Introducing Zeller for Startups.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

31.05.2021

A business’s success relies on a laundry list of items that require considerable attention, including rigorous market research, effective strategies and finance. An effective business plan requires a business owner to consider all of these things.

A business plan isn’t just an outline for what an entrepreneur imagines their business becoming. It’s documentation of each and every step to achieving both short and long-term goals — providing accountability, direction, and valuable information that business owners can reflect back on throughout the different stages of running their business.

An effective business plan serves a number of purposes.

Starting and scaling a business is inherently risky. Expanding too quickly or in the wrong market, failing to undertake a suitably specific market analysis, or ignoring gaps in the existing market can have significant ramifications.

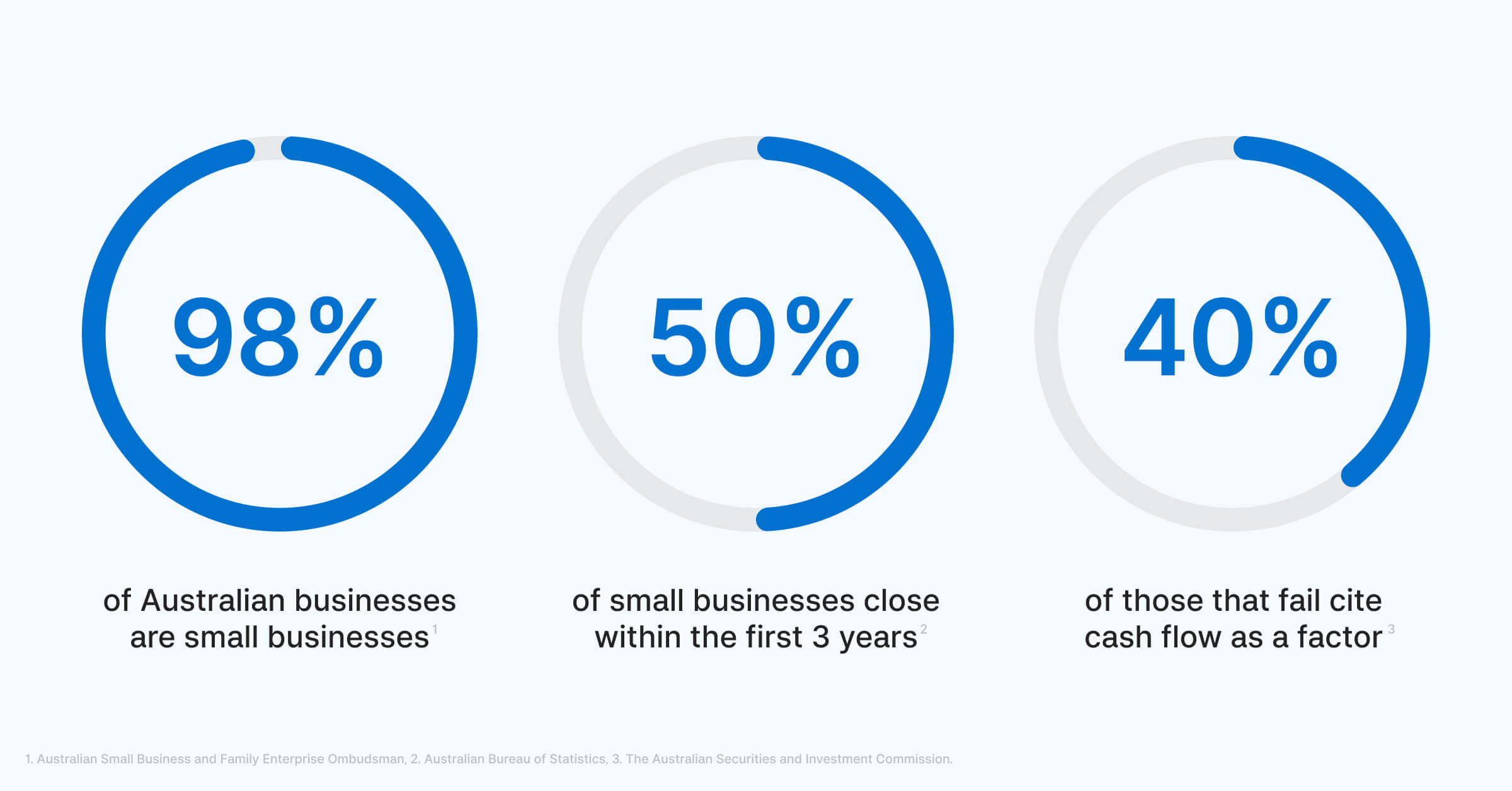

In Australia, 50% of businesses fail within their first three years. Of the businesses that don’t make it, many fail due to poor financial planning, preemptive expansions, and overall lack of experience and knowledge from leaders — however, the overwhelmingly common reason for business failure is lack of cash flow.

One of the most important steps in creating a business plan is working out how cash will flow in and out of your business. The faster you can access your takings, the faster you grow your business. The right EFTPOS machine can help speed up the process.

The average Australian business takes around a year and a half to become fully funded. Some new business owners dip into their personal savings or turn to friends and family members for startup costs — but this isn’t an option for every new business owner. Sometimes, funding from external sources will be necessary.

