Introducing Zeller for Startups.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

Don’t waste time assembling disparate tools or waiting in line at a bank. Zeller for Startups is an all-in-one financial solution for founders, by founders.

Speak to our expert team about your in-store payments, and we’ll personalise a solution to your business and budget.

Enjoy a free, built-in POS system with the new Zeller Terminal 2. Order today with free express shipping nationally.

Starting a new business? Enjoy a free, built-in POS system with the new Zeller Terminal 2.

Net migration to regional Australia has doubled since the outbreak of the pandemic, the Regional Mover Index shows — a shift which is having a positive impact for regional economies. In the first 90 days of 2021, capital cities suffered the largest quarterly population loss on ABS record as 11,800 people packed up and left town. Despite the end of lockdowns, the urban exodus is continuing.

At the same time, the outbreak of the pandemic spurred a wave of entrepreneurialism across the country. Yet Zeller data shows it’s those living in regional Australia that have overwhelmingly embraced the opportunity to start their own business.

The Australian Bureau of Statistics (ABS) reports a 15% increase in the number of small businesses registered during the pandemic. What’s more, the ABS saw a 20% increase in the entry rate for sole proprietors — indicating a rapid increase in the number of people pulling the trigger to start their own business.

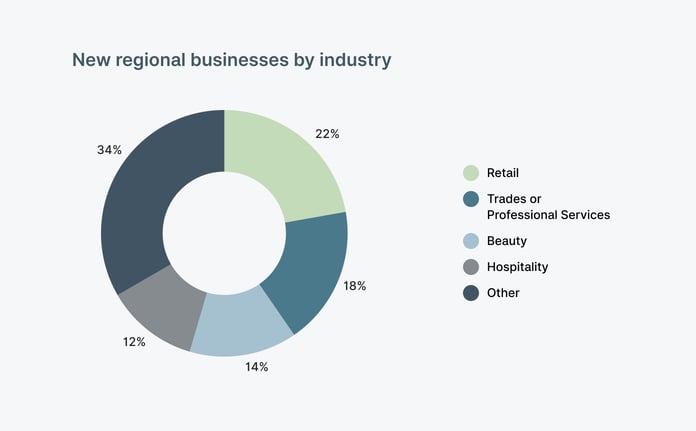

As for the types of businesses being started, the most commonly started regional business is a retail store; where there are more people, there is more spending. Zeller data also shows there is a swell of new regional businesses being started in trades or professional services industries — both of which are required to support a growing population.

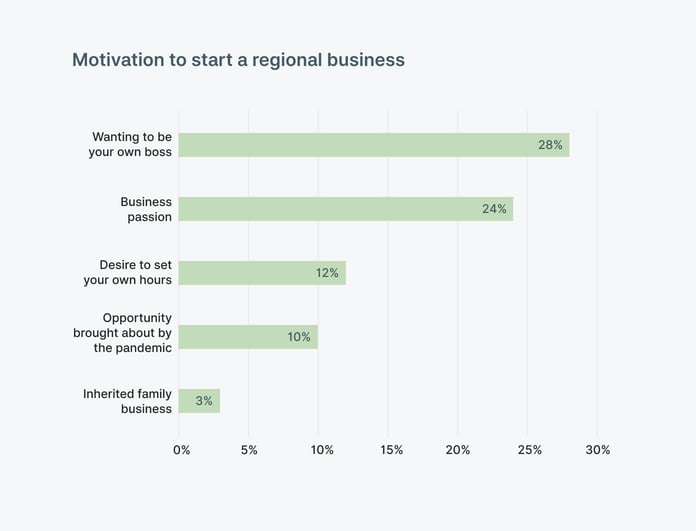

Regional merchants are twice as likely to have started their business as a direct result of the pandemic, compared to those in metro areas. Overwhelmingly, the motivation was to work for themselves — almost a third (31%) of regional merchants surveyed cited a desire to be their own boss as the primary reason for starting their business. The second most common reason was to follow a passion. No doubt, the extended periods of lockdown gave many more time than usual to ponder this train of thought.

While it is easy to identify the most front-of-mind reasons for starting a business in regional Australia, anecdotal data shows there’s more to the story. Zeller merchants living regionally tell us they started their business out of a desire to help their local community; they wanted a fresh start, a career change; it was the right time. In reality, each merchant's motivation for starting a regional business is personal and nuanced.

In 2020, partners Matt Smith and Chris King were living between Inverell and Sydney. Alongside his day job working with horses, Matt was exploring a passion for floral design and could often be found foraging to create bunches for friends — each as unique as the receiver. Soon, he began selling bunches from a friend’s shop every Saturday.

