Introducing Zeller for Startups.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

9.09.2021

As a merchant, you work hard to attract and retain customers — so when they decide to transact with you, it’s frustrating to have that payment be declined. Unfortunately, it’s something you’ll likely experience at one point or another — for reasons outside of your control.

A payment might be declined for any number of reasons. The customer may have exceeded their credit limit, or they may be using a foreign credit card without first advising their bank of their travel plans, for example. If the customer has made an unusually large purchase recently, their card might have been blocked by the card issuer for security reasons.

When a customer’s payment is declined, it can be difficult to know how to respond. This latest update takes the guesswork out of the equation.

In the event a payment is declined:

You’re also able to see in Zeller Dashboard the reason why a transaction was declined.

Your customer may simply need to try another card, or quickly transfer funds onto their card via mobile internet banking. Or, they may need to contact their bank.

The point is, armed with knowledge of the reason for the declined payment, you are able to attempt to progress the transaction and make the sale.

Every Zeller Kit comes with a free Zeller Mastercard, which you can use to spend the funds accepted via Zeller Terminal and settled nightly to your Zeller Transaction Account.

You have the option to link multiple Zeller Mastercards to one Zeller Transaction Account — or set up multiple Zeller Transaction Accounts, and link one Mastercard to each account. These options are especially handy for those merchants with business partners, or senior staff members who regularly make purchases on behalf of the business.

With this update, you now have the option to order additional Zeller Mastercards directly from Zeller Dashboard — at your leisure.

Ordering a new card is quick and simple — follow the steps below.

All that’s left to do now is set up your new PIN. For more information on setting up your Zeller Mastercard, visit the Support Centre.

Whenever Zeller Mastercard is used, you’ll see the transaction details in your Zeller Dashboard — enabling you to quickly spot who’s spent what, as well as when and where they spent it.

Mail Order, Telephone Order transactions (also known as MOTO) can now be processed through Zeller Terminal, enabling you to grow your business by offering customers the ability to pay for your goods or services remotely. It’s as simple as tapping the MOTO button.

Unlike traditional transactions — where both the customer and their card are physically present at your place of business — MOTO payments can occur anywhere. Your ability to accept payment isn’t contingent upon having a physical shopfront, or even a website or online store. Importantly, MOTO functionality also enables you to continue transacting during a lockdown.

Read more about Zeller’s MOTO functionality, including how to set up MOTO payments with Zeller Terminal, on the blog.

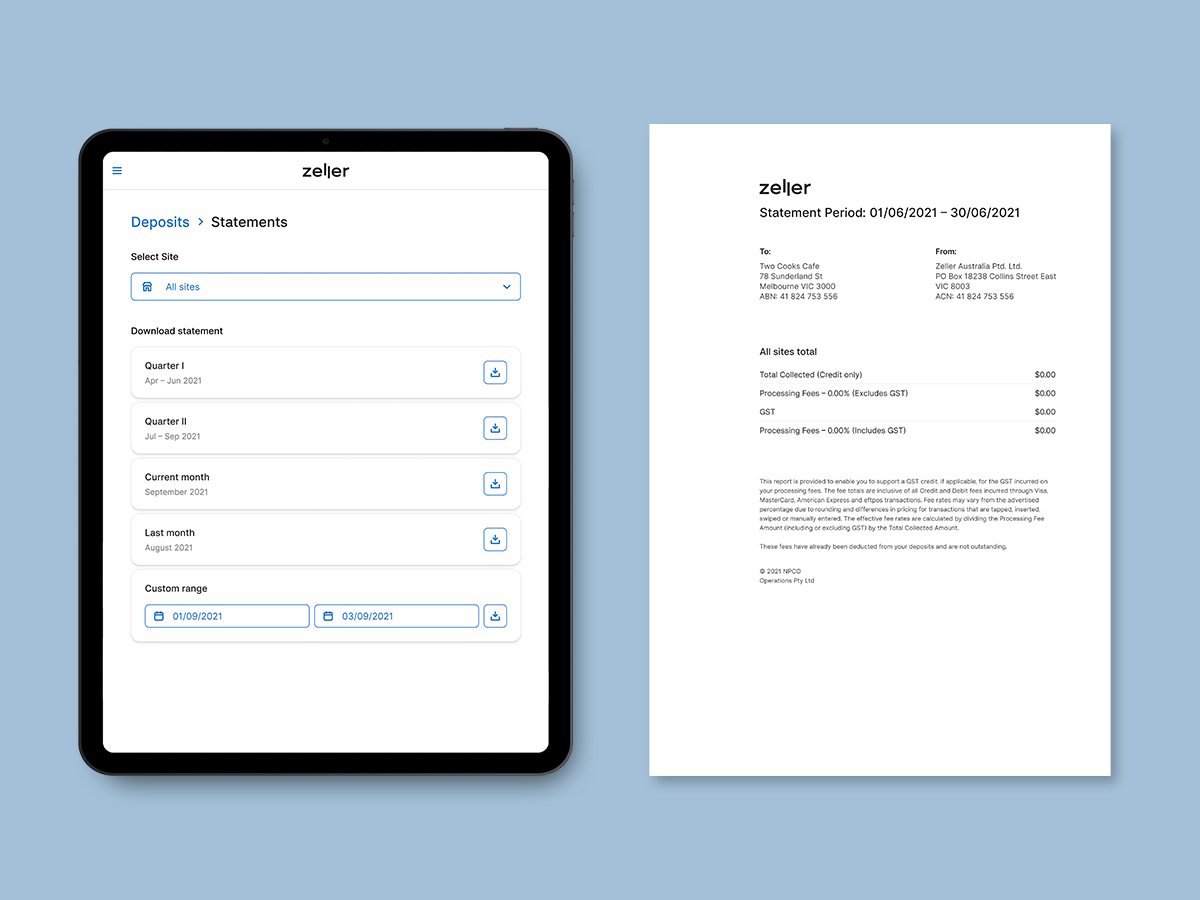

As a merchant, you have an obligation to report your transaction fees to the Australian Taxation Office. To assist with this, you can now quickly generate a one-page Settlement Statement that sets out the fees you have paid over a particular period. This document can also be used to support your claim for GST credits (if applicable).

At a glance, your Zeller Settlement Statement shows:

for any particular period.

Zeller Settlement Statements are highly customisable; you have the option to generate a statement for a particular quarter, the current or preceding month, or a particular time period.

Follow the below steps to generate your first settlement statement.

Remember Sites are the physical or logical locations of your businesses — outlets, branches, mobile stores, or any other grouping of business activity you would like to classify. You can generate a Fee and Settlement Statement for every Site.

More information about Zeller’s settlement statements is available in the Support Centre.

Visibility of your incomings and outgoings is critical. Having the ability to see where and when money is flowing in and out of your business allows you to identify, at a glance, how business is tracking and quickly spot any anomalies. This is what the Transactions and Settlements pages within Zeller Dashboard are for.

Previously, you’ve needed to manually refresh these pages to see the latest records as they are processed. Our engineers have worked their magic and automated the process, removing the unnecessary click so that new transaction and settlement records appear in real-time. It’s an added level of convenience for your business.

If you have any questions, reach out on Facebook or call our Support team on 1800 935 537. Or, email feedback@myzeller.com to provide any product feedback or feature ideas to our team directly.