Introducing Zeller for Startups.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

27.10.2023

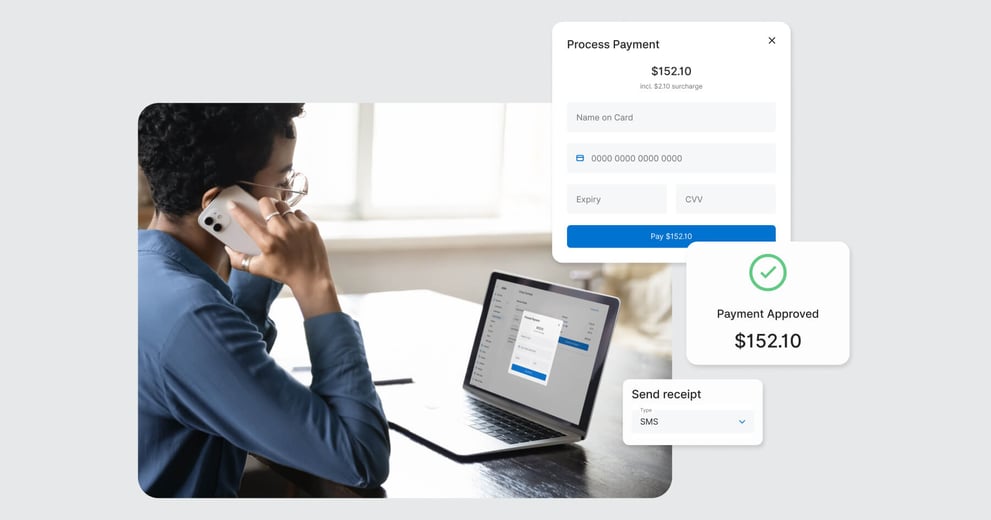

A virtual terminal does the job of an EFTPOS machine, virtually. It is a web-based tool that allows you to process payments made over the phone (as well as mail order, fax, or email) by manually entering a customer’s card details into the browser of a computer or mobile device. In the case of Zeller Virtual Terminal, merchants can also send customers a secure payment link where they can enter their card details themselves. It therefore enables businesses to transform their desktop, laptop, smartphone or tablet into a payment system, without the need to purchase a physical EFTPOS machine.

A virtual terminal is a highly useful solution for situations where card-not-present payments need to be made instantly, or for businesses looking for a cost-effective way to accept payments electronically. The beauty of this solution is that all you need is your own device and a browser – no other hardware is required.

What’s more, unlike an EFTPOS machine or payment gateway that will incur an upfront cost or monthly fees, a virtual terminal is a very cost-effective way to take payments, where only a small per-transaction fee will be charged. Plus, if you’d like to reduce your costs to zero, Zeller gives you the option of passing on the transaction fee to your customer through surcharging.

Whether your business is still in its infancy and you aren’t ready to invest in a long-term solution, whether you need need a backup option to be able to take payments when your EFTPOS machine is in use, or whether you just want to save on costs: there are a number of reasons why a virtual terminal is a great solution.

Businesses just getting off the ground may not yet have the capital or the volume of customers to justify buying an EFTPOS terminal or investing in a payment gateway. A virtual terminal is a great interim solution that helps you build your revenue without the costly outlay.

At busy restaurants or cafes where customers can place orders or paid reservations over the phone, typing customer details into an EFTPOS machine isn’t always practical. Having a virtual terminal means that the EFTPOS machine can be freed up for in-person purchases, while another staff member can manage the phone payments via their preferred device.

While invoicing is a common payment method used by the likes of accountants, bookkeepers, graphic designers, or architects, it doesn’t have to be the only option. Giving customers another, immediate way to pay with virtual terminals means clients can settle up instantly, doing away with administrative and cash flow hassles caused by late payments.

For businesses that move from one location to another, a virtual terminal is a great alternative to having to carry around a physical EFTPOS machine. Gardeners, mobile pet groomers, event caterers or repair technicians can simply send their customers an SMS or payment link that can be settled up on the spot.

Companies offering wholesale or custom orders may require immediate payment for their goods, but are unlikely to have a shopfront where they can take an in-person payment. A virtual terminal lets them accept payment remotely so they can ship the items quickly.

With a virtual terminal, influencers communicating with their clients through social media channels don’t need to take their work onto a different platform. Instead they can simply copy a payment link and share it via direct message on Instagram or TikTok.

Accessed from Zeller Dashboard, anyone who has a free Zeller Account will have access to the feature. Before getting started, you’ll need to enable Virtual Terminal from Site Settings on your Dashboard. Each transaction will incur a 1.75% + 25 c fee, which can be passed onto the customer through surcharging.

