Introducing Zeller for Startups.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

Speak to our expert team about your in-store payments, and we’ll personalise a solution to your business and budget.

Enjoy a free, built-in POS system with the new Zeller Terminal 2. Order today with free express shipping nationally.

Starting a new business? Enjoy a free, built-in POS system with the new Zeller Terminal 2.

The big banks are cutting interest earned on your savings. Switch to Australia's best business savings account. Terms apply.

Create a business savings account with a click — no lengthy application forms.

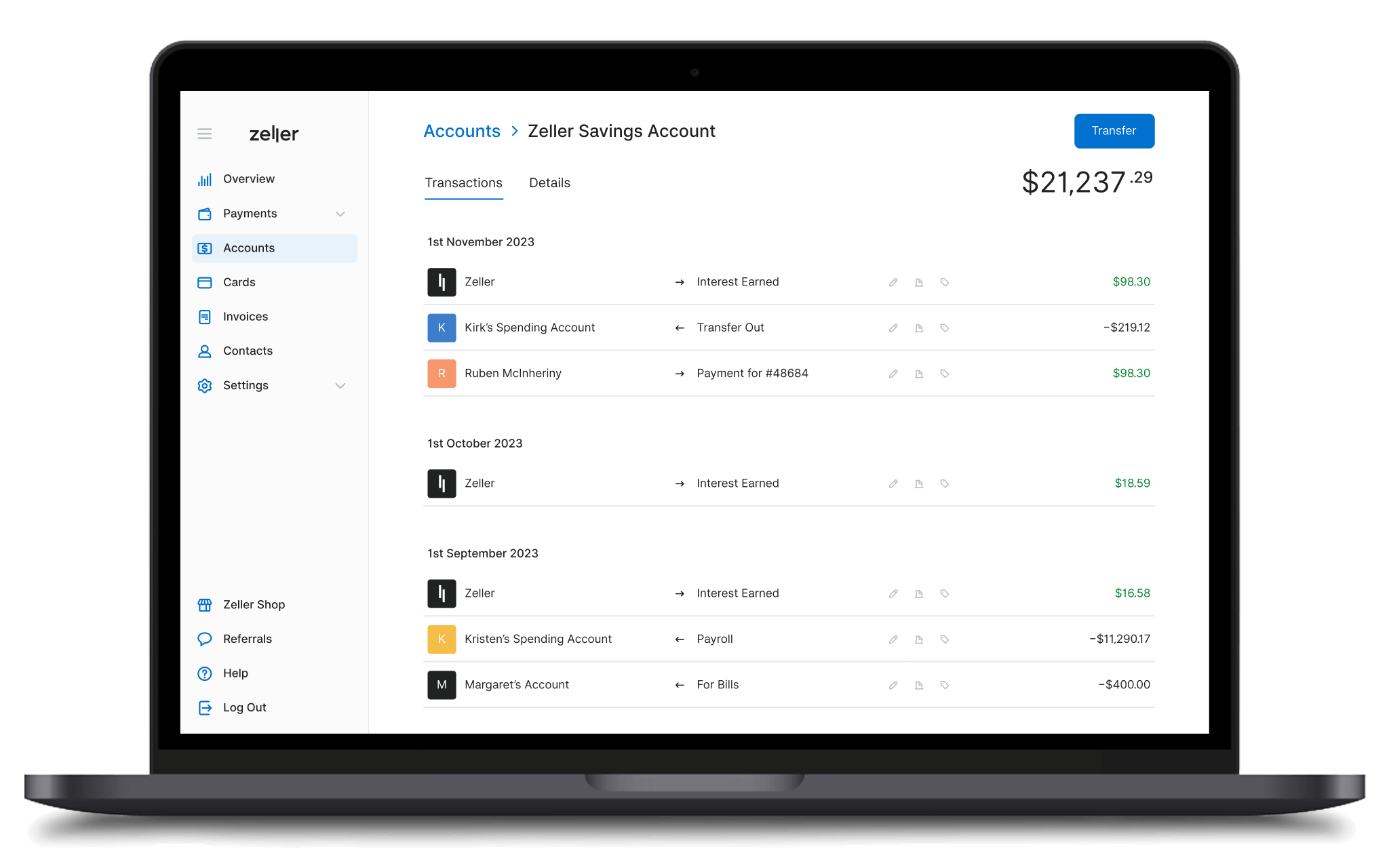

Earn more interest than you would with a big-4 bank — up to 3% p.a.*

Withdraw your business savings to use and spend whenever you need them.