Your best bet for securing funding from investors or financial institutions is compiling a detailed and strategic business plan.

However, not all businesses will require a loan. The Australian Government has prepared a guide to help entrepreneurs determine what their funding needs are. It’s worthwhile doing the maths to figure out if your business can grow without the additional expense of loan interest.

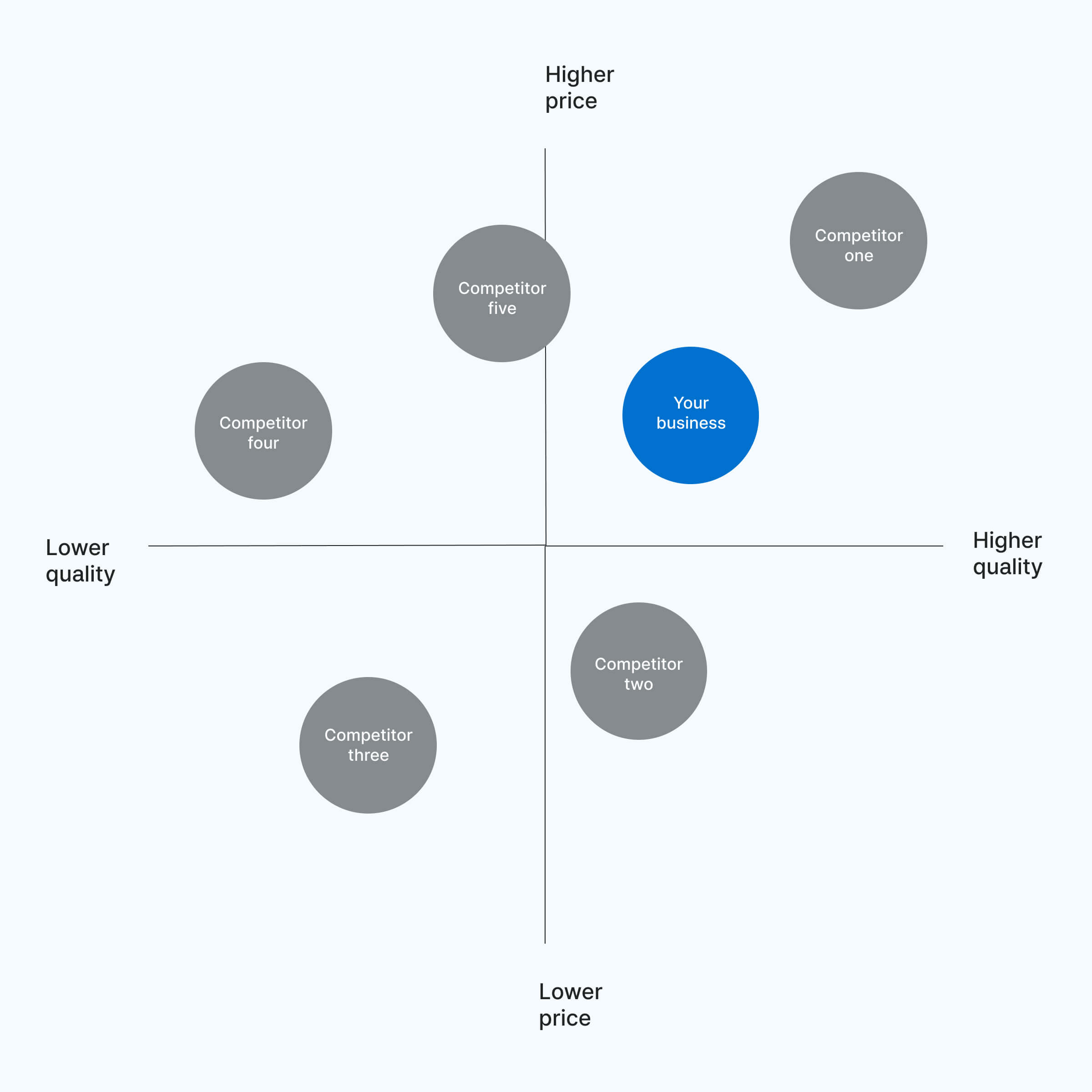

To succeed, businesses need to offer something that customers can’t get anywhere else — whether the product or service itself is unique, or it is delivered in the best or most affordable way. These factors are called unique selling propositions (USPs).

In the beginning stages of developing a business plan, when the vision and objectives are explored, these USPs should become clear. They will become critical to marketing your business.

Building a business from the ground up requires a business owner to take on many responsibilities and constantly complete complex tasks. It can be easy for a new business owner to get lost in their many responsibilities and forget their initial vision. A business plan will serve as a blueprint for what was envisioned.

The same goes for scaling an established business. Many business owners hold off on hiring additional staff before it’s certain that the business is growing at the speed anticipated, meaning there’s often a period of understaffing. A business plan will help to ensure everyone involved understands the direction of business growth, and is on a clear path to success.

Now you understand the importance of writing a business plan, it’s time to consider six essential steps you'll need to complete before putting pen to paper.