The distinct arrangements of colour, texture and floral varieties were sell-outs, and it quickly became clear there was an opportunity to move into the floral design industry full-time. When travel restrictions were imposed, an immense hurdle was placed in front of the long distance couple. “For us, the pandemic highlighted the importance of what’s most important: being together. So we made the decision to move to Port Macquarie permanently, and open Thistle Flowers in a bigger regional centre,” said Matt.

Thistle Flowers owners Matt and Chris

Despite a difficult run initially, as more than 30 brides cancelled or rescheduled their weddings due to restrictions, destabilising a large portion of the newly launched business, Thistle Flowers is thriving. Matt and Chris’s determination to showcase the raw beauty of Australian flora, coupled with their individual flair and personalised service, has quickly attracted the attention of locals. For Matt, it’s the community aspect he loves most about running a small town business.

Thistle Flowers, Port Macquarie, New South Wales

“The best thing about running our business here is that we can visit local flower farms, and sell bunches the next day. It cuts the supply chain down, and is more relationship-based. It’s important to us to develop and keep strong ties with the community,” he says.

While shifts in consumer behaviour have inspired some merchants to adapt their offerings, economic shifts have spurred others to configure unique business models that are more flexible.

Wyong Creek merchants Hannah Greenshields and Tim Eyes dreamed of running their own organic farm, but found themselves priced out of the local property market — where farms often fetch upwards of $2 million. Leveraging their relationships within the local community in Tim’s hometown, the couple has built a mobile farming business: leasing land from neighbouring properties and using mobile fences, netting and coops to pursue their passion of bringing conscious farming and sustainable produce to northern New South Wales consumers.

The Food Farm owners Hannah and Tim

The couple’s marketing and sales techniques have been equally as innovative. The Food Farm's first chicken caravan was purchased using the funds generated by a potato pulling event at an open farm day. “We wanted to do something cool, where people can get dirty and have a good time. We had about 4,000 people finding us on social media and wanting to come — so many that we had to go out the night before and bury more potatoes, from a neighbouring farm,” Tim said.

The Food Farm at the Carriageworks Farmers Market, New South Wales

Hannah and Tim also made the decision early to accept digital payments, as they observed other merchants limiting themselves by relying solely on cash. Throughout the week, a courier delivers boxes, purchased online, to nearby areas. On the weekend, Hannah and Tim travel to the Carriageworks markets in Sydney, where regulars are often waiting to fill their bags and talk of the meals cooked using last week’s purchases. Locals can make a last-minute purchase from Hannah and Tim's front gate using their card or digital device.

The pair’s out-of-the-box thinking has set them in good stead to grow the business and introduce new animals and fresh produce lines, and they’re not alone. After a difficult couple of years, Australian business owners have shown incredible resilience and ability to adapt. Now, their optimism is shining through.

Of those surveyed, 87% of Zeller merchants are confident in their ability to grow their business in 2022. These changing patterns and newfound business confidence will no doubt make a mark on Australia’s regional economies for decades to come.

Zeller merchants speak fondly of the lifestyle benefits, tight-knit communities, lower cost of living, and customer loyalty that often comes with regional living, yet running a business outside of a major hub comes with its own set of challenges.

From the daily challenges of hiring staff and the increased cost of freight, to greater obstacles such as natural disasters, there is a need for regional merchants to be increasingly agile.

.png)

Port Macquarie, New South Wales

According to Zeller data, the top three challenges regional business owners have faced in the last year are managing COVID-19 restrictions, a lack of time to do everything, and slow cash flow. Other challenges include steep hikes in rental prices and more competition, and difficulty hiring staff.

The reality is that starting or growing a successful business in regional or rural Australia in 2022 and beyond requires a different approach to that which has worked in the past.

Community support is imperative to the survival of regional businesses.

Bendigo business Boneless Barbers recently introduced an additional revenue stream by designing and selling merchandise, a move which has been well received. Retail sales have picked up also, according to owner James Seaman. “Everyone seems to understand businesses have struggled. We’ve noticed more customers making an effort to support the business by purchasing their hair products from us, rather than large retail stores, and buying one of our new graphic tees,” says James.

Boneless Barbershop owner James

They’ve since expanded the business — opening up more chairs, a tattoo parlour out back, and a cafe out front. This strategic move has seen an increase in foot traffic as regional Australia returns to normal following the ease of restrictions.

The pandemic tested the resilience of regional merchants more than most. Small businesses are the lifeblood of many regional communities, and local communities were quick to rally support those hardest hit by restrictions — like hospitality venues, beauty salons and barbers. With restrictions now a thing of the past, the key to future business success for regional merchants will be to find ways to build upon the relationships established through lockdown.

Boneless Barbershop, Eaglehawk, Victoria

Cash use has been in steep decline for a decade, increasingly passed over in favour of more convenient methods. It’s a shift in spending habits that has seen more than one in three ATMs outside of metropolitan Australia close since June 2017 — in turn making it difficult for those consumers who still want to use cash to access it. Since concerns over cleanliness and hygiene heightened, cash has become even more infrequently used. Instead, consumers are paying contactlessly using their cards, mobile phones and smart devices.