We partner with a fully-licensed, APRA-regulated Australian bank to keep your funds safe.

See how your savings could grow over 12 months with our high-interest savings account.

Learn more about how a Zeller Savings Account can help your business grow.

Thank you, check your inbox to unlock your bonus interest.

This calculator is for guidance purposes only and is based on information you provided, actual figures may vary. The information provided on this savings calculator is for general informational purposes only and should not be considered as advice that takes into account your business needs and objectives. If you are unsure, seek the advice of a qualified accountant or financial service advisor before deciding whether a Zeller Savings Account is right for your business. Please refer to the Product Disclosure Statement, Target Market Determination and Part C of the Zeller Terms of Service here.

These calculations assume that the interest will not change during your chosen time period which may not be the case, actual figures may vary based on factors including number of calendar days in each month and any rounding. The indicative total amount at the end of your chosen period assumes no withdrawals or transfers from Zeller Savings Account.

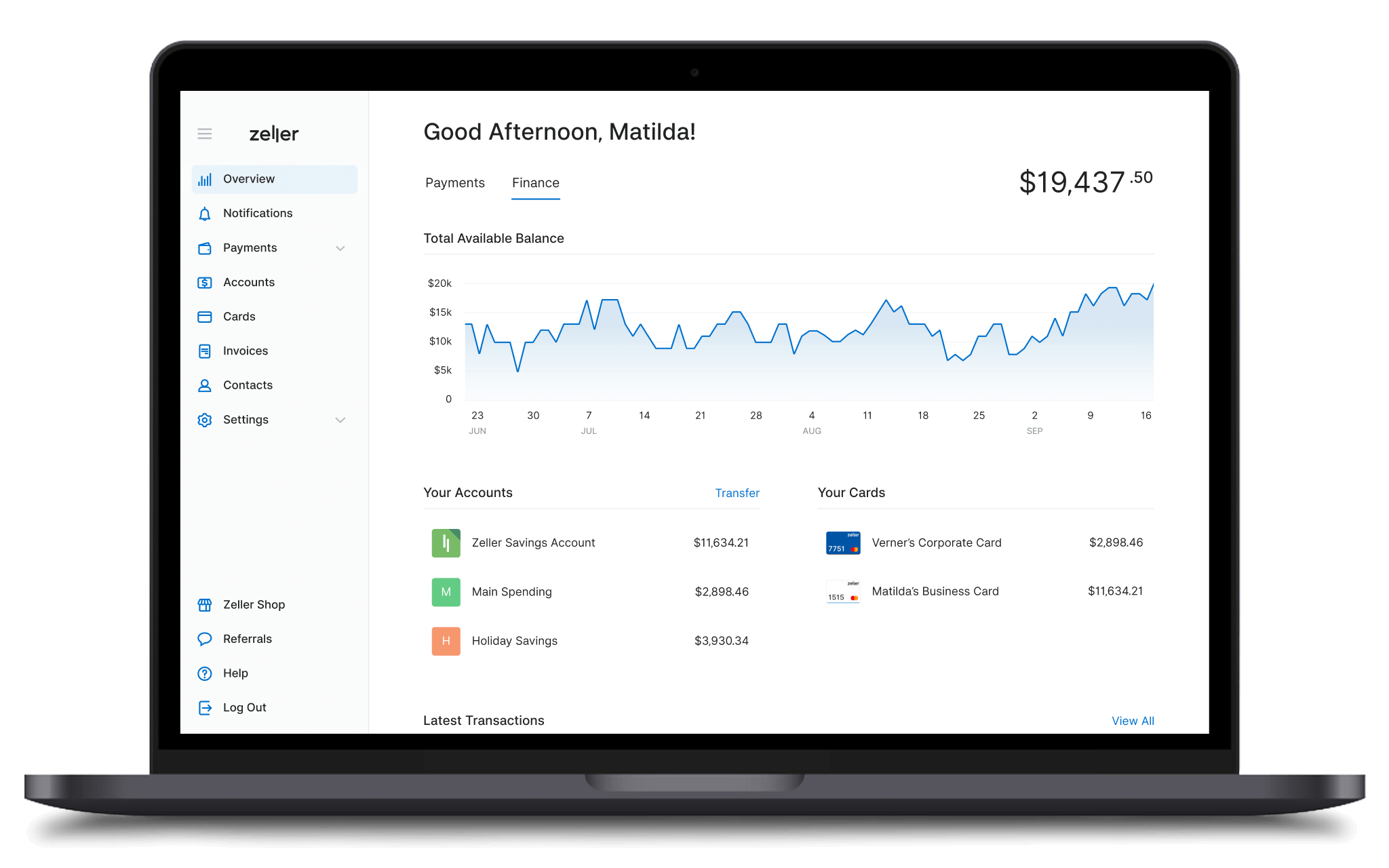

Whether you're saving for a rainy day, or organising your transactions — Zeller has accounts for any business need.