A business plan should be a succinct document, outlining everything from your growth goals, to your marketing budget, to business risks and plans for mitigation.

Consider the below steps as preparation work necessary to create an effective business plan that you can use to keep yourself and your business partners aligned for years to come.

The very first step of writing a business plan is solidifying the motivation behind the business itself. That means establishing a purpose, mission statement and vision statement. These three things must be aligned.

When someone comes up with a business idea, the purpose is likely the first thing they think of. It’s the whole reason for starting the business in the first place. Whether the business’s objective is to make unique, delicious food, or provide a valuable service that the community lacks, the purpose is the driving force behind the innovation. This is also where a business’s USPs begin to emerge.

When a business owner decides to grow their business, the purpose outlined in their business plan may stay the same — but on a bigger scale — or it may shift the direction of the business to keep up with a change in market conditions, for example.

A mission statement is what business owners will show lenders and investors when trying to secure funding. It establishes how the business will meet its goals. There are four questions business owners should ask themselves when drafting a mission statement.

They are:

Many businesses choose to publish their mission statement on their website, to give customers some context as to why they should support the business. Depending on your particular circumstances, this might be a good idea — considering the propensity of Gen Z to support businesses that align with their values.

A business’s mission statement is rooted in what the business can accomplish in the present, and how its day-to-day actions will uphold its values — whereas a vision statement is focussed on the future.

A vision statement looks 5 to 10 years into the future and provides the context for setting long-term goals. How will strategies change as the business grows? What is the correlation between short-term growth goals and objectives and long-term business health?

If the mission statement is the blueprint for today, think of the vision statement as the plan for tomorrow.

Every business has a legal structure that determines rights, responsibilities and more. The legal structure is sometimes decided for the business owner based on the size and the type of business, as well as goals and plans for growth. However, there is often room for flexibility — so it’s up to a business owner to choose the right structure for their venture.

The most common legal structures are:

A business plan will need to include an overview of the business’s structure, including a “who’s who”, so it’s important to understand the implications that come with your chosen structure.

It’s essential to conduct a market analysis before diving too deep into a business plan. Market research provides important context on the industry, including how necessary a business’s product or service is, who the target market will be, and who the business’s competitors are.

There are many directions to go in market analysis. Some effective ways to obtain information on the industry and target audiences include:

Use this insight to determine how your offering compares to your direct competitors'.

The market research stage can be a great opportunity for business owners to connect with potential customers for the first time — perhaps through market research or survey groups. By connecting with potential customers, you’ll learn more about who your target audience is, and how they spend their money, while also generating brand awareness for your business.

The next step towards documenting a business plan is to devise a marketing plan, which is heavily informed by the market analysis — as well as the particular growth goals of the business. Your marketing plan will help to refine your budget and provide the structure for upcoming marketing activities.

When creating a marketing plan, keep the 7 P’s in mind.

The equipment a business needs to operate will depend largely on the type of business it is. Equipment can fall under two categories: tangible and intangible.

Tangible equipment means physical items.

Some types of tangible equipment are universal to most, if not all, businesses. For example, all businesses with in-person locations need a payment processor — otherwise, they would be restricted to operate as a cash-only business, which is often unappealing to customers. In fact, 50% of Australians find cash-only businesses inconvenient.

Businesses can take convenience to the next level — for their customers, employees and business owners — by opting for a mobile electronic funds transfer at point of sale (EFTPOS), such as Zeller Terminal. Read more about the benefits of this type of payment processor on the blog.

Other types of equipment may be required, depending on the industry the business operates in. For example, a restaurant may need a walk-in fridge while a trades provider may need a concrete mixer.

Equipment can be expensive, so equipment financing or leasing might be the best route for some business owners. Money.com has a tool for finding equipment financing options.

Intangible equipment includes things like a website and accounting software, which are essentials for most businesses regardless of the industry in which they operate.

Businesses typically need a website to get their name out there and provide convenience for customers — whether that’s through e-commerce, or providing a mechanism through which to book a service.

The cost of tangible and intangible equipment will need to be taken into account when creating a budget and financial projections. This is why determining the types of equipment necessary, as well as their costs, early on is important in drafting a business plan.

Your budget is one of the most important elements in your business plan. You need to understand how much you are able to spend to grow your business, and whether you will be able to generate an income from the business. Fixed costs, such as rent or mortgage, salaries, business insurance and possible equipment leases or equipment financing should all be taken into account — as should variable costs, such as hourly wages, utilities, products, materials, and more.

At a minimum, you will need to create a cash flow plan and establish a balance sheet. These track the money coming in and going out of the business, which is critical to manage in order to ensure your business survives long term.

Once set up, business owners can assess their monthly spending and earnings by analysing their merchant statement at the end of each month, which they will receive if they open a business account. These accounts are essential for long-term business health because they keep business owners organised and provide crucial information on cash flow.

The meticulous research and planning involved in developing a comprehensive business plan can help business owners avoid some of the problems most commonly faced when building or scaling a business.

Once you’ve followed the above preparatory steps, follow our business plan blueprint. Use it to hold yourself to account and make sure business remains on track. Make sure to revisit your business plan at least every year, and make any changes as necessary.