Introducing Zeller for Startups.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

28.01.2022

A new age is dawning within the payments industry. This era, dubbed “Payments 4. X”, will see a focus on personalised customer experience, industry consolidation and new tech industry players — offering business owners and their paying customers alike “smarter experiences and smarter interactions”. But what sparked the change?

Payments 4. X has been ushered in by an unprecedented push for contactless payment options, faster transaction settlements, and foolproof security. The most straightforward explanation of the shift comes from Capgemini's 2021 Global Payments Report, which provides an in-depth look at how payments have changed over the last year, as well as the various ways in which the COVID-19 pandemic has shaken the industry up and created new opportunities for merchants to improve the way they run their business.

Access the entire global report online, or keep reading for the short version: a distillation of 5 payment trends that will likely impact small business owners in Australia as we enter the age of Payments 4. X.

The success of any business hinges on its people, processes, and systems. As new tools and apps continue to be developed, the success of a business will increasingly depend on its tech stack.

The ecosystem of tools you piece together will impact everything from how you communicate with your customers, to the ease of running promotions, to the time it takes to report on business performance. Integrating your EFTPOS terminal with your point-of-sale system, for example, will enable you to select a customer’s item on-screen and have the transaction amount immediately appear on your terminal — ready for the customer to tap, dip, or swipe to pay.

An interconnected system will also make real-time data accessible, enabling you to make quick decisions for the betterment of your business. For your customers, connected systems mean a better experience; more personalised, more efficient, more fulfilling.

As tech companies continue to develop products built on the software-as-a-service model, businesses of all shapes and sizes will be able to create their own modular value chain of tools. This plug-and-play tech will enable those merchants who spend time comparing and selecting tools that work well together to save time, build better customer relationships, and grow profits.

Perhaps most importantly, spending the time to find the right systems will enable you to run your business in your own unique way.

Buy Now, Pay Later schemes (BNPL, for short) are exactly what they sound like. A customer can buy a product now, for a small amount of money, and pay the balance later — no need to wait for payday. In removing these hurdles for customers, they’re more likely to spend.

An American study found that businesses that offered their customers to option to buy now, pay later experienced a 20 to 30% uplift in conversion rates. 80% of those that began offering BNPL saw an increase in the amount customers spend in-store.

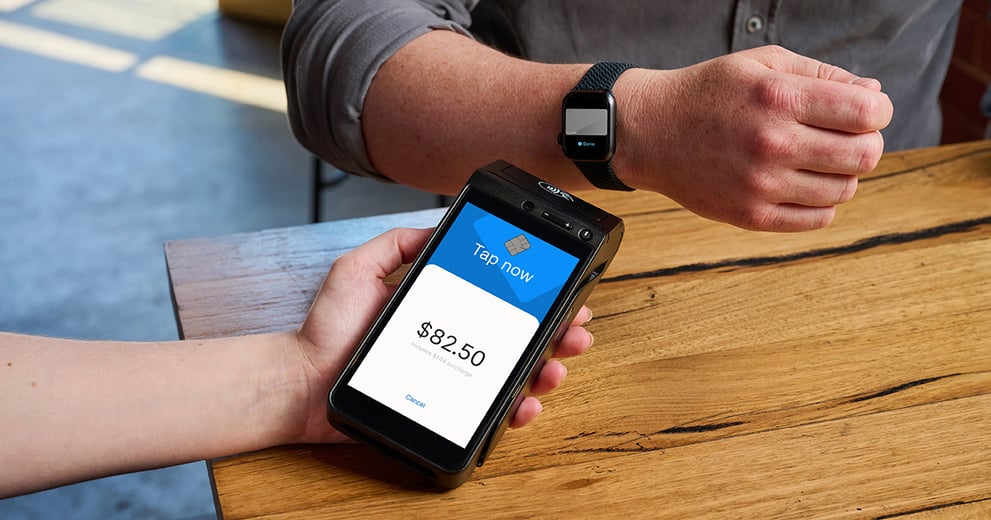

Unsurprisingly, BNPL has exploded in popularity — especially amongst younger generations, where trends come and go quickly. The way they’re using the platforms demonstrates a clear preference to debit over credit; according to Afterpay, 94% of its Gen Z users are opting to buy now, pay later using their own money rather than link their account to a credit card. This is the same generation that commonly reaches for their phone or extends their wrist when it comes time to pay.