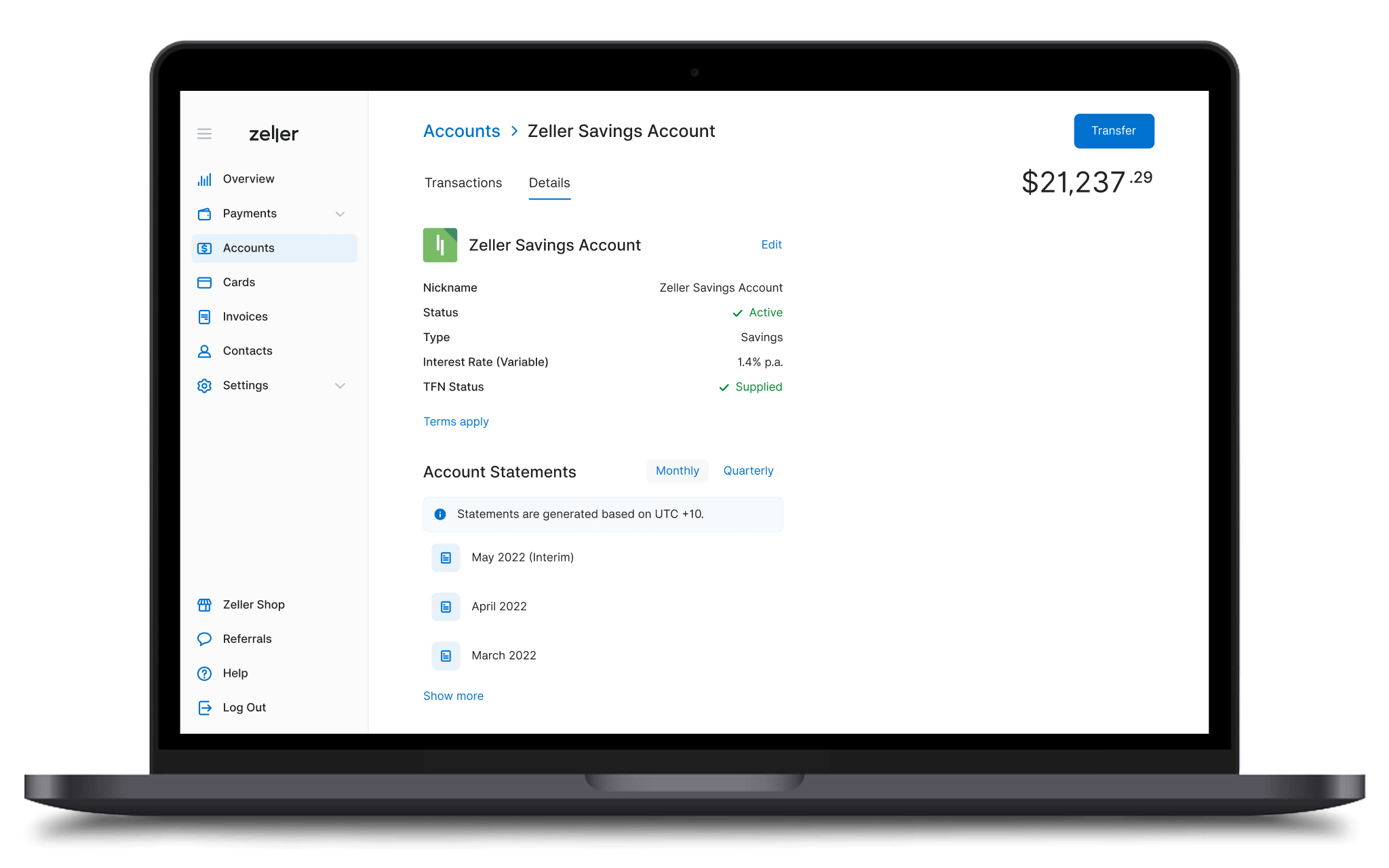

Earn a competitive interest rate.

