Introducing Zeller for Startups.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

24.08.2021

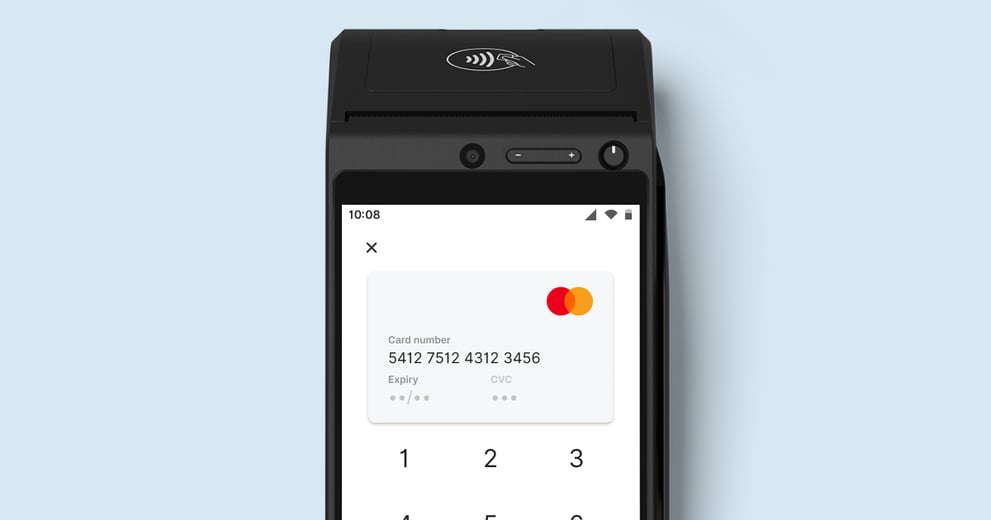

MOTO is short for Mail Order, Telephone Order. It refers to the act of processing a payment remotely — over the phone via a verbal request, or in writing via mail. Both of these scenarios are what’s known as card-not-present transactions, or CNP payments.

Instead of a customer tapping, dipping, or swiping their card or another payment device to Zeller Terminal, the merchant will enter the card details and process the transaction manually. Typically, when a merchant processes a MOTO transaction, neither the card nor the cardholder is physically present — making it difficult to verify the purchaser’s identity.

This lack of visibility increases the risk for fraudulent transactions to occur. For this reason, additional security practices are required to process MOTO payments.

For more information, visit the Zeller Support Centre.

To process a MOTO payment:

You also have the option to default to MOTO payment. This is especially handy for merchants operating without a brick-and-mortar shopfront, or those processing a higher volume of MOTO payments. Simply update your Sites settings in Zeller Dashboard by toggling Default to MOTO on.

To reflect the increased risk of fraud with MOTO payments, you can require that a site PIN be entered before a MOTO payment can be processed by toggling Require site PIN on.

Zeller monitors your transactions round the clock — 24 hours a day, 7 days a week — to help prevent fraud before it occurs. Our expert team of fraud detectors works alongside real-time, machine-based transaction monitoring in order to identify and reduce fraud risk.

However, it’s important to ensure your staff is knowledgeable about securely accepting MOTO payments, as well as best practices for doing so, before you begin accepting MOTO payments from customers. Visit the Support Centre for more information on the risks of accepting MOTO payments, and tips to help keep your business safe when processing manually entered card payments.

To cover the cost of measures put in place to protect against fraudulent transactions, the fee to process a manually entered card transaction is 1.7% — slightly higher than the flat fee of 1.4% applied to in-person card payments.

Zeller exists to help Australian businesses grow. When Zeller merchants told us they wanted the ability to accept payment over the phone, our team got to work building the functionality to make it possible.

If you have any questions, reach out on Facebook or call our Support team on 1800 935 537. Or, email feedback@myzeller.com to provide any product feedback or feature ideas to our team directly.