. By separating it from your operating account, you will be less likely to spend it.

It's easy to accumulate funds in your account, forgetting that at some point down the line there's tax to pay. Entrepreneurs and business are legally obliged to pay a number of different taxes, such as sales tax, trade tax, income tax, and wage tax.

When you first start trading, you’re not paying tax on your earnings. But the year after you lodge your first tax return in net profit, you get a tax bill for that year — plus all of a sudden you also have to pay PAYG installments. Depending on which type of tax you pay, you will be required to make specific quarterly or monthly payments in advance to tax authorities. These advance payments help your business to budget and plan ahead, by spreading the business’s tax burden over the entire year.

If you set aside money in a sub-account on a regular basis, it can help to make sure that you have sufficient financial resources available to pay your taxes on time. Each week or each month, start to put money aside money that will cover your obligations such as:

Finally, the third account you’ll need is a profit account. This is where you put money aside for the profits of your business. So, as your business makes a profit, simply put a portion of that money aside.

Again, if you leave it in your operating account, it’s far easier to spend. But if you put it aside in your profit account, it will be available when you want to make any changes in the business. This could be things like:

The beauty of starting to manage your money this way is that you’ll be able to start choosing where you spend your accumulating profits, rather than your takings being simply absorbed in the day-to-day operations.

Set these three accounts up today and use them frequently — you’ll soon find that you’ll have the money that you’ll need to scale your business. Once your business grows, it’s a good idea to look for a high-interest business savings account. This will let you earn interest on extra funds that you don’t need right now; effectively, it’s another revenue stream as it allows you to make money on business assets.

With Zeller, you can accept payments from customers, track spending and manage your business's finances online. It’s an all-in-one solution for merchants looking for the most straightforward way to start or grow their business — no hidden fees or lock-in contracts required.

In Zeller Dashboard, you can see:

and so much more. By putting valuable insights at your fingertips, we hope to enable Zeller merchants to be able to make important business decisions with ease.

Sign up to the Zeller Business Blog for more business tips delivered straight to your inbox.

Please note this article is for educational purposes only and does not constitute advice.