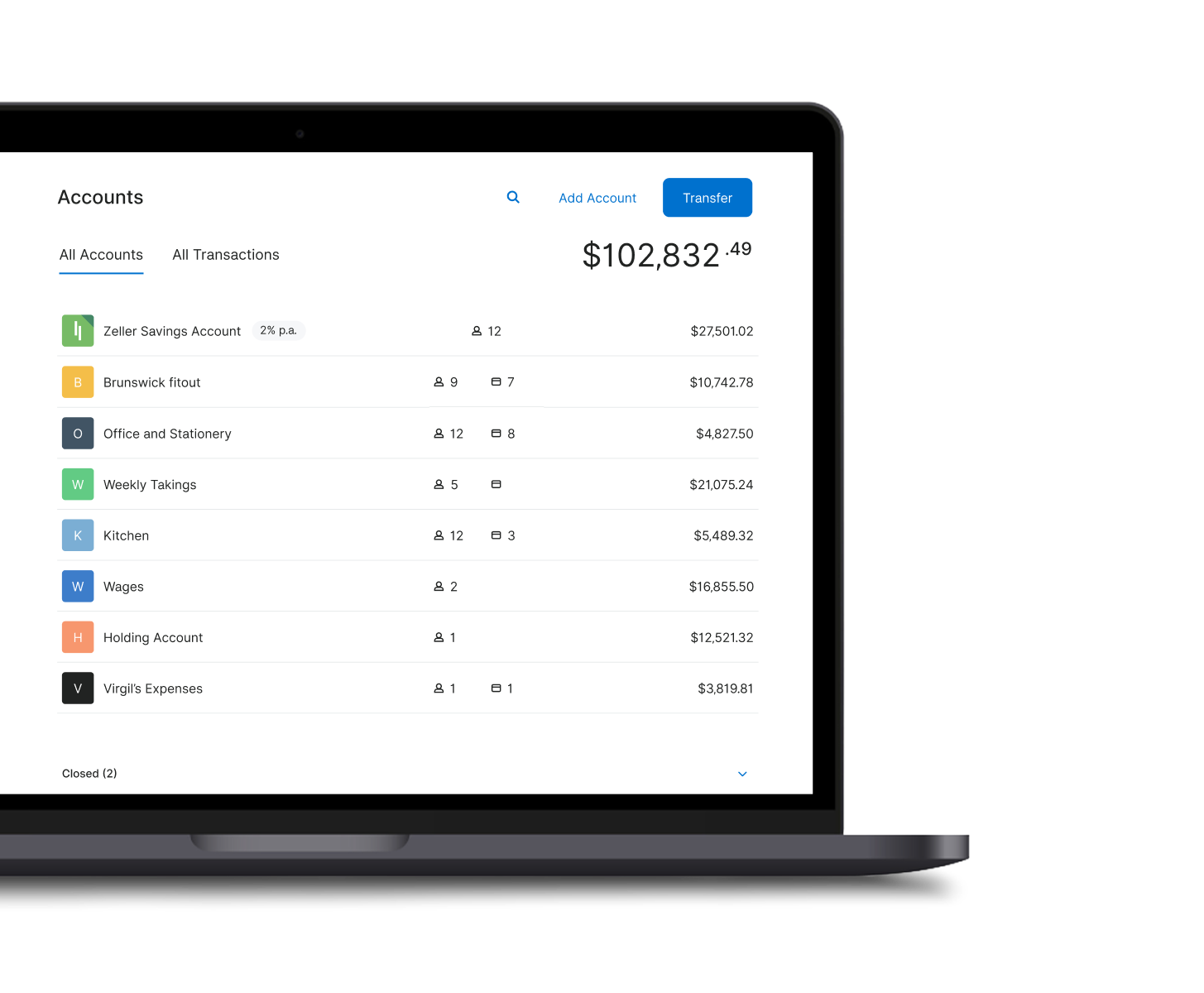

Unlimited operating accounts.