Fewer customers paying with cash is good news for all business owners. The less cash transactions, the less cash kept on site and the lower the security risk. This translates to fewer trips to the bank to deposit funds.

Rather than needing to manually count cash drawers and then securely move deposits to bank branches, which are now further away than ever before, Zeller merchants can accept the vast majority of funds via their EFTPOS terminal and have those funds settled to them nightly, 365 days a year. The ability to quickly pay rent and other bills, purchase more supplies, and pay yourself as a merchant relies on fast settlement times.

For local Geelong chef Tolga Biyik, who lost both of his jobs when the hospitality industry was shuttered, a brief break was exactly what was needed to spark a change. “I had a lot of time to reflect on what’s important. I think COVID was the break a lot of people needed to reflect on what they want in life. Losing both jobs was actually good for me,” he said.

Despite never having run a business before, Tolga leveraged his network to find opportunities to quickly establish a presence in the busy Victorian hospitality scene.

A true testament to the power of agility, as well as opportunity in the regions, Zeller merchant Zach Fowler made the decision to open a coffee shop after a brief conversation with a friend. Just three weeks later, he was serving cappuccinos from Quoll Coffee House, Bellingen’s newest cafe — evidence of the opportunity regional towns offer budding business owners to take risks and test the market, which they are unlikely to find in metropolitan cities.

Over the last few years, widespread bank closures have forced regional business owners to travel longer distances — disrupting business as usual processes — under the guise of ‘digital transformation’. Yet in reality, the support provided by the banks has been inadequate for most and, according to Zeller data, it’s a move that negatively impacts over half of regionally-based businesses.

It’s little surprise research shows 67% of Australian businesses would prefer to use a non-Big 4 bank. Australian merchants are more than ready to embrace new technology providers that offer payments, transaction accounts, and business Mastercard backed by reliable uptime and accessible, local support. It’s a move that is enabling them to offer a better customer experience, and benefit from fairer pricing, faster access to funds, and next-gen technology.

For Bendigo-based merchants Matilda and Paris, who opened their salon Hair & Halo in January 2022, the decision on payment providers was not taken lightly. “I sat down with my Dad, who used to work at a bank. We started with the terminals offered by the Big-4, but we googled “best EFTPOS terminals” and found Zeller. My Dad said it was the right option,” said Matilda.

Hair and Halo, Bendigo, Victoria

“I like the fact you can purchase the terminal, and it’s yours forever. Everyone else makes you rent. Plus, our clients say Zeller looks amazing — it really fits with our aesthetic,” said Matilda.

Flooding, bushfires and drought are just some of the unique challenges Australian merchants face. Business owners in remote areas are often disproportionately affected by these extreme weather events and other natural disasters — road closures, telecommunication issues and inventory losses are particularly difficult challenges to overcome outside metro areas, where distance creates additional hurdles. It could take weeks, months, and potentially even years for a business to get back up and running again after a crisis.

While it is difficult to plan for forces of nature, there are a couple of things regional merchants can do to safeguard their business. Establishing a crisis communication policy, business continuity plan and seeking appropriate insurance are all important steps. Yet as the devastating recent floods in Queensland and New South Wales show, one of the best ways to protect your business from the impact of future crisis is to develop and rely on strong community ties.

Individually-owned businesses play a central role in the social and economic fabric of regional communities. In times of crisis, people look to retailers for supplies. Hospitality owners often open their kitchens and prepare food for their community. Businesses of all shapes and sizes contribute their time and resources. It is in those times that the strength of a community, and the resilient attitude of the merchants operating within it, shines through to get local businesses back on their feet once more.

As more and more Australians continue to take the opportunity to start their own business, and others work to get back on their feet after two years of lockdowns and restrictions, there is a sense of optimism in the air.

For regional businesses to succeed, merchants will need to garner the support of their local communities, and partner with financial services providers that understand the unique challenges of running a business outside metropolitan centres. As new challenges arise, an entrepreneurial mindset and an ability to adapt will be invaluable business tools, enabling merchants to quickly identify and take advantage of growth opportunities — a common thread amongst the most successful businesses.

For the rest of Australia, the benefit of this growing trend is clear. The more people that leave the metropolitan cities in favour of a regional lifestyle, and visit those areas as tourists, the more businesses that will be required to support those growing populations — diversifying and enriching the national economy.

Do you run a business in regional Australia? We'd love to hear your story, and understand how we can support you to grow. Reach out to us at community@myzeller.com.

By sharing your details with us, we may contact you from time to time. We promise we won’t bug you — and you can unsubscribe from communications at any time.