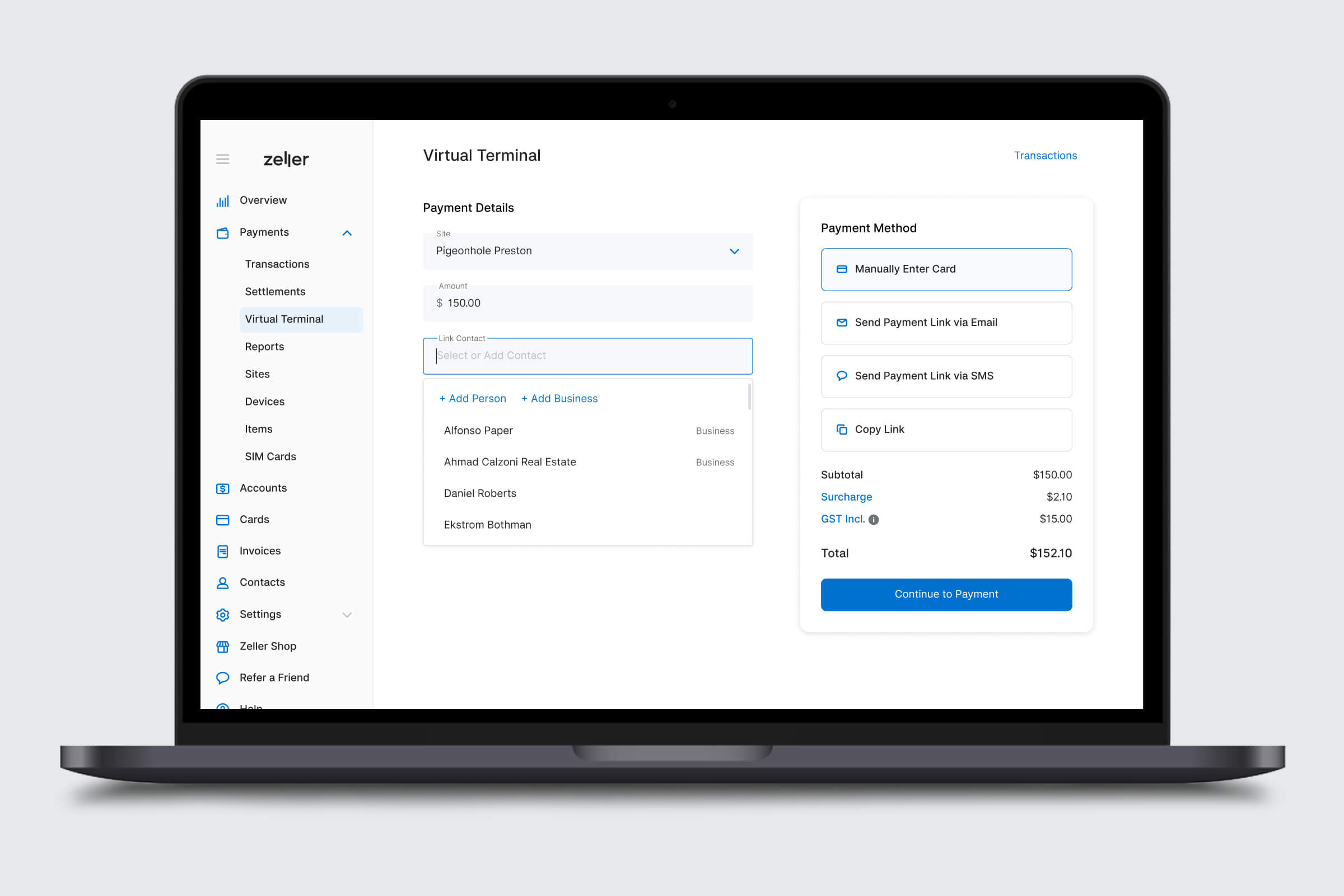

Once logged in, simply click on ‘Virtual Terminal’ on the left hand side panel, and start entering in the relevant details. If you have multiple business locations, these will be listed under ‘Site’. Select the Site you wish to take the payment for, enter the value, select the contact you wish to charge or create a new contact, add any notes about the transaction then click, ‘Continue to Payment’. Fill in your customer’s card details then click ‘Pay’. Once the payment has been processed, you will have the option of sending your customer a digital receipt via email or SMS.

If you would prefer to send your customer a link to enter their card details themselves, from Zeller Virtual Terminal, click ‘Send Payment Link via Email’ or ‘Send Payment Link via SMS’. Enter the mobile number or email address of the customer and click ‘Send Link’. Alternatively you can click ‘Copy Link’ and share the link with your customers in a direct message on social media or via Whatsapp or iMessage for example. The link is secure and will direct customers to a page where they can enter their card details and proceed with the payment. Once the payment has been processed, customers will have the option to download a copy of the receipt.

Zeller Virtual Terminal gives merchants the option to fully or partially pass on the transaction fee (1.75% + 25c) to customers through surcharging. To enable or manage this function, go to Sites and toggle surcharging off or on. When toggled on, you will be given the option of nominating a percentage of the fee to surcharge.

When you use Zeller Virtual Terminal, Zeller Invoices, or Zeller EFTPOS Terminal, each transaction processed can be assigned to a singular contact to help you track unpaid balances, view payment history and manage relationships with your customers. If you take payments through a combination of Zeller’s payment methods, the Zeller Contact Directory allows you to select a contact and see any previous transactions or outstanding payments across all payment methods. So, whether you choose to use Virtual Terminal alone, or in combination with EFTPOS and Invoices, contact linking ensures your records are always simple to manage and up to date.

At Zeller, we understand that all businesses are different. That’s why we’re dedicated to bringing you tailored solutions to help manage your finances. Keep up to date with all the latest product releases, features and enhancements by signing up to the Zeller Newsletter.