Organise your accounts across sites, teams, or projects.

Your funds are secure with a fully licensed, APRA-regulated Australian bank.

24/7 secure access to your funds when you need them.

Two-factor authentication is enabled on all Zeller Accounts.

Multiple layers of account encryption and authentication.

3% p.a.*

0.25 - 1.05% p.a.

1.05% p.a.

0% - 0.9% p.a.

0% - 1.15% p.a.

Customers are eligible to earn up to 3% p.a. standard variable rate on funds saved in an active Zeller Savings Account until 31 May 2025 (AET). Terms apply. Interest rates accurate as at 31 March 2025.

Signing up takes minutes for most businesses, and it’s free.

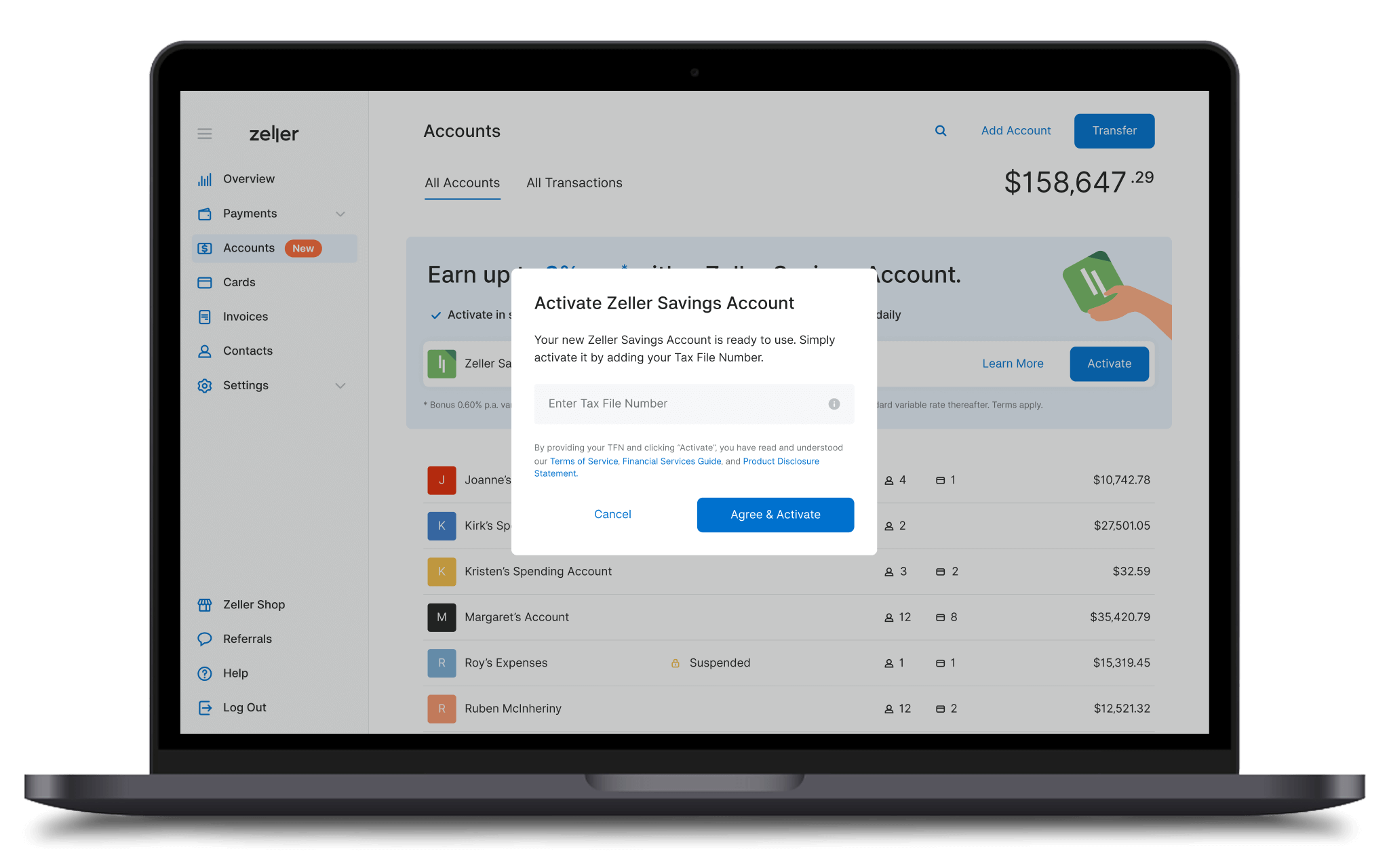

Add your business tax file number to activate your account.

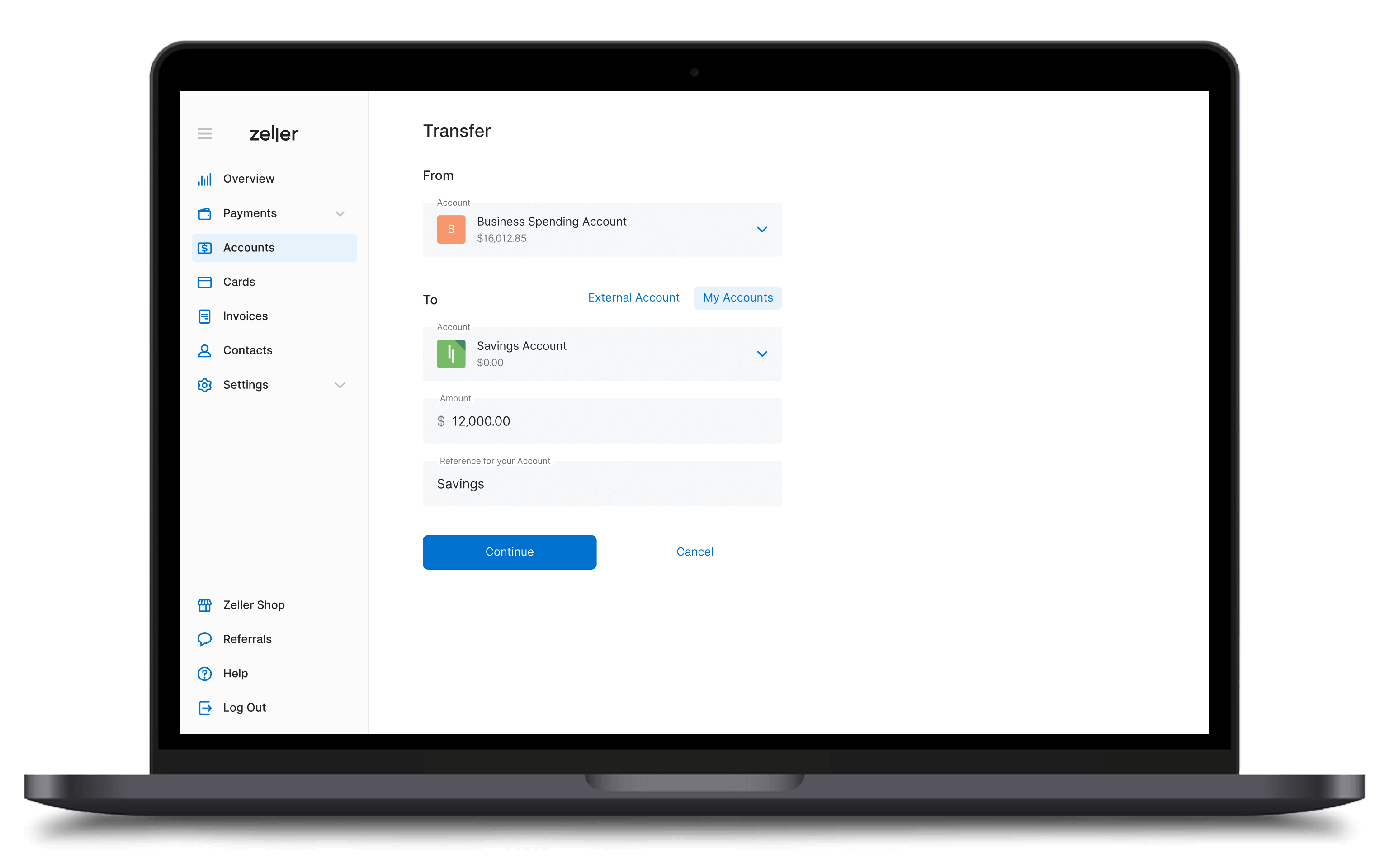

Transfer funds to your Savings Account to earn interest.

