Introducing Zeller for Startups.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

11.03.2025

Whether you’re just starting out or have already amassed a large savings balance, a business savings account is an excellent financial tool. Here’s why:

Mixing your savings with your operating account can make financial management messy. A dedicated savings account keeps your reserve cash separate, ensuring that funds meant for growth, emergencies, or future expenses remain untouched until needed.

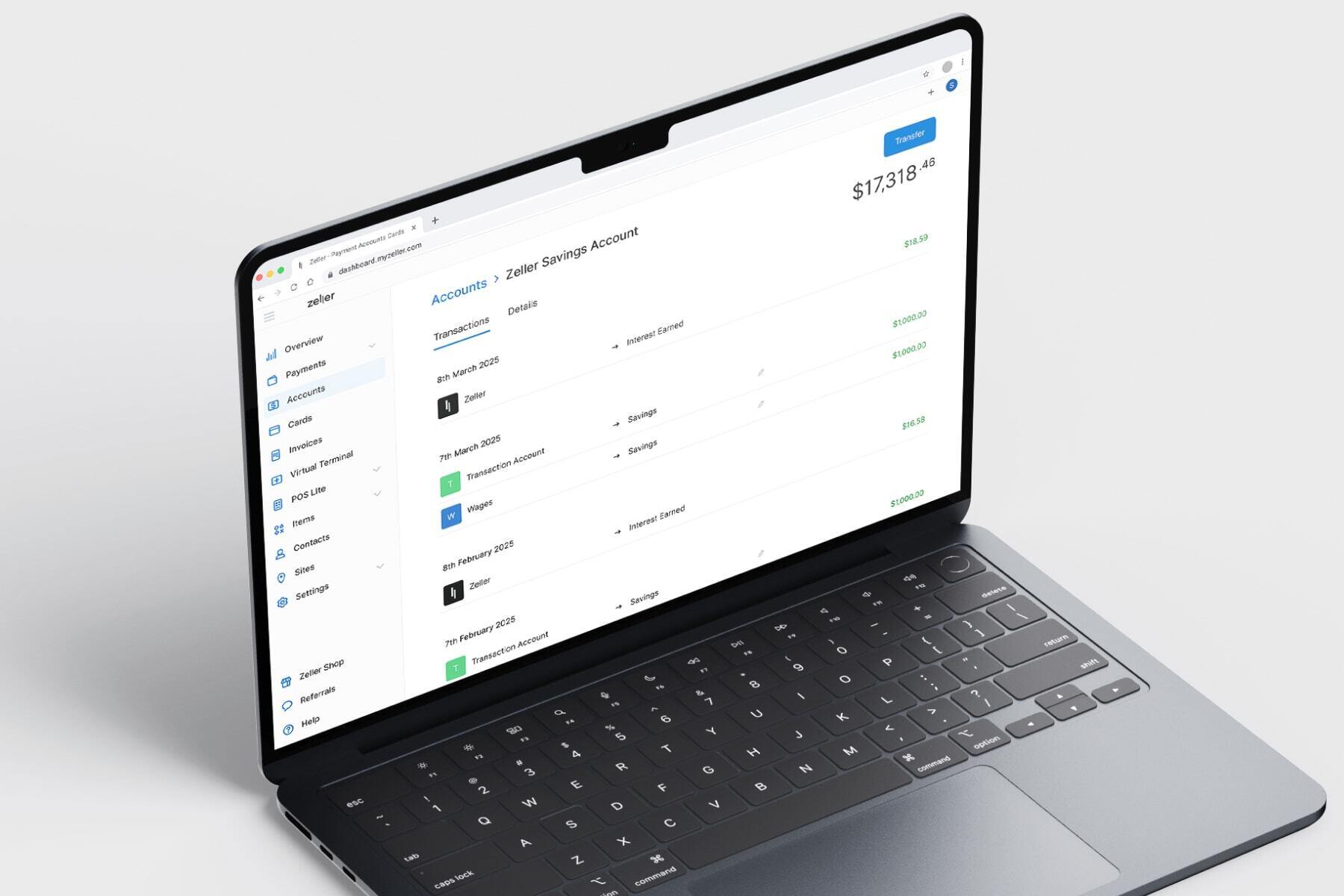

In business, every dollar counts. With a 3% p.a interest rate, Zeller Savings Account makes your money hard for your business instead of sitting idly in an account that pays next to nothing.

Unexpected expenses are part of running a business. Whether it’s replacing essential equipment, handling a cash flow shortfall, or taking advantage of an unexpected growth opportunity, having funds readily available ensures your business remains financially resilient.

Even depositing a small amount regularly can help create a healthy financial habit for your business. With a Zeller Savings Account, there’s no minimum balance required to earn maximum interest, so you’ll watch your business savings grow with daily interest calculations, paid monthly to your Zeller Savings Account, while earning our highest interest-rate from the first dollar you deposit.

In addition to offering a much higher interest rate than the big-4, a Zeller Savings Account provides instant access to your funds, ensuring your money is both secure and easily available when needed.

But there’s another big benefit that isn’t immediately obvious – having a Zeller Savings Account means you’ll also have access to a Zeller Business Transaction Account.

With both accounts working together, you’ll get:

These features go beyond just savings, they make managing your business finances easier and more efficient.

The days of being forced to use an outdated business bank are over. Thankfully, Australian businesses no longer need to settle for subpar savings accounts with low interest rates and strict conditions.

If you’re currently banking with one of the big-4, ask yourself:

If the answer to any of these is "no", then it’s time to make the switch to Zeller.