Anyone with a bank account that meets a set of standard eligibility criteria can sign up for a BNPL scheme to buy whatever they want at stores that accept the payment method. Essentially, that means anyone over the age of 18, with a bank account, who passes a credit risk check can use BNPL.

If your business doesn’t already accept BNPL as a method of payment, consider whether 2022 is the year to start. It could be a way to reach a new subset of customers whose spending power is increasing with time, and grow your profits.

The pandemic has hastened the pace of cash’s decline even faster than predicted. In 2020, cash was used for just 20.5% of transactions at a point of sale across the globe. That’s a 32.1% reduction in cash use since 2019. Companies like FIS, for example, previously speculated we would reach these levels in 2023; the pace of decline is three years ahead of schedule.

In Australia, we are even further ahead of the pack; cash has been approaching legacy status as a payment method for years. Cash is used for less than 20% of point-of-sale transactions in the Asia-Pacific region, and it’s expected that by 2024 it will account for less than 10% of those transactions.

So, how are consumers paying? With their new limb: the mobile phone.

Nearly 45% of consumers say they frequently used their mobile wallet to pay for things in 2021 — meaning almost half of consumers reached for the mobile wallet upwards of 20 times. A year prior, just 23% of consumers did the same.

This is good news for businesses; the less frequently your customers pay with cash, the less time you’ll spend counting your cash drawer, visiting the bank, and waiting to be able to put those funds to work. Instead, simply accept payment through Zeller Terminal and the funds will be available in your Zeller Transaction Account the very next day. Spend them using your Zeller Mastercard.

There’s no question that COVID has accelerated the adoption of digital wallets while speeding up the decline of cash. However, consumer payment preferences are growing increasingly diverse.

With Payments 4. X ushering in an accelerated transformation timeline, every business owner needs to take stock. How will your customers expect to be able to pay in 12 months’ time? Credit card use is expected to flatline.

There’s an abundance of payment methods available, and more to come. What was once considered an ‘alternative payment method’ — such as a digital wallet attached to a mobile phone or smart ring — is now mainstream. Cash won’t simply be replaced by credit cards and mobile wallets. Remember, the technology powering NFC-reliant digital wallets is still in its infancy.

As younger generations embrace these newer payment methods with gusto, the trend accelerates — indicating there’s more change to come. Is your business prepared?

Convenience is key; when a new payment trend emerges, you’ll want to ensure your EFTPOS terminal can meet your customers’ needs by accepting whatever form of payment is most convenient.

The pace of innovation and competition within the industry has sparked a change in consumer expectations: everything must happen quickly. Near instantaneously.

Consumers have gotten used to fast transactions, and are increasingly expecting the process to become faster and faster.

In this instance, a ‘consumer’ in a digital transaction refers to both:

Both expect the transaction to happen swiftly, meaning instant payments and quick transaction settlements are already table stakes.

Businesses need the ability to quickly and seamlessly process transactions, so customers can pay and continue with their day without disruption. This includes the ability to quickly identify the reason for a declined transaction, and being enabled with the information to quickly correct the issue and progress the sale.

However, increased transactions volumes and instant processing requirements are stretching the banks’ decades-old legacy payments infrastructure. Nimble payments providers will be able to adapt to change and offer their users the most forward-thinking solutions, so that you can offer your own customers a great payment experience.

The picture the Global Payments Report paints is overwhelmingly positive, despite the obvious challenges. Innovation is opening significant opportunities for payment providers to step up and differentiate themselves as forward-thinking companies that can keep up with the pace of change, and build the functionality that enables businesses to take advantage of those changes.

As a merchant, it’s up to you to ensure that every one of your customers has a positive payment experience. Whether you are able to accept a customer’s method of payment, troubleshoot a declined transaction, or even continue operating in a thunderstorm depends on your EFTPOS provider.

It's an important choice that will have an impact on the way you run your business for years to come.