Any Australian business with a tax file number and an active Zeller Account is eligible to open a Business Savings Account with Zeller. Simply add your business Tax File Number to activate your Zeller Savings Account.

Log in to your Zeller Account and select Accounts from the menu. Click on Zeller Savings Account from the accounts list. Follow the steps to open your Zeller Savings Account. There's no additional paperwork or sign-up required — simply add in your business Tax File Number and your Zeller Savings Account will be opened instantly.

You cannot link a Business Debit Card to your Business Savings Account with Zeller. Zeller Business Debit Cards can only be linked to an active Zeller Transaction Account. Click here to learn more about Zeller Business Debit Cards.

In comparison to Australia's big-4 banks, a Zeller Savings Account pays more interest. Businesses saving money in a Zeller Savings Account receive a 3% p.a.* standard variable interest rate (current as at 1 March 2025), while most major Australian banks offer between 0% and 1.15% p.a. standard variable interest rate (current as at 1 March 2025). Banks and financial service providers may update their interest rate at any time, and it's important that you do your research to determine which business account offers the best interest rate for your requirements.

Yes, a Business Savings Account can earn interest on your business savings. For example, a Zeller Business Savings Account can earn you up to 3% p.a.* interest (current as at 1 March 2025).

With a competitive 3% p.a standard variable rate, Zeller Savings Account can help you grow your business savings faster than a big-4 bank.

By moving funds into a business savings account, you can contribute to building your businesses' resilience. These extra funds may come in handy when your customers are late to pay you, when your overheads increase, or during seasonal fluctuations. Having some extra funds to see you through these leaner times will help give your business more stability. If you’d like to help safeguard your business against unexpected events, it’s very important that you have a cash reserve & expense management tools such as Zeller's Corporate Cards. Adding funds regularly to a company savings account will help build a buffer that your business can use through unforeseen expenses.

One great way of managing funds for not yet paid tax obligations is to put them into an interest-earning business account before you need to pay the tax office. Not only will you have set aside cash to meet your tax obligations, but you will also have earned interest on it. When ascertaining your credit rating, a lender might assess your cash flow and your cash on hand. Having a business saver account that you regularly contribute to can therefore assist in providing important context to a lender, and potentially improve your position to borrow funds.

With a 3% p.a. interest rate, Zeller Business Savings Account offers a way to earn some passive income on idle funds. Making a contribution each week to a savings account can set you up for future expansion by earning you money in the background, which can then be invested back into your business. When comparing business savings rates across interest-earning accounts, make sure to also consider whether the accounts have a minimum balance requirement and whether you can access your funds at any time. Zeller Business Savings Account lets you add or move money between business transaction accounts whenever you like, your savings are never locked away.

To open a business savings account, you also need to obtain the Enhanced Zeller Payment Services. Your funds are held securely by Zeller, on your behalf, in an account with a fully regulated, licence holding Australian bank. Amounts held in the Zeller Savings Account are not protected by the Government’s Financial Claims Scheme. The information provided on this site is for general informational purposes only and should not be considered as advice that takes into account your business needs and objectives. If you are unsure, seek the advice of a qualified accountant or financial service advisor before deciding whether a Zeller Savings Account is right for your business. Please refer to the Product Disclosure Statement, Target Market Determination and Part C of the Zeller Terms of Service here.

You will earn 3% p.a. standard variable rate on funds stored in a Zeller Savings Account between 1 October 2024 12:01AM (AET) and 31 May 2025 11:59PM (AET). From 1 June 2025 12.01AM (AET), your previous standard variable rate that you are eligible for will apply. This offer is available to new and existing merchants who sign up and onboard for a Zeller Account, and who activate and transfer funds to a new Zeller Savings Account. Previous standard variable rate is defined as 3% p.a. standard variable rate.