Introducing Zeller for Startups.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

20.07.2021

Also known as invoice factoring, accounts receivable factoring, invoice financing or invoice discounting, debt factoring is a strategy employed by businesses to create instant cash flow. This cash flow can then be directly reinvested back into the business without having to endure the wait times associated with clients finalising their invoices.

The process of debt factoring works by selling unpaid invoices to a factoring company or third party at a discounted price in return for receiving the capital upfront. The third party will then collect the full invoice payment from the buyer.

The lender will usually pay 80 to 100 per cent of the agreed-upon price within 24 hours, ensuring businesses don’t need to wait 30 days or more for their invoices to be paid.

According to Australian Small Business and Family Enterprises Ombudsman Kate Carnell,

"Poor cash flow is the primary reason for business insolvency in Australia.”

Having instant access to cash allows a business to not only stay afloat but scale faster, take on more opportunities available to them, and pay their own expenses sooner.

Without good cash flow, businesses are more likely to experience financial stress.

Pre-pandemic, Australian businesses were already struggling to get invoices paid on time. The Payment Times Inquiry conducted in 2017 found that for half of all survey respondents, it was normal for 40% of their invoices to be paid late — often resulting in cash flow problems. These days, the average invoice is paid a grant total of 26.5 days late.

According to a Sydney Morning Herald report from November 2020, small businesses in Australia are “owed $26 billion at any one time because of unpaid invoices.” However, that figure does little to explain the impact on an individual business owner such as yourself.

Intuit recently surveyed 508 small businesses and found that, on average, a small business is typically owed $13,200 from unpaid invoices at any one time. As long as that money is sitting outside your bank account, in the possession of someone else, it can’t be reinvested in the business.

Debt factoring is one way to quickly inject your business with more cash flow. The lender makes cash instantly available to you based on the total amount of your pending invoices, eliminating lengthy wait times for cash.

This is why some businesses opt to use debt factoring services. But what exactly are the risks and benefits associated with this strategy?

Before committing to the debt factoring process, it’s a good idea to be aware of the pros and cons, as well as explore other options to keep your cash flow healthy.

Many small businesses lose at least 12 work days a year chasing late payments. By debt factoring, you can leave that task to the professionals and use the time wisely to accelerate your business growth.

According to an MYOB report, more than half of the business owners surveyed suffered from elevated stress levels and anxiety surrounding the consequences of late payments. Leaving the lender to collect payments will reduce your stress and allow you to focus on more important matters.

Without having consistent working capital at your fingertips, there is less room to move in your business. Debt factoring offers a flexible way to essentially have a line of credit. The more invoices you have, the more credit you have available to reinvest into your company.

By engaging the services of a factoring company, one of the main concerns to consider is the reduced profit of your business. The lender will generally charge a 1 to 3 per cent fee of the total invoice price, which has the potential to stack up substantially over time, especially with larger contracts.

There are a few expenses to weigh up when it comes to factoring. One of the biggest is that for every day your invoices go unpaid, you will be charged a factoring fee. In the case that you have customers that are slow to pay but you are still eligible for debt financing, these fees will be much higher.

Another consideration is that debt factoring companies usually have higher annual interest rates than banks, making them a less affordable option.

The key to a successful business is having solid client relationships. When you opt to use accounts receivable factoring, the payment collection process is outsourced to a third party. This can sometimes alienate customers who may feel uncomfortable dealing with another business or pressured by aggressive lending companies. Ultimately, it could affect the way they do business with you.

It’s important to distinguish that factoring companies are not the same as collection agencies. They often won’t pursue late payments effectively or follow up with those customers who have defaulted on invoice payments as aggressively as a collection agency might.

In this situation, your agreement may state that you are liable for any defaults that occur on unpaid invoices, leaving you further out of pocket. Be sure to know the terms of your contract in advance.

When you use Zeller, you can avoid the liabilities associated with debt factoring, such as reducing your profit, while still receiving the benefits of speeding up your cash flow and eliminating the stress associated with late payments.

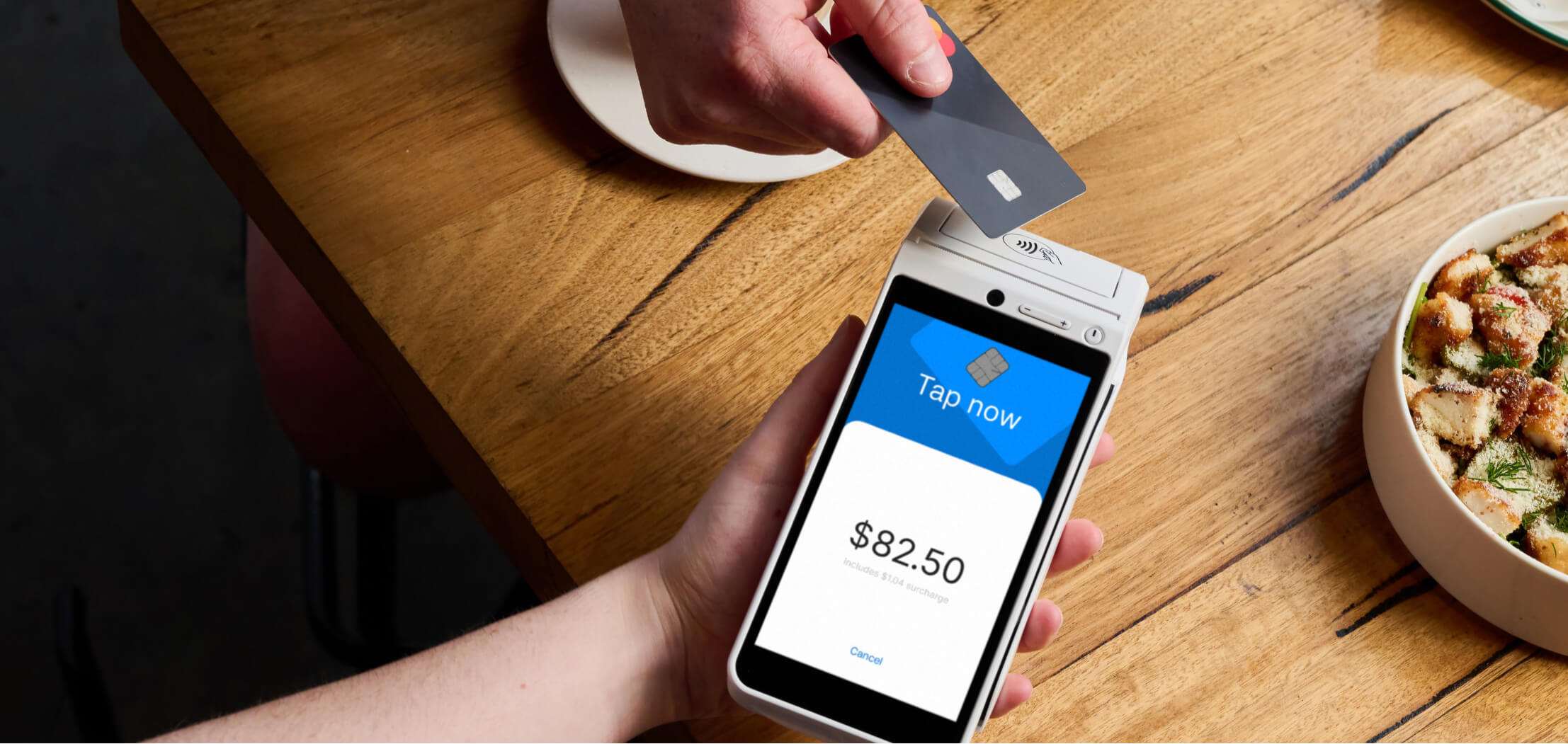

With Zeller Terminal, businesses can accept payments on the spot without having to issue an invoice and wait for it to be paid. Find out more about how Zeller can help you improve your